Chapter 14 - Principles of Financing

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Explain the difference between the primary and secondary mortgage markets.

2) Explain the difference between a fully amortized loan and a straight-term loan.

3) Explain the difference between the mortgagor and mortgagee.

4) Explain the difference between judicial and non-judicial foreclosure.

14.1 Theory of Real Estate Financing

Transcript

Let’s imagine you’re sitting at your desk in the office and a new prospective home buyer walks in the door. They’ve heard mortgage loan interest rates are low, and they want to buy a home. How do you guide this would-be buyer with directions?

Another common situation involves the homebuyer who is determined to buy a dream home and is ready to look at a number of properties for sale. They have yet to speak to a lender to determine their budget range. How do you provide them with guidance on which homes fit their budget?

Still, other instances arise when investors want their agent to help them find the best home to flip using a low-cost interest rate loan. They want advice on the best type of loan for their unique situation.

Real estate financing is responsible for most purchases today. As an agent, you must understand not just what the current rates are, but also what the options for borrowers are in any given circumstance. To get started, we need to focus on the heart of the system – the Federal Reserve System

Understanding the Federal Reserve System

The Federal Reserve System, commonly referred to as “the Fed” is the banking system within the United States controlled by a central board of governors called the Federal Reserve Board. This federal bank has 12 geographical districts. It has significant control over a variety of financing sectors including credit and the amount of money in circulation.

This national bank plays an important role in the real estate financing sector. It creates various rules that govern how, when, and why lenders lend money. When your clients come in to buy a home, whether they realize it or not, the amount of funding available to help them purchase that property is directly controlled by the actions of this bank.

The regional reserve banks do most of the work for the Federal Reserve. They impact the interest rates your clients pay for a mortgage. This is done through the Federal Open Market Committee (FOMC) which is a section of the Fed. This committee meets eight times a year or whenever there is an economic concern. A key component of the work they do is to set the target lending rate. This is the interest rate charged when banks lend their deposits to other banks overnight. This is done to keep the banks within their reserve requirements.

The impact here to the real estate market is a bit less complex. In short, banks are charged this key interest rate by other banks. To make their profit, banks must increase the rate they charge their clients - your home buyers – when lending money. Changes in the interest rate paid by home buyers, in part, stems from the changes made by the Federal Reserve, then.

To spur lending, the Fed recently dropped the interest rate significantly. As a result, banks had more money to lend to borrowers, including home buyers. The bank may tighten up or increase this rate, on the other hand, to minimize inflation.

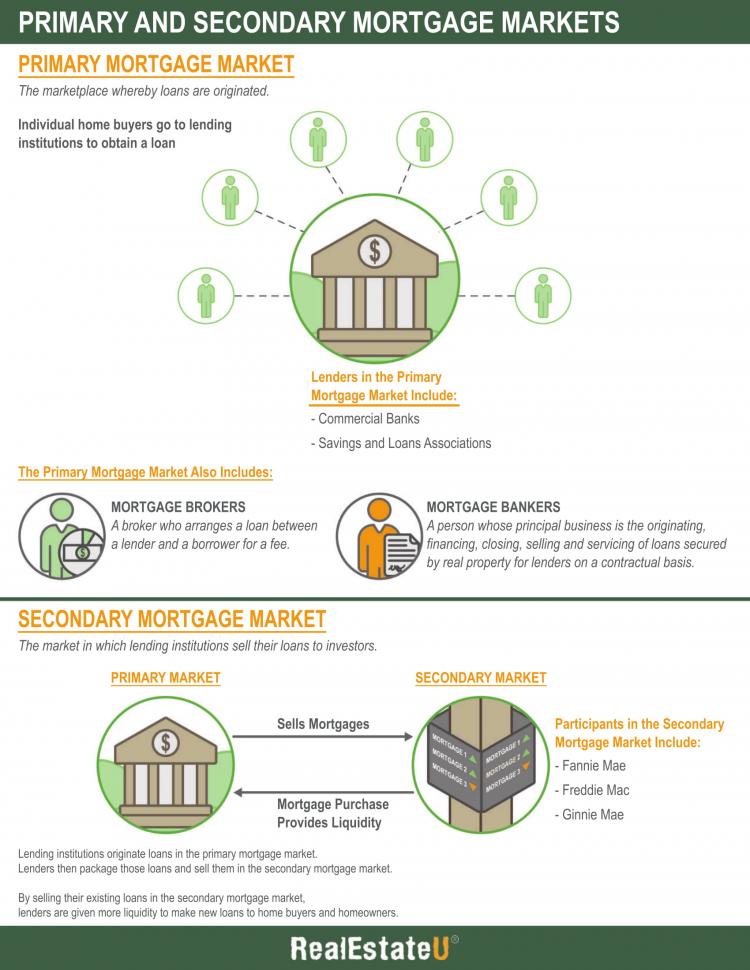

The Fed impacts two main marketplaces where loans are bought and sold. The Primary Mortgage Market is the main market in which loans are originated. Your home buyer will turn to a bank to secure a loan. A financial institution underwrites the loan. This is the primary market.

The Secondary Mortgage Market is the market where lenders can sell those loans to secondary agents. This includes the Federal Home Loan Mortgage Corporation (FHLMC), Federal National Mortgage Association (FNMA) and the Government National Mortgage Association (GNMA).

Let’s take a step back here and explain what each of these organization is and how they work.

First, consider the Primary Mortgage Market.

The primary mortgage market is where mortgage originators and borrowers come together to discuss the terms of a mortgage and to put the mortgage loan into place. This market is where mortgage brokers, credit unions, traditional banks, and mortgage bankers work together to connect with the borrower.

In most situations, such as a home buyer requesting help with obtaining a loan, you will need to point your borrower towards a member of the primary mortgage market. Real estate agents generally do not negotiate terms for borrowers, but they can make recommendations!

Once a loan is originated in this market, it is then (most commonly) sold to the secondary mortgage market. This happens behind the scenes, with most borrowers not having any knowledge of it occurring.

Next, consider how the second mortgage market works.

Now, the secondary mortgage market is a bit more complex, but it’s important to understand what is likely to happen to your borrower’s loan once it secures origination. Generally, by the time your home buyer has moved into his or her home, the originator of the loan is already moving it to the secondary mortgage market.

This market is made up of mortgage originators, the mortgage aggregators (also known as securitizers) and investors. This market is very large. It is also very liquid, meaning investments are sold frequently between these individuals.

Once a loan is originated, it is then packaged with other recent loans to create mortgage-backed securities. These securities are sold to pension funds, hedge funds, or insurance companies – all of which are investors who hope to profit from buying and selling the packages. In a roundabout way, this market is what makes it possible for credit to be available to all people across the country. Without it, your borrower in a low-income area may find it hard to secure a loan from a small lender.

What about Fannie Mae, Freddie Mac, and Ginnie Mae?

If you’ve heard these names and wondered who these people are, realize they are not actually people, but rather investors within the secondary market. We’ve mentioned them before – when discussing the Federal Reserve. But, let’s talk about each one of these a bit more individually. It’s important to understand this because some types of loans your borrowers may want, such as FHA loans for first time home buyers, are often backed by these investors.

The Federal National Mortgage Association, or Fannie Mae, is a company listed on the New York stock exchange. This is a public company that works under a federal charter. What’s most important to know is that it is the largest financial backer of mortgages in the country. However, homeowners are often confused by this. Some may request a loan through Fannie Mae. The organization does not lend directly to the borrower – but, due to its investment strategies, it is able to help make sure mortgage funds are available at affordable rates.

Freddie Mac, or the Federal Home Loan Mortgage Corporation, is another independent company operating on the stock market. It invests in conventional mortgages as well as FHA and VA loans. FHA and VA loans are an important tool for today’s borrower. This federally backed program protects investors from borrower default but reduces interest rates and down payment requirements to borrowers. In short, FHA and VA loans are what you’ll most likely talk about to your home buyers if they are first time home buyers or home buyers that were a member of the Armed Forces of the United States.

Finally, Ginnie Mae, or the Government National Mortgage Association, is a government-owned company that’s structured within the US Department of Housing and Urban Development, more commonly known as HUD. This organization guarantees mortgage securities (or packages as we’ve referred to them here) that are backed by other government agencies.

