Chapter 19 - Appraisal of Property

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) List at least one property types that is commonly valued using the direct sales comparison approach.

2) List at least one property types that is commonly valued using the cost approach.

3) List at least one property types that is commonly valued using the income capitalization approach.

19.1 Definition of an Appraisal

Transcript

Appraisals are necessary for every real estate purchase and sale agreement. Many real estate professionals are uncertain as to what an appraisal is and who performs an appraisal. In general, an appraisal is an opinion formed by a professional about the value of a property. To complete an appraisal, analysis of data and facts about the property must be completed. This analysis is completed by an appraiser.

Who Can Be an Appraiser?

Generally, an appraiser is a person who has at least a Bachelor's degree and had completed specific educational requirements. On a federal level, an appraiser must be a Certified Residential Real Property Appraiser or Certified General Real Property Appraiser. States often require additional licensing before this person can determine the value of residential or commercial properties.

Definition and Purpose of an Appraisal

As previously stated, the purpose of an appraisal is to arrive at a market value of a given property. Keep in mind, an appraisal is an estimate of the value of a property at a specific time. One would not use an appraisal of a property from a year ago as the value today; values fluctuate over time depending on numerous factors. Normally an appraisal may be used in three cases: transfer of property, financial reasons and tax purposes.

- Transfer of property — When a buyer and seller are involved in a real estate transaction, there needs to be a value placed on the property. There may also be instances where a property transfers ownership for other reasons that may require a market value.

- Financial reasons — When a buyer is borrowing money, a property owner is considering refinancing or a property is being used as collateral, the lender will typically require the property be appraised.

- Tax purposes — In some cases, a current market value is needed for tax purposes. This can occur during the estate planning process, when determining taxes for an inheritance or a gift or for other reasons where it may be necessary to provide an estimated assessment value.

There may be other reasons for obtaining a valid appraisal, but the three are the most common reasons.

While a real estate professional may rely on data obtained from recent sales to reach an estimated value, this is not considered an appraisal, instead it will result in an estimate of what the seller may reasonably expect to receive when a property is sold. This is typically called a market valuation and not an appraisal.

Who hires an appraiser?

Appraisers may be hired by a buyer, a seller, a lender, or any number of other persons who may need to have a property valued. In most cases where a real estate agent is involved in the purchase or sale of a property, the lender will hire an appraiser of their choice.

It is important to keep something in mind: if a buyer or seller hires an appraiser before there is a purchase and sale agreement in place, the lender working with the buyer may not accept that appraisal for the purposes of approving a loan. This could ultimately result in two appraisals being ordered on a single property.

Key Terms

Appraisal

An estimate of the value of property resulting from an analysis of facts about the property. An opinion of value.

Appraiser

One qualified by education, training and experience who is hired to estimate the value of real and personal property based on experience, judgment, facts, and use of formal appraisal process.

19.2 Purpose of an Appraisal

Transcript

As a real estate professional, you will be involved in the sale of property and possibly helping sellers reach a decision on listing price. In nearly all cases, you will depend largely on comparative sales in the area to reach a consensus on the home's value. However, before a buyer can obtain financing, a professional appraiser will be required. In effect, the purpose of an appraisal is to determine the value of a property at a fixed point in time.

Introduction to value

While most items we purchase have a limited life and are used nearly immediately, our home values are realized over time. To properly value a piece of property, all appropriate elements must be taken into consideration. The elements of the value of real estate are generally known as the acronym "DUST". The acronym means demand, utility, scarcity and transferability. Here's how they play a role in the value of a piece of property:

- Demand — as with any commodity, the more popular something is, the more people who are interested in buying. This results in an increase in value. If fewer people are interested, the demand is lower and the value therefore is also lower.

- Utility — one tends to not think about the utility of a property because of the subjectivity of utility. However, the more useful the property, the higher the value. To put this into perspective, think about the features that would be helpful in a senior housing development. Features like handicap bars in the bathroom would be an example of something of value to seniors, but less attractive to someone in their 20's.

- Scarcity — if 10 people are trying to find a three-bedroom home and there are only five available in the neighborhood they are interested in, the property has a higher value. If there are five people looking for a three-bedroom home and there are 10 in the neighborhood, the property will have a lower value.