Now, to wrap up, let’s talk about how a real estate agent fits into this puzzle.

As a real estate agent, you won’t be involved in either the primary or secondary markets. However, your home buyer views you as the expert in the home buying process. For this reason, it pays to keep up to date on the market and its changes. If the Fed plans to increase interest rates, you may want to encourage would-be home buyers to lock in a loan rate now before that happens.

When a borrower comes to you to request help finding a home, without loan approval, you’ll want to recommend they do that as a first step. And, of course, as conditions change it can impact how much the borrower can purchase based on interest rates.

As an agent, it’s important for you to be mindful of changes within this industry as it plays a role on how many people are in the market as well as what they are likely to be able to afford.

Key Terms

Federal Home Loan Mortgage Corporation (FHLMC) (Freddie Mac)

An independent stock company which creates a secondary market in conventional residential loans and in FHA and VA loans by purchasing mortgages.

Federal National Mortgage Association (FNMA) (Fannie Mae)

A New York stock exchange company. It is a public company that operates under a federal charter and is the nation’s largest source of financing for home mortgages. Fannie Mae does not lend money directly to consumers, but instead works to ensure that mortgage funds are available and affordable, by purchasing mortgage loans from institutions that lend directly to consumers.

Federal Reserve System

The federal banking system of the United States under the control of central board of governors (Federal Reserve Board) involving a central bank in each of twelve geographical districts with broad powers in controlling credit and the amount of money in circulation.

Government National Mortgage Association (GNMA) (Ginnie Mae)

A government-owned corporation within the U.S. Department of Housing and Urban Development (HUD) that guarantees securities backed by mortgages that are insured or guaranteed by other government agencies. Popularly known as “Ginnie Mae”.

Primary Mortgage Market

The marketplace whereby loans are originated.

Secondary Mortgage Market

The market where lenders sell their loans to the large secondary marketing agencies (FNMA, FHLMC, and GNMA) or to other investors.

14.1a Primary and Secondary Mortgage Markets Infographic

Please spend a few minutes reviewing the Infographic below.

14.2 Promissory Notes

Transcript

Real estate agents will face many questions from their home buyers. Among them will be concerns about terminology used within financial documents and titles. Agents need to understand the legalities of these documents so they can reassure clients they are making the right decisions for their future. One key – and often misunderstood – term is promissory notes. What are they? Why do they matter to you, as an agent?

What Is a Promissory Note and What Role Does It Serve?

A promissory note is a promise to pay. It’s a financial document that states one party, called the insurer, or maker, promises to pay another party, known as the payee. It lists the specific sum agreed upon. It also states when the debt will be paid, whether it will be paid in one lump sum or in payments with an end date. Promissory notes contain virtually all of the terms of a loan. And, your client is agreeing to these terms when they sign their promissory note during the closing process on a home.

These notes will include:

- The principal amount – or the amount of money the home buyers agrees to borrow to buy the home

- The interest rate – the cost of borrowing the money to buy the home

- The maturity date – the day on which the loan is due to be paid in full

- The date and place of issuance – who, where, and when the loan is agreed upon by those involved

- Signatures of all parties

These notes are legally binding. Ensure your homebuyer understands that buying a home using a loan is a legal commitment without a simple “way out”. They also encourage them to buy a home that’s within their budget ensuring they are not at risk of overspending.

During your initial meeting with your home buyer, make this an important conversation! Ensure they’ve worked out the financials of their home loan with a lender. And, be sure that they understand the down payment requirements. All of this impacts the way you do your job. You’ll need to guide the home buyer to purchasing a home that’s within their budget, which is within the amount the lender has agreed to let them borrow.

This ensures your time is spent helping a home buyer finding a home they can actually afford to purchase. A frank, open discussion is critical. There’s much to discuss and explain to your clients.

One important aspect is related to the security of these loans. Promissory notes are available as secured or unsecured loans.

Secured loans

These are loans backed by collateral. For example, with home buying, collateral is generally the home itself. The loan is based on the value of the home and the home protects the lender. Should the borrower default, the home becomes accessible to the lender to seize to repay what is owed. Most home loans are secured loans.

Unsecured loans

These are just the opposite. The most common example is a credit card or a personal loan. It’s given based on the personal credit history and financial security of an individual. These are very rarely used in home loans.

Agents must explain to borrowers when asked, that if they fail to make payment on their loan, they will lose the home because it is a secured loan.

What Is Interest? Why Do Banks Charge Interest on a Loan?

While you may understand interest on a loan, it can be hard to explain. The short answer is that interest is the cost associated with borrowing money to buy a home. It’s often expressed in a percentage. For example, borrowers may pay 7 percent to borrow the funds. Because home loans are secured loans, they tend to be a bit more affordable.

Banks charge interest, of course, to make a profit in lending to a home buyer. It’s important to instruct your home buyers to consider all of their options when borrowing since just a small difference in a loan can make a big difference overall in what they end up paying for the home.

Here’s an example.

When interest rates are lower, the associated home loan payment, the borrower pays, is less. Let’s say the borrower wants to purchase a home for $100,000. He or she secures a loan for 4 percent interest. They will make payments for 30 years. The monthly payment will be $477. And, when he or she is done paying for the loan, they would have paid a total of $171,870 to buy their home.

If the home is worth $100,000 and they pay 4.5 percent, their monthly mortgage payment rises to $507 and the total cost of the home increases to $182,407. That’s why every percentage point matters.

Usury Laws – What Are They?

Banks charge interest to make a profit from borrowers. However, there are limits on how much they can charge. These limits fall under usury laws. This type of regulation governs the amount that can be charged on a loan. It’s a law that’s in place to reduce the risk that borrowers will pay excessively high rates to buy a home. The laws protect consumers. Each state sets their own usury laws.

Discount Points: Are They Beneficial to Your Client?

Your job as an agent may focus around helping your buyer find a home, but you also want to ensure they pay the smallest amount possible for that property. One way to help encourage them to pay less may be through discount points. Points are a type of pre-paid interest. Paying 1 point means the borrower is paying 1 percent of the loan amount. It’s often referred to as buying down the rate.

Your home buyer may want to pay points to lower his or her interest rate on a home loan. Paying a 1 point means paying 1 percent of the mortgage amount. For example, 1 point is $1,000 on every $100,000 borrowed. By doing this, the borrower lowers the monthly payment he or she pays on the home.

Here’s another look:

The buyer borrows $100,000 for a home and will pay it back over 30 years. He decides to pay 2 Points. This means he’ll pay $2,000 upfront. On an interest rate of 4 percent, the monthly payment is $477.

Without points, the borrower will pay $497 per month. Over 10 years, that’s a saving of $2,000. Paying points like this can save the home buyer significantly, especially when this is spread out over larger loans.

Overall, points will save the consumer per month on the loan terms. However, borrowers have to ensure they have the money upfront to make these payments.

Understanding Loan Origination Fees

Another financial aspect you may need to explain to your home buyers is loan origination fees. This is a fee that is charged by the lender on a home loan. View it as a fee to obtain a loan. It is paid to the lender as a fee to put the loan in place.

Buyers will need to pay origination fees. This fee is usually between 0.05 percent and 1 percent of the amount of the home loan obtained to purchase the home. It pays for:

- Paperwork

- Calculations that are done to determine the loan rate and terms

- Verifications

In other words, it is a fee that pays for all of the research and setup of the home loan by the lender for the borrower.

Again, if you purchase a home and borrow $100,000 to pay for it through a home loan, you will pay about $1,000 towards the cost of setting up the loan. It could be much lower.

To find out what is anticipated as the loan origination fee, your home buyer can ask for a good faith estimate. This is an estimate given in good faith – meaning as accurately as possible, to the borrower by the lender. This estimate can help the home buyer to understand how much he or she will need to pay out of pocket to purchase a home. It is possible, in some cases, for this fee to be rolled into the loan as a part of the closing costs.

As a real estate agent, be sure to inform your home buyer of this and other closing costs as they begin the process of finding a home. For example, if your client is talking about having $10,000 to put down on the home sale, and nothing more than that, explain that loan origination fees – among other types of costs – may also play a role in their out of pocket costs. As a result, this can impact the amount they can spend on a home. Knowing this in advance is beneficial to all involved.

Prepayment Clause and Prepayment Penalties – Before They Sign

Your home buyer has plans to purchase a home and live in it for a few years before they sell and move on. You’re happy to help them find the home. But, you want to make sure they are using the right loan for the task.

This is a time when talking about prepayment clauses may become evident. A prepayment clause is a line in the contract they sign with their lender (within the promissory note) that states a penalty will be paid if the mortgage is paid off within a certain timeframe. This penalty cost is usually a percentage of the amount borrowed or a certain number of months’ worth of interest payments.

The home buyer needs to know:

- If a prepayment clause is within the home loan contract.

- If it is present, when does it apply? This could be a number of years or months after securing the loan.

- And, if present, the borrower needs to know how much that fee will be.

Prepayment penalties help the lender ensure they will get enough compensation and profit from the loan if you pay it off early. Remember, if a home buyer buys another home and sells their existing one, they are paying that loan off early and this clause may apply.

Understanding Straight Loans

Straight loans are a type of loan. It is often referred to as a term loan or an interest-only loan. In this type of loan, there is a period of time in which only the interest on the loan is paid and the principal is paid at the end.

Here’s an example.

The home buyer secures an interest-only loan (the most common term used by lenders today) to borrow $100,000. The interest rate on the loan is 4 percent. Each year, the home buyer will pay $4,000 towards the loan. If the term is for 10 years, at the end of those 10 years, the borrower will need to pay the original $100,000 in principal. This is known as a balloon payment.

This type of loan structure seems affordable, but only if the borrower is confident he or she can do one of the following:

- Pay off the principal in full at the end of the term.

- Sell the home to repay the loan at the end of the term.

- Secure a traditional home loan at the end of the term to pay off the $100,000.

For those who are unlikely to remain in their home for a long time, this type of loan can be beneficial to them as long as there is no prepayment penalty involved.

Amortization is a complex process that calculates the amount of interest on any home loan. In the above example, there is no amortization because the interest is applied. Most home loans are fully amortized. Some are partially amortized.

In full amortization, the amount of interest paid by the borrower is spread out over the entire term of the loan. With every monthly payment, the home buyer pays a portion towards the principal and a portion for interest. Initially, more is paid towards the interest, but towards the end of the loan, the borrower is paying more towards principal, paying down the balance sooner.

In partial amortization, the interest is paid during the loan term and the principal is paid at the end, as described in the interest-only loan. The final payment at the end of a term is sometimes referred to as a balloon payment.

Your home buyer will receive a complete amortization schedule – which outlines how much is paid in interest and principal on the loan with each payment. This is given at the time of closing and is a part of the promissory note.

Escalator Clause and Acceleration Clause

Within a promissory note there can be terms for an escalator clause or acceleration clause. Here’s how they work.

Escalator Clause:

This is a statement added to a promissory note that says that the lender (or legal holder of the note) can decrease or increase the interest rate of the note with given notice. If it is present in a promissory note, the borrower must agree to it as it can mean a higher mortgage payment. Specific conditions for this will be listed, such as cost of living increases.

Acceleration Clause:

This is a statement in a promissory note that may require that the loan be paid in full at a specific time beyond what the current contract states. Generally, it is due to a breach in contract. For example, if the home buyer fails to make two monthly payments in a row, this clause may go into effect and lead to a demand for payment in full. It may also occur if the homeowner doesn’t maintain proper insurance on the home.

A promissory note contains a wide range of individual components that lay out the terms for the loan. As a real estate agent, you may face questions about these terms from your prospective buyers. Having this knowledge shows your dedication and willingness to help them on their journey to securing a home.

Please understand these concepts well enough to be able to guide your clients in taking the right decision, however do not give any advice on what loans they should take out. Make sure you refer your clients to an actual mortgage professional early on in the purchase process, even prior to showing them any properties.

Key Terms

Acceleration Clause

A condition in a real estate finance instrument giving the lender the power to declare all sums owing the lender immediately due and payable upon the happening of an event, such as sale of the property, or a delinquency in the repayment of the note.

Amortization

The liquidation of a financial obligation on an installment basis.

Amortized Loan

A loan to be repaid, interest and principal, by a series of regular payments that are equal or nearly equal, without any special balloon payment prior to maturity.

Discount Points

The amount of money the borrower or seller must pay the lender to get a mortgage at a stated interest rate.

Escalation

The right reserved by the lender to increase the amount of the payments and/or interest upon the happening of a certain event.

Interest

The charge in dollars for the use of money for a period of time. In a sense, the “rent” paid for the use of money.

Interest Only Loan

A straight, non-amortizing loan in which the lender receives only interest during the term of the loan and principal is repaid in a lump sum at maturity.

Prepayment Penalty

The charge payable to a lender by a borrower under the terms of the loan agreement if the borrower pays off the outstanding principal balance of the loan prior to its maturity.

Promissory Note

Following a loan commitment from the lender, the borrower signs a note, promising to repay the loan under stipulated terms. The promissory note establishes personal liability for its payment. The evidence of the debt.

Straight Note

A note in which a borrower repays the principal in a lump sum at maturity while interest is paid in installments or at maturity.

Usury

On a loan, claiming a rate of interest greater than that permitted by law.

14.3 Mortgages

Transcript

As you sit at your desk, a client walks in the door to your office inquiring about a home for sale. This individual seems ready to set up a viewing and potentially make an offer. She is young, inexperienced, and looking for guidance on buying a home. Before you set up that appointment to view the listing, it’s important to step back and gather information. It may not take long to realize this person has yet to speak to a bank about a home loan, knows little about mortgages, and isn’t sure she may even qualify.

While it may seem obvious to many in the industry that obtaining financing for the purchase of property should be the first step, that’s rarely what first-time homeowners realize. Rather, they shop first and figure out the financing later. For this reason, real estate agents quite commonly need to educate their buyers about home loans, deeds, and mortgages.

Here, we’ll break down more than the basics to provide a thorough look at this financial and legal transaction and what it may mean to you, as an agent, to teach this information to your would-be home buyer.

Introduction to Mortgages

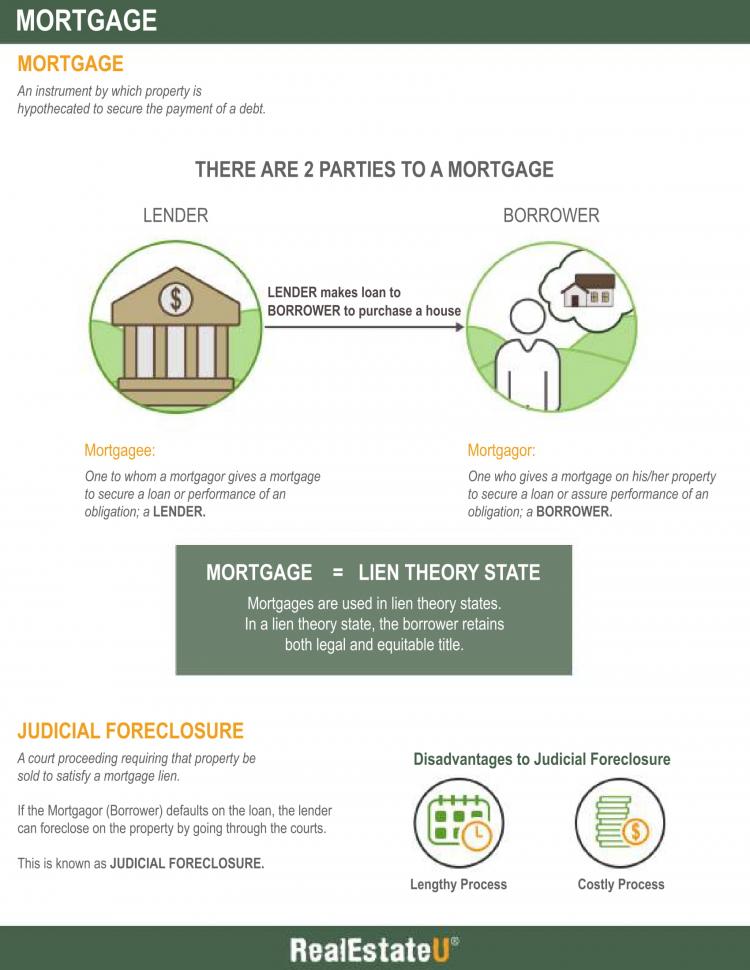

A mortgage is not a home loan. The term “home loan” refers to the financial product used to make the purchase. A “mortgage” refers to the legal process involved in securing that loan and legally tying its value to the home as collateral. It’s quite common for home buyers to refer to the loan as a mortgage and to imply that they need a mortgage – when speaking about the financial investment. Here’s some information you need to keep in mind.