- Transferability — most real estate professionals are familiar with clean, clear title. This means the property can be transferred to another person without restriction. This means properties that have an encumbrance such as a right-of-way will typically be valued lower than one with no encumbrance.

Types of Property Value

Properties are valued in differing manners depending on the party who is requesting the value. Investors, insurance companies, mortgage companies and taxing authorities all use different values for the same property which can be confusing. Here are the various types of property value:

- Investment Value — investors are going to look at a variety of factors including available financing and terms as well as the tax rate of a property. Different investors may have different criteria when determining value.

- Insured Value — insurance companies will assess the parts of a home that may be destroyed to determine how much insurance coverage a homeowner may need. The value of the land a property sits on is therefore deducted from the overall value of the home.

- Value-in-Use — typically used for commercial properties. This valuation is determined by the current use of the property. For example, a single-site retail facility which is currently operated as a pharmacy may not covert well to be a single-site restaurant. Therefore, the empty facility would be less valuable to a restaurant investor than to another retail investor.

- Assessed Value — this value is assigned by municipalities for the purpose of determining the tax rate for a property.

- Mortgage Value — this figure is determined by the amount of the mortgage of the property. This value changes in the event a property owner takes out a new mortgage. However, the mortgage value is not impacted if the property increases or decreases in value.

Market Value of Real Estate

The market value of a property is based on what the property, in the condition it currently exists in, will sell within a reasonable period of time. In a stable real estate market, this usually means what the property could sell for within a 30 to 90-day period. Keep in mind, the market value takes various issues into consideration; including that both the buyer and seller understand the transaction, that the sale is not based on coercion by one party or the other, and that the transaction is "arm's length" meaning there are no related parties involved in the purchase and sale.

Understanding True Market Value

To expand further on market value, one must understand there are several factors that must be taken into consideration. Some of them include:

- Equal Motivation — both the seller and the buyer must be equally motivated. This means neither party is under duress. An example of this would be if the seller is going through a divorce and is being forced to sell the home, they may be willing to accept a lower price for the home than it might be otherwise worth.

- Parties Best Interests — while the interests of the buyer and seller may be different, both parties must be well-informed about the risks and rewards associated with the pending agreement. For example, if a buyer sees a home they like and the home's roof is 20 years old, the buyer must be informed about this. When the final decision is made as to whether to move forward with a purchase and sale, both parties must be taking their own interests into consideration.

- Exposure on Open Market — the market for the property must be considered open. This has two factors: time and exposure. First, there must be a reasonable time the property is listed for sale. Second, the property must have exposure to the open market. One could not post a property for sale on a supermarket bulletin board for three weeks and assume that will insure the proper level of exposure, nor that access to the open market was achieved.

- Consideration — the buyer must be willing to pay for the property in cash or the equivalent of cash. This will typically involve the buyer making a cash down payment and securing reasonable financing in return for the purchase of the property. Basically, the buyer is not trying to exchange the home for something of lesser value; for example, one would not expect the seller to accept a rake in return for a home.

- Financing Considerations — the buyer must be able to secure financing to facilitate the purchase. If banks have frozen lending to all single-family homes with fewer than five bedrooms, then the market value would be negatively impacted on homes with fewer than five bedrooms.

- Pricing of Property Sold — the price must be considered normal consideration for similar properties. In other words, if the seller was to make concessions like agreeing to pay the buyer's mortgage for the first year in the home, this would fail the normal consideration test.

Market Value versus Sales Price

While most people believe that market value is tied to sales price, this is not always the case. A seller may believe a property is worth $200,000 but may not find buyers willing to pay more than $175,000. Therefore, the market value is not driving the sale price; instead the perceived value to a buyer is driving the sale price.

When there are more buyers in a market, the value of a property increases. This is due entirely to demand. Remember, demand for properties are often cyclical; parents with children in school are less likely to be looking for new homes between Halloween and New Year meaning there is less demand for properties during this time. However, come May or June, parents who are considering a new home will be flooding the market making demand much higher.

Market Value versus Cost versus Price

While one may believe the price of the home, cost of the home, and market value of the home will all be similar, this is not always the case. In fact, these values are all likely to be different based on various market conditions. Let's take a look at the difference between each:

- Market Value — as previously stated, market value is based on numerous factors including the condition a property is in at the time it is listed for sale. There is an assumption when a property sells in 90 days or less, without repairs, then the value of the property is the sale price. There are certain assumptions that are made with market value including the knowledge of both buyer and seller; both must have an understanding of the transaction they are entering into and both must be negotiating in good faith.