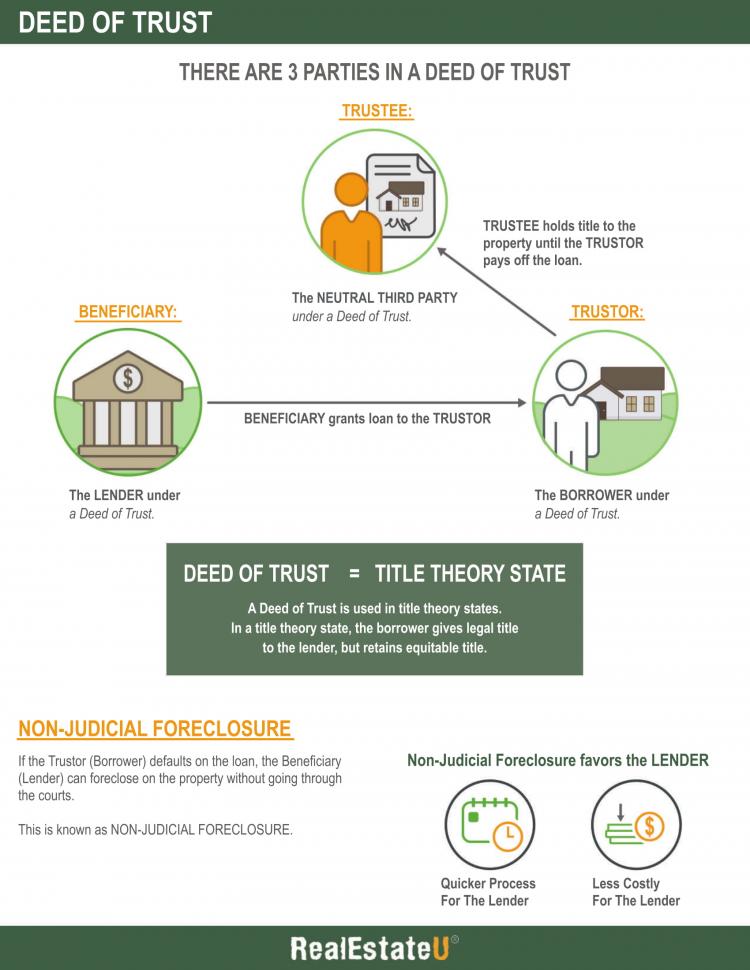

Title Theory States and Lien Therapy States

The state in which you sell the property will be either a title theory state or a lien theory state. You’ll need to know what method the state you are operating in uses. This practice influences two factors: (1) who holds the title of the home while there is a home loan in place and (2) what happens during foreclosure.

In a lien theory state, the home buyer will hold the deed to the property during the term of the loan. This means the borrower continues to hold onto the title throughout his or her term. As a result, the foreclosure process is much more difficult for the lender. While it is still possible for the lender to foreclose – or take ownership of the property if the borrower defaults on the loan – it’s a more complex process. The home buyer maintains legal ownership and title to the property throughout the loan term. Lien theory states are states with mortgages.

In mortgage states, the borrower will hypothecate the property to the lender. This means the borrower uses the home as collateral. If the owner defaults on the loan, the collateral is seized to repay the debt owed.

In a title theory state, things are a bit different. Title theory states use a Deed of Trust. Here, the buyer signs a Deed of Trust. This makes the lender the beneficiary in the agreement. In this situation, there is a third part – the trustee. The trustee holds the legal title to the property. The trustee’s job is to sell the property at an auction if the borrower defaults on the loan.

To sum up this portion:

- In mortgage states – or lien theory states – the borrower maintains the title but provides legal ownership rights to the property in the event of default to the lender.

- In Deed of Trust states – or title theory states – a third-party trustee holds the title legally, but can process the sale of the home should default occur. It is also important to point out that in Deed of Trust states, there is no legal proceeding in a courtroom, speeding up the foreclosure process.

Rights and Obligations of the Mortgagor and Mortgagee

Within any mortgage there are two main parties – the mortgagor and the mortgagee. It’s important to understand the difference here and to remember it. It is quite common for home buyers to confuse the two – and that can mean misunderstandings later when they go to sign their closing documents.

Mortgagor: This is the borrower or home buyer. It is your client. They allow the property to be used as collateral (done through the signing of the mortgage.)

Mortgagee: This is the lender. The lender is the provider of the loan. They do not hold the title of the home, but can utilize the mortgage to obtain ownership should a default occur.

What are the mortgagor (borrower’s) duties? It’s very common for real estate agents to need to explain this concept to their buyer. In short, they need to know what their rights are and what their obligations are. The mortgagor’s duties will include (as outlined in the mortgage document):

- They must pay the debt, and they must do so according to the terms listed in the promissory note.

- They must pay all real estate taxes on the property.

- They must maintain adequate home insurance on the property that protects the value of the home from catastrophe.

- They must maintain the property with the goal of maintaining the value of the home.

- They must obtain permission from their lender before they make significant changes to the property (this does not include home improvements, but may include home additions or significant renovations to the structure).

When your home buyer signs on the dotted line, he or she is promising to follow these rules. If the borrower fails to do this, then the loan enters default (more on that in a moment). What this means is that you need to educate your home buyer on what he or she is responsible for when buying a home with a loan.

The lender, of course, wants to maintain the value of the property. This way, if they need to foreclose on the home down the road or the home is lost in a fire, the lender can recoup its costs.

The Mortgagor (borrower) also obtains the right to possess the property. They are able to use the property as designed, but generally, there are clauses to limit, for example, commercial use of the property or to rent it out without prior approval from the lender.

The Mortgagee (lender) also has several rights. In signing the mortgage, these rights are agreed to. They include:

- The right to foreclose on the property if there is cause, generally as a result of default.

- The right to take possession of the property after foreclosure. When this happens, it is often called a Real Estate Owned or REO.

- The lender has the right to assign the mortgage. This is generally done in the secondary mortgage market. It simply means the lender can trade the loan with other commercial lenders (The terms of the loan are not often changed during this process. Rather, it is a general investment strategy that banks often pursue.)

In signing a mortgage, both parties enter into the agreement according to these terms or others outlined in the document. Your client needs to understand their rights and obligations in this process.

Provisions for Default

We’ve talked a lot about default previously when discussing the financial aspects of the home buying process. It’s important for borrowers to understand not only that this is a real possibility, but that it undoubtedly will occur if they fail to hold up their side of the contract.

When meeting with your client – perhaps those new buyers who strolled into the office – be frank with them. How much can you afford? How much will a lender provide to you? Do you have the ability to make $X amount of a mortgage payment every month for the next 30 years? While it is not the job of the real estate agent to provide financial advice on home loans, it is important for the agent to be knowledgeable and to educate the buyer on his or her options.

Now, as noted before, the borrower of the loan has numerous obligations in obtaining the mortgage. If the borrower fails to meet those requirements, the borrower defaults on the loan automatically. This means the lender can then exercise the Acceleration Clause (discussed previously) and demand the full principal balance on the loan. In other words, the lender can demand payment in full for the loan at that given time – usually without a lot of time.

In situations where the borrower falls behind on loan payments, the lender has the right to pursue payment immediately for the entire borrowed amount (or what is left of it). However, the lender also has the right to allow for a grace period. During this time, the borrower is able to catch up on all payments (often with interest and fees included) to avoid the default. Defaulting for failure to make on-time payments is by far the most common cause of default.

Assignment by Mortgagee

As noted previously, the lender is allowed to assign the mortgage in the secondary mortgage market. Let’s clarify this a bit further here. Lenders are in the business to make money. In order for them to make money, they need to ensure their assets are liquid enough to invest. The term assignment by mortgagee simply means that all of the interest the original mortgagee had in the loan is then assigned or transferred to another bank.

It is very common for banks to “sell” mortgages like this to free up assets. The mortgage is recorded shortly after the mortgagor (borrower) signs it. It is then commonly transferred. Every time the underlying bank transfers or assigns the loan to a new mortgagee, it is recorded on the county land records.

Alienation Clause

This clause within a mortgage contract provides the lender with the right to demand full principal balance when the property is sold. It is sometimes called the Due-on-Sale Clause. This type of clause provides protection to the lender and prevents the borrower from assigning the loan’s debt to another person without the lender’s prior approval.

In other words, when the home is sold, the loan is paid in full. The home loan cannot transfer to another person. That new home buyer will need to obtain his or her own loan.

Release of Mortgage Liens and Satisfaction

Now, this is what your borrowers want to know about. They’ve made payments on their loan for the whole term. Once that last payment is received by the lender, the lender must then issue a Satisfaction of Mortgage document to the borrower. This is outlined in the Defeasance Clause. This clause is a provision within the document that states that the borrower is given full title to the property once they’ve met their mortgage terms.

With the Satisfaction of Mortgage comes a legal recording of the transaction in public record, such as with the county’s land office. Once this is done, the borrower owns the property free and clear of any loan.

Reserves for Taxes and Insurance

It’s common for mortgages to have clauses that no one knows about or thinks about when first signing up for the loan. One key term often used is a “reserve” for taxes and insurance. It is commonly found when a home buyer purchases the property with a down payment that is under 20 percent of the home’s sale price. This is then a requirement by the lender to maintain a reserve account. This reserve account – called escrow – is in control by the lender, not the home buyer. It’s meant to collect funds, with each payment the borrower makes, that are held to pay home insurance or real estate taxes on the property.

The lender is hoping to protect the borrower from defaulting due to a lack of payment of taxes or insurance. By collecting an equal amount per month and holding it in an escrow account, the lender maintains more control over the payment of the insurance and tax requirements. The lender makes the payment on time to protect the property.

There’s often an acronym used to describe this. PITI, or Principal, Interest, Taxes, and Insurance are used to describe each of the components of the borrower’s loan. With each payment, he or she will be paying each component here – a portion of the principal borrowed, a portion of the interest on the loan, a portion of the taxes on the property, and a portion of the insurance on the property.

Assignment of Rent

In some situations, home buyers will purchase real estate with the intention of renting that property out. Now, the lender must agree to these terms prior to providing the loan. It is also important that the lender has a built-in clause called Assignment of Rent.

When this clause is present in a mortgage document, it means that the buyer will assign the rent to the lender in a situation where default occurs. Let’s clarify that a bit more.

Your home buyer is hoping to buy a duplex. He or she will live in one unit and rent the other. The mortgage document includes an Assignment of Rent. If the borrower defaults on the loan, this clause allows the lender to collect and keep the rental payments from the rental unit. The homeowner is assigning – or giving the right – to the lender to collect these funds.

Assumption Clauses

Some mortgages have an Assumption Clause. If your home buyer is hoping to purchase a home but may want to sell it within a short period of time, he or she may wish to have this clause included. It may also be included when buyers are hoping to let someone else – such as a child or friend – buy to own the property.

The Assumption Clause simply is a provision that gives the lender the right to allow someone else – a third party – the ability to assume the loan on the home. For example, your client buys the home and begins making payments. The lender agrees to allow another person to take over that loan instead of requiring payment in full at the time that the loan changes hands.

It’s important to keep in mind here, though, that the lender is given this right. The borrower is not. The Assumption Clause still requires that the borrower get approval for such a transaction from the lender. It is not possible for the borrower simply to move out and let someone else take over.

Recording the Mortgage

Finally, it’s important to communicate with your buyer that this is a legal transaction. As a result, it must be recorded under local law. The lender and the borrower will need to agree to the terms of the mortgage. All parties involved – the borrower and the lender – will sign the document. This signing of the contract is an important step. It puts the terms into place legally.

Mortgages should always be recorded. This is done in the office of the county clerk or another county land office. It is often termed differently from one location to the next.

It is the lender’s responsibility to ensure every step is taken and to ensure the document meets all legal requirements to be recorded. This means the lender’s representative will need to ensure every document is organized and structured according to the laws of the county. The county will record the mortgage in its files and send the borrower confirmation of this. This way, borrowers can often ask for clarification on ownership.

Wrapping Up on Mortgages

Real estate agents often face questions about each component of any mortgage document. It’s not an easy document to understand. Yet, this is perhaps one of the most important documents your home buyers will ever sign. For that reason, real estate agents really do need to learn the terminology of the process.

If and when your clients do not agree to any of the terms in their mortgage document, they should consult their attorney before signing the document. And, the lender’s agent, or Title Company, should be able to fully explain to the buyer any statement in order to ensure the home buyer completely understands all details.

It’s always advisable to be able to pull aside your home buyer and ask them frank questions about why they are buying, how they are buying, and whether or not they understand their specific requirements in such legal transactions. It’s surprising that most borrowers just want more information – and they are not necessarily going to turn away from a loan because of the risks involved.

Default and foreclosure are very real risks involved in obtaining a mortgage. It’s essential that your home buyers understand these risks. Ultimately, it impacts your bottom line. If your area begins to see a number of foreclosures occurring, this degrades the value of other homes in the area. Foreclosures are harder to sell – and homes near foreclosures are even more difficult sells. To protect the value of properties, explain the details of a mortgage to the buyer to ensure he or she is fully aware of their responsibilities in the process.

Key Terms

Acceleration Clause

A condition in a real estate finance instrument giving the lender the power to declare all sums owing the lender immediately due and payable upon the happening of an event, such as sale of the property, or a delinquency in the repayment of the note.

Alienation Clause

A clause in a contract giving the lender certain rights in the event of a sale or other transfer of a mortgaged property.

Assignment

The transfer to another of any property in possession or in action, or of any estate or right therein. A transfer by a person of that person’s rights under a contract.

Assignment of Rents

A provision in a mortgage or deed of trust under which the lender may, upon default by the trustor, take possession of the property, collect income from the property and apply it to the loan balance and the costs incurred by the lender.

Assumption of Mortgage

The taking of a title to property by a grantee wherein the grantee assumes liability for payment of an existing note secured by a mortgage or deed of trust against a property, becoming a co-guarantor for the payment of a mortgage or deed of trust note.

Default

Failure to fulfill a duty or promise or to discharge an obligation.

Defeasance Clause

The clause in a mortgage that gives the mortgagor the right to redeem the mortgagor’s property upon the payment of the mortgagor’s obligations to the mortgagee.

Hypothecate

To pledge a thing as security without the necessity of giving up possession of it.

Mortgage

An instrument recognized by law by which property is hypothecated to secure the payment of a debt or obligation.

Mortgagee

One to whom a mortgagor gives a mortgage to secure a loan or performance of an obligation; a lender or creditor.

Mortgagor

One who gives a mortgage on his or her property to secure a loan or assure performance of an obligation; a borrower.

Satisfaction of Mortgage (Release of Mortgage)

The discharge of a mortgage from the records upon payment of the debt.

14.3a Mortgages Infographic

Please spend a few minutes reviewing the Infographic below.

14.4 Deed of Trust

Transcript

Providing your potential buyers with insight and information into the legalities of the home buying process is one of the more complex components of the job. Yet, real estate agents need to fully understand all components of the process including terminology such as deed of trust.

What is that? How does it impact you as an agent?

Most of the time, home buyers will use a loan to purchase a home. Most people don’t have hundreds of thousands of dollars they are interested in spending to buy a home outright. Hopefully, once a buyer comes to you, he or she has already obtained a loan. If not, it’s important for you to encourage them to do so simply because you need to know how much of a home they can afford to buy.

Here’s a bit of clarity before we get into details. The term “mortgage” or “deed of trust” refers to a document that the buyer signs. A loan is the actual financial transaction and money owed that must be paid back.

As a real estate agent, one term you’ll likely come into contact with is deed of trust. There are slight differences between a deed of trust and a mortgage and your buyers will want you to explain those differences.

What is a dead of trust?

Let’s break down what a deed of trust or trust deed is, how it can apply to the transaction, and what it means for your buyers.

Let’s step back a bit. When your buyer finds the house he or she hopes to buy, they will work hand-in-hand with their lender for the financial component. As an agent, you may be asked a few questions about the loan itself, but it is never your place to actually offer financial advice.

Many real estate brokerages handle the title search and processes while the lender handles the legalities regarding the loan itself. The legalities of the ownership of the home once bought, are complex. What’s important is for your buyer to realize that they do not outright own the home until they pay it off. In the process of doing so, the promise they signed – the mortgage or deed of trust – truly holds the ability to reclaim the home if they fail to make payment on it.

When your buyer obtains a mortgage or deed of trust, he or she is signing a basic IOU to the lender. They promise to repay the money borrowed. These documents pledge not only that they will repay, but also that the property is used as the security for the loan. This becomes important should the buyer fail to make the payments and enter into foreclosure. This document gives the lender the right to foreclose and take ownership of the property. That’s why it is so important that your buyers understand what they are entering into.

What are the differences between a deed of trust and a mortgage?

We need to take a closer look at the differences between a mortgage and a deed of trust. This is important. Many times, home buyers will come to you and ask about a deed of trust. They may wonder why their lender is talking about a trust deed or why they have to sign this document titled “deed of trust.”

Most of the time, people associate trusts with wills or with savings planned for a wealthy family. However, there are various forms. Trust deeds are complex documents and they do impact the way your buyer will own and maintain his or her loan. So, what’s different here?

Some states use mortgages and others use deeds of trust. Some use both. You should know what your buyers in your state will likely encounter so you can provide the proper explanation to them. We’ll get into more details about when this applies in a few minutes.

Who is involved in a deed of trust?

The deed of trust involves several people that are involved in it:

- The trustor is the borrower – your home buyer

- The beneficiary is the lender – whoever the home buyer decides to work with

- The trustee – this is a third party; this party owns the actual legal title to the property. If your buyer defaults on the loan, the trustee will sell the property at an auction. Remember, this benefits the lender, not the buyer. Sometimes, the trustee is an escrow company.

To see some of the difference between a mortgage and a deed of trust, consider the parties involved in a mortgage:

- The mortgagor – Again, this is your home buyer

- The mortgagee – The lender.

That’s it. There’s no third party involved here. How can you explain this to your buyer?

Even though people often call their home loan a home mortgage, it’s technically not. By legal terms, the mortgage is actually this piece of paper that your home buyer will sign. Your home buyer will sign a mortgage document and give it to his or her lender. When they do this, they create a lien on the home.

When a buyer asks you to explain this, it’s important to be clear. Once the home buyer secures the money to purchase the property, the lender will take steps to protect that loan. The mortgage and deed of trust will help them to do just that.

For example, if you wanted to loan your friend $2,000, but you needed those funds to be repaid to you, you may ask for the title to his or her car. While legally without a contract this may not hold up, to your friend, it’s enough to ensure they repay the loan. And, if they don’t, you seize the vehicle. Lenders have to protect their investment in the property. They do that through the actual mortgage or trust deed document.

To further explain the differences, consider this.

There are two main differences. The first is what we’ve already discussed – the two parties involved in a mortgage and the three that make up a deed of trust. The second difference is in the way the lender takes action if and when your buyer defaults (or doesn’t pay for) his or her loan. Now, let’s break down what your buyer can expect here.

What happens in a deed of trust state when a home buyer takes out a loan to buy a home?

As noted, the deed of trust is a lien on the collateral (the home) that provides security to the lender. At this point, your buyer has secured a loan and qualified for it through an initial pre-screening and credit check. The lender has offered the loan to the buyer. You’ve worked with your buyer to find their dream home! You’re happy, they are happy, and now you want to close the deal.

There are legal filing requirements with all deed of trust documents. These will differ from one state to the next. This is a legal document that must be filed with the court system as well as made public. Yes, this means anyone can get a copy of the deed of trust. That’s not much different than a traditional mortgage, though.

Here’s how the process unfolds.

The lender agrees to move ahead with the loan closing. The loan goes to underwriting. That’s the process in which the lenders and backers work together to ensure the borrower is a safe bet. This can take several weeks.

Once the underwriters approve the process the loan moves towards closing. The home buyer will sit down with a representative from the lender or with a third-party title agency. This signing process includes many of the details of the loan, but it also includes all information about the deed of trust. Encourage your home buyers to read it. In some cases, real estate agents can (and may wish to) be present during the property closing. However, this is a transaction between your buyer and their lender.

Then, we need to record the deed of trust. The buyer doesn’t have to do this him or herself, and neither does the real estate agent.

First, state laws will require the lender to hold a copy of the deed of trust for themselves. This is always accessible to the borrower as well as to other interested parties. The trustee will file the deed of trust document with the court system. As you will see later, the trustee holds a great deal of power throughout the ownership. Most often, the deed of trust document is filed with the county recorder’s office – some states have different terminology for this.

Finally, at this point, keys are exchanged and the transaction is complete.

What happens in the event of a default?

It is important to be able to explain the Foreclosure process to Your Buyer.

Most people have an opinion or thought about foreclosure. Your clients have likely had friends who lost their home through foreclosure. They’ve seen the news reports of homeowners being kicked out of their homes as a result of the “big, bad banks.” Yes, it is heartbreaking when this happens, but it is also legally justified in most cases.

Here’s the bottom line. When your buyer is sitting in front of you ready to buy a home, they are thinking about the layout, the backyard, and what color to paint the interior. What you need to ask them is whether or not they are confident they can afford the monthly loan payment. Sure, this isn’t your legal requirement, but real estate agents are often indirectly connected with the loan. If you sell them a home and they cannot pay for it, they will indirectly blame you.

That aside, you also need to explain foreclosure to your buyers when they ask about it. Some may say, “I’ve heard the market is too risky and banks are foreclosing on buyers…” Or, in some areas, the view is much harsher. “I don’t know if I want to buy. I know banks are taking back homes from people right from under them.”

In a deed of trust case, the process is a bit different than with a mortgage. Here, the court isn’t used directly. It’s bypassed. This is called a non-judicial foreclosure. And, that also means it is far more affordable and a quicker method to resolving the situation. It means the court does not oversee the procedure. On a side note, some states will have a requirement that a judge will sign off on the foreclosure. To be blunt, non-judicial foreclosure – or foreclosure with deed of trust documents – favors the lender, not your buyer.

What Happens During the Non-Judicial Foreclosure?

Let’s say your home buyer finds him or herself facing foreclosure. In a non-judicial state, they may have very limited time to take action. There’s not usually very much time required for giving notice of a pending foreclosure. And, once it does happen, most homeowners have little ability to get out of it.

Here’s a very brief overview of what will happen in this situation. We’ll go into more detail about non-judicial foreclosure in a later chapter. However, to understand the deed of trust, you need some info:

- The borrower missed a payment and the trustee sends a letter to the borrower of the missed payment.

- If the borrower fails to make payment in the given time, the trustee lists the property for auction.

- The trustee auctions off the property and, if not bought, it reverts to the lender’s ownership.

- Some states allow the borrower to redeem the property by paying all fees and all that’s owed within a specific timeframe after the sale.

Let’s create a visual for how this might happen.

Mr. Smith is your client. He buys a home with your help. The transaction is in a state where deeds of trust are used. He secures a home loan, obtains the deed of trust when the property is sold and starts making payments to the lender. As an agent, your job is done at this point.

Six months later, he’s missing payments for some reason. He may have lost a job, became ill, or just didn’t manage his money wisely. With a deed of trust, the trustee sends a notice usually within 30 days of missing his first payment of a notice of default. Soon after, sometimes just a few days, a notice of sale occurs.

Now, many times, lenders will start calling borrowers the day after a loan payment is missed. Some even offer to work out payment arrangements or will accept late payments. A borrower that ignores those calls is one that is going to see these notices occur much sooner.

Once Mr. Smith receives the notice of sale, he has very little legal opportunity available to him. Remember, he can’t buy time or delay the proceedings since the court isn’t involved here. The trustee handles it all. He should invest the time in speaking to the trustee to see if they will accept late payment to reinstate the loan. Sometimes, they will not offer this.

The trustee holds the auction to sell the home. The homeowner has to vacate the property. Mr. Smith sees the home sold at auction but still has the right to redeem. Mr. Smith works to secure the additional fees along with the loan payments he missed. He’s able to meet the conditions of the right to redeem. That means, Mr. Smith will maintain his home and whoever purchased it at auction loses any claim to the property.

What Is Your Role as a Real Estate Agent?

As noted earlier, most real estate agents don’t have to worry much about these proceedings (unless they are working with a homeowner who is trying to sell the property prior to defaulting on it.)

As an agent, you do not want to encourage someone who cannot truly afford a home to make a purchase even if that is contradictive of creating a profit for you. It’s better to ensure they understand the risks of foreclosure from the start.

Key Terms

Beneficiary

The lender on the security of a note and deed of trust.

Trustee

The third party under a deed of trust.

Trustor

One who borrows money from a trust deed lender, then deeds the real property securing the loan to a trustee to be held as security until the trustor has performed the obligation to the lender under terms of a deed of trust.

14.4a Deed of Trust Infographic

Please spend a few minutes reviewing the Infographic below.

14.5 Recording Procedures and Priority

Transcript

Real estate agents often are asked questions about the legalities surrounding the mortgage signing process and what happens after that. While your home buyer is interested in getting the keys to their new home in hand, there is also the need to understand the legal process behind obtaining a mortgage. Remember, a mortgage is a document that is signed by the buyers promising to make payment and linking the actual real estate to the home loan.

After signing this document, what happens next? The answer to this question is: the recording process.

First, let’s talk about who handles the recording. In most cases, the county government will be responsible for the recording process. It may be a service called “registrar of deeds” or “county recorder.” This happens in the county where the home is located.

The recording process, in basic terms, simply makes a public record of the transaction. It means that now everyone can know that you own a home and have a mortgage on that home – as well as who holds the title to the loan. Mortgages are recorded. Promissory notes do not get recorded.

During the document signing process, the home buyer agrees to the terms of the mortgage and home loan. The title agency or lender is then required to submit these documents to the county for recording. The documents must be in writing and they must be signed by the necessary parties. Most counties have very specific details for these documents. As a real estate agent, you don’t necessarily need to know those details, but you should be able to clarify questions your home buyers may have.

There’s also the importance of understanding priority of liens. Lien priority is, as its name sounds, a listing to determine who gets paid first if there is a default or foreclosure on the sale. Those liens with a higher priority are paid first in this situation. Conversely, a lower priority lien is less likely to receive funds – or may not receive all of the funds owed to them – should the property head towards default. This is generally based on the date the liens are filed.

Take a closer look at first priority liens since this is the most common situation for your home buyer. As the name sounds, first priority liens are the first loans on a home. These are typical mortgages. When working with your real estate buyers, you are likely to deal only with mortgages. Typically, these are the loans used to make the purchase of the home. As a result of being a first lien, they have the highest priority and the least amount of risk to lenders.

It’s important to note that tax liens and special assessments are two types of liens that are actually above mortgages in most cases. In other words, these are paid first even if there is only a first mortgage on the property.

If your buyer is purchasing a home that has a tax lien on the property, this will be known at the time of the sale. In most cases, the tax lien must be paid by the home buyer (or the seller) right away. If a property owner fails to pay his or her tax lien – at any time during ownership of the property – the county or tax lien holder can take ownership of the property through foreclosure. If this occurs, the mortgage lien will not be the first priority on the property.

Junior liens are the term given to any additional secondary loan on the property. In short, this is any subsequent lien that is on the property. These are any type of loans on the property in which the property is used as collateral.

Perhaps the most common type of junior lien is the second mortgage, such as a home equity line of credit. As an agent, you may not have to come into contact with this type of loans. However, home equity loans and other junior liens take advantage of a home’s available equity. Many times, your home buyers will want to tap into equity for repairs or for credit consolidation. Equity is the un-mortgaged portion of the home’s value and equity builds over time, as the home loan is paid down and as home value increases.

As noted, junior liens do not get priority when the homeowner defaults on the loan. They are only paid out if there is available value after the mortgage or first priority liens are paid.

Keep in mind that it is possible for things to change. Subordinate is the process in which the holder of a lien can change their priority through an agreement. The subordination agreement – though not common – simply means that a junior lienholder can move up the line to take a higher priority position in the repayment if foreclosure occurs. In some situations, a lender will demand this in order to have a higher priority and to reduce its risk.

What does all of this mean to today’s real estate agent?

Generally speaking, you’ll need to understand the reason for recording (which again, it is the process to make a public record of the home sale and loan) as well as whom holds access to the home’s value should default occur. If a lender pursues foreclosure, moving the home to auction or bank ownership, these loans will be paid out in order of priority. Your home buyer should understand this when signing any agreement to obtain their first mortgage or any other loans they will obtain down the road.

Key Terms

Junior Mortgage

A mortgage recorded subsequently to another mortgage on the same property or made subordinate by agreement to a later- recorded mortgage.

Priority of Lien

The order in which liens are given legal precedence or preference.

Recording

The process of placing a document on file with a designated public official for public notice.

Subordinate

The make subject to, or junior or inferior to.

Subordination Agreement

An agreement by the holder of an encumbrance against real property to permit that claim to take an inferior position to other encumbrances against the property.

14.5a Priority of Liens Infographic

Please spend a few minutes reviewing the Infographic below.

14.6 Foreclosure

Transcript

Real estate agents will encounter foreclosure from time to time. In many situations, foreclosure is the most misunderstood of real estate transactions. You may have a client step into your office inquiring about buying a “foreclosure” or looking for a home that’s priced very low because it is being sold by a bank.

It’s important to be able to explain to your would-be home buyers what foreclosure is, why it happens, and what it means to them whether they are the homeowner or the home buyer. As may be expected, it is not as clear cut as many think. In fact, it tends to be a very long process and any cost savings associated with foreclosure in the eyes of a buyer is often diminished because of the legal hurdles in the way. Many believe that foreclosures are gold mines, when they could very well be significant problems. Of course, there are many opportunities for true profitability here as well.

Here, we will talk about what foreclosure is and what it means to the legal transactions involved in buying and selling a home. Most importantly, we’ll talk about your responsibilities as a real estate agent to communicate with your buyer about what foreclosures mean to them. They will have questions. It’s your job to ensure your clients know exactly what happens when they default on a loan as well.

What Does the Term Foreclosure Mean?

Foreclosure is a term used to describe the process of taking possession of a home with a mortgage when the mortgagor (the homeowner) fails to maintain his or her payments on their home loan. It’s important for home buyers to recognize this is a very real threat to them if they purchase a home without solid financial means to repay the loan.

Now, that’s not to say that the foreclosure process is simple. Depending on where a property is located, it can be quite complex and take months to process. Yet, the end result tends to be the same. If the homeowner does not have the means to continue to make payments – and catch up any late payments and debt owed – the lender will eventually pursue foreclosure and take ownership of the home or force the sale of the property.

How is this done? There are several methods.

Methods of Foreclosure

Generally speaking, foreclosure processes are outlined and governed by state laws. These laws spell out the specific steps required for the lender to take in order to foreclose on a property. This is nothing new to the homeowner, though. At the time of signing the mortgage contract, the buyer of the home agrees to the terms he or she must meet in order to maintain the loan and avoid foreclosure. In other words, your home buyer is agreeing to the foreclosure process at the time he or she obtains a home loan for the purchase of a home. That’s why he or she must understand what’s involved here.

Let’s break down the three methods of foreclosure commonly present and used. Which one is used is dependent on state law, or in some cases local law, or mortgage agreements made in advance.

Judicial Foreclosure

Judicial and non-judicial foreclosures are the two most common forms of foreclosure. The simplest breakdown of the two is that judicial foreclosure goes through the court system while the non-judicial foreclosure is handled by a third party. Many states require that all foreclosures go through the court system, but others allow for this not to be a requirement.

Judicial foreclosure states include:

- Connecticut

- Delaware

- Florida

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- New Jersey

- New Mexico – in some cases

- New York

- North Dakota

- Ohio

- Oklahoma – in some cases, if homeowner requests it

- Pennsylvania

- South Carolina

- South Dakota – in some cases, if homeowner requests it

- Vermont

- Wisconsin

Judicial foreclosure is most common.

Here’s how the process works. The lender takes the first step in approaching the court to get the foreclosure process started. The court will require the lender to send various letters and notifications. There are often waiting periods. Ultimately, the lender will work to meet all court requirements before the process is finalized. Here’s a breakdown of what commonly happens.

- The home buyer gets behind on his or her home loan payments. Your homeowner can face foreclosure even if he or she only misses one payment. In most cases, the wait for this process is a bit longer.

- The lender sends the homeowner a letter informing them of the intent to foreclose on the property. The letter outlines what the homeowner must do to avoid this – generally paying all late payments, fees, and interest to catch up on the loan.

- When this does not occur, the lender files a notice of a lawsuit. This may be a summons or a complaint that is given to the homeowner stating the lender’s actions to foreclose. This is being served by the lender.

- The lender gives the homeowner a chance to respond. This is when the court begins to impose specific requirements. In some cases, there is a period of 15 to 30 days for the homeowner to respond. The homeowner may contest the process or argue the lawsuit. The homeowner is not required to file a response. The lender holds the burden of proof, which means it needs to prove the actions are justified.

- If the homeowner does not respond, in most cases, the foreclosure will go through. In this case, the court will issue a default judgment against the homeowner allowing the lender to sell the home.

- If the homeowner does respond, the homeowner is given an opportunity to tell the judge why they should maintain legal right to keep the property and prove the foreclosure is not warranted. The lender is given a chance to correct any problem that caused the homeowner complaint. Generally, this process can buy the homeowner time, but unless the loan is paid up to date, it’s likely the foreclosure will continue.

- At this point, the lender is given the right to sell the property, unless the court rules in favor of the homeowner to keep the property provided the homeowner meets any terms set by the court to do so.

- The lender will send a notice of intent to sell the home. The only way to redeem the mortgage at this point is to catch up all payments, sell the home, or pay it off in full (this generally will include the foreclosure costs).

- The property is auctioned. If there are no buyers at the auction, the ownership of the home transfers to the lender. The lender then can place the home for sale or hold onto it, depending on its needs.

The process of judicial foreclosure generally takes between three and four months, sometimes longer. However, as long as the lender maintains ownership of the property, there is no immediate need for the homeowner to move. In fact, he or she can remain on the property, living in it without making a mortgage payment, until a written and official eviction notice is sent. This may be months if the lender plans to hold onto the property until the market improves.

In all cases, though, the foreclosure process ends with the court granting ownership of the property to the lender unless the homeowner can redeem him or herself.

Non-Judicial Foreclosure

As noted previously, a non-judicial foreclosure is a second type. Here, the court is not involved in the same manner. This type of foreclosure, though, will still result in the home’s ownership changing hands.

Non-judicial states include:

- Alabama

- Alaska

- Arizona

- California

- Colorado

- District of Columbia

- Georgia

- Idaho

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Mexico – in some cases

- North Carolina

- Oklahoma – homeowners can elect for judicial foreclosure here

- Oregon

- Rhode Island

- South Dakota – homeowners can elect for a judicial foreclosure here

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wyoming

As a real estate agent, it is important to understand the specific requirements in the operating state. That is, agents must know whether judicial or non-judicial laws are in place and how that impacts their homebuyers, down the road, if default occurs.

In states with non-judicial foreclosure, the homebuyer signs a series of documents at the time the home is purchased. This includes a promissory note and a deed of trust. A deed of trust document will turn the promissory note into the debt that is secured by the lien on the property. This process creates a legal claim to the property by the lender should the homebuyer default on the loan. This deed of trust gives the lender the right to foreclose on the property when the buyer fails to make payments according to the terms of the loan.

Additionally, the deed of foreclosure gives the lender the right to proceed outside of the court system for the foreclosure. The states still establish laws that must be followed during the legal procedure, including how much time the homeowner has to respond to claims and how the property is sold. It also provides for rights of the homeowner to have the loan reinstated, should certain terms be met.

Take a look at how the legal process occurs in a non-judicial foreclosure.

- There’s generally very little time for a homeowner to take action since the foreclosure sale can occur much faster outside of the court. A notice of sale is given, in some cases, as the first step. Some states require this notice to be given to the homeowner in person, while others require it simply to be posted in a newspaper or at the courthouse.

- The notice of default and notice of sale are two common notices required by some states. These are formally written documents that state the loan is 30 days past due (in most cases, but it can be less) and that the house will go up for auction. Most often, there is only a month given to the homeowner prior to the auction.

- The homeowner at this point must determine if he or she wants to pay the loan off in full or otherwise meet the obligations of the lender to reinstate the loan. With very few opportunities for delay, the homeowner may be unable to do so.

- The auction occurs. If the property does not sell, the home becomes the legal property of the lender.

- Some states provide for a right to redeem, giving the property owner time to meet specific requirements set by the lender to redeem the property such as paying it off in full after the foreclosure and auction occur.

It’s important to tell your home buyer that the foreclosure here is much faster – involving just a matter of two or three months.

Deed in Lieu of Foreclosure

A third type of foreclosure, really, isn’t a specific method. In this situation, the homeowner is unable to make payment on the loan. He or she may have tried to get the lender to work with a repayment plan or forbearance, but have been unable to achieve any methods to getting the loan caught up. The homeowner still wants to avoid the foreclosure process. He or she is faced with either a short sale (more on that in a bit) or a deed in lieu of foreclosure. These are two similar transactions, but they can be very different in terms of how they are processed.

As a real estate agent, you may not have much hands-on experience with these, but you will encounter short sales. In many cases, short sales – on the other side of the transaction – can become one of the more challenging situations for you, as you try to help home buyers purchase these, or help lenders sell them.

First, let’s talk about what happens with a deed in lieu of foreclosure.

Often, individuals will try to sell their home through a short sale to avoid the foreclosure process. But, for various reasons, this does not happen. This is when the homeowner may approach the lender to request this process.

A deed in lieu of foreclosure is a legal transaction in which the property owner will transfer the title of that property to the lender. In exchange for this outright ownership, the homeowner is released from the home loan obligation. In short, the homeowner wants to hand over ownership of the property to the lender to get out from the mortgage.

This may seem like a win-win situation; however, lenders are not in the business of owning homes. Generally, they do not want to own homes because this reduces any type of actual profit they can make on the property. For this reason, lenders may not agree to the terms of a deed in lieu of foreclosure.

Here’s how the process will work in most cases:

- The homeowner and borrower will request loss mitigation from the lender. This initial process is an opportunity for the lender and the homeowner to find better terms for the loan, if possible, that helps the homeowner to continue to make payments on the loan. There is an application for the homeowner to fill out, and documentation is required, showing the borrower’s financial state.

- The borrower will need to prove his or her case for the situation. Financial statements, questionnaires, tax returns, proof of income, and a hardship letter are often required.

- The lender then decides whether or not to move forward with the process. In some cases, the lender may require that the homeowner try to sell the home on the open market for a period of 30 to 90 days. This would produce the best outcome for the lender and the homeowner if possible.

- If the home does not sell, the lender may agree to the deed in lieu if it believes that this is best for its benefit – not that of the homeowner. The lender may agree to do so simply because the foreclosure process is very expensive in many cases. Those expenses come from the lender’s pocket.

- If it goes through, the lender will send documents requiring the homeowner to transfer ownership to the lender. An estoppel affidavit is a document that will include a provision that the homeowner is acting freely and voluntarily through this process.

The home transfers hands. In a moment, we’ll discuss what happens to the left over balance on the loan. This is called deficiency. For now, though, realize that this legal process generally can take three to six months, or longer. During that time, the lender may elect to pursue foreclosure actions if there are delays.

Redemption in Foreclosure