- Cost — cost may or may not equal value. There are numerous factors which go into the cost of a home beginning with the land costs. Costs include all money that is spent in developing a property. This means the cost for an architect to design the property, legal services and fees for filing the appropriate titles and deeds as well as legal services. There are other fees including the costs of a contractor, the taxes paid on the property, financing costs, materials for the property and labor costs. Any cost that is associated with the purchase, development, ownership or financing will be taken into consideration.

- Price — the bottom line in all real estate transactions is what the purchaser agrees to pay and what the seller agrees to accept. The price also takes other factors into consideration including whether or not the transaction is conducted in an arms-length transaction. If two family members are involved in a purchase the chance is that the sales price will be lower, compared to a transaction where the persons are not related.

An example of how these varying factors may be different can be seen in this type of scenario:

Let us assume for a moment that a developer's goal is to build a house, and sell the home to make a profit. This means the builder would need to factor in all costs such as land acquisition, legal fees, financing fees, construction fees, etc. Once the builder has completed the construction, they now have the final cost.

Therefore, based on their costs, they add on their projected profit, review the market, and make an analysis of what the property should sell for. In other words the developer will list the property for sale at a specific price, based on what they spent, what they want for a profit and what they estimate the market will bear.

Let’s assume that after a sufficient period of time, where the developer listed the property for sale, the best offer is $50,000 below the price they wanted. This decrease is often due to different factors and market conditions. Some of the market conditions that have impacted the seller negatively include increases in interest rates, less demand for property of that size or type, or other factors outside of their control. This may have a negative impact on the seller, but is typically good news for buyers.

Buyer and Seller Relationships

While the end goal is to complete a purchase or sale, the buyer and seller are often working at odds with each other. This is because their interests are not the same; the buyer is interested in getting the home they want at the best possible price, while the seller is interested in making as much profit as possible from the sale.

Chances are, as a real estate professional you will be dealing with competing property values. The more unique the property, the more challenging is to establish value. While you may be able to give a seller a basic idea of the value of a home, based on the factors that are publicly available to you, only when a professional appraiser is hired will the seller have a firm understanding of the appraised value of their property.

Real estate professionals must be aware of all factors impacting property value because they will have an impact on how you help sellers determine the price at which a property will be listed, as well as provide realistic information about how long a property will remain on the market before being sold.

Key Terms

Assessed Value

A valuation placed upon a piece of property by a public authority as a basis for levying taxes on the property.

Cost

The total dollar expenditure for labor, materials, legal services, architectural design, financing, taxes during construction, interest, contractor’s overhead and profit, and entrepreneurial overhead and profit (may or may not equal value).

Demand

The supply of willing and able buyers in the marketplace or lack thereof.

Insured Value

The value of an asset or asset group that is covered by an insurance policy; can be estimated by deducting cost of non-insurable items (e.g. land value) from market value.

Investment Value

The specific value of an investment to a particular investor or class of investors based on individual investment requirements; distinguished from market value, which is impersonal and detached.

Market Value

The highest price in terms of money which a property will bring in a competitive and open market and under all conditions required for a fair sale, i.e., the buyer and seller acting prudently, knowledgeably and neither affected by undue pressures.

Price

The amount a purchaser agrees to pay and a seller agrees to accept in an arms length transaction.

Scarcity

A lack of supply

Transferability

The ability to transfer ownership of property from one person to another.

Utility

The ability to give satisfaction and/or excite desire for possession.

Value

Present worth of future benefits arising out of ownership to typical users/investors.

19.3 Factors Influencing Value

Transcript

For most people, the bulk of their wealth is tied to the value of their home. Regardless of how well a property is maintained, there are external forces which have an impact on home values, which are out of the homeowner’s control. These factors, individually, or combined, impact real estate value and may also have an impact on how quickly a home is sold. The four factors are social forces, economic forces, housing construction costs, and governmental matters. As a real estate professional, it is important to have an understanding of how each impacts real estate values

The Impact of Social Forces on Real Estate

Social forces are unique to every neighborhood. An example of this is if a neighborhood has numerous small commercial properties and more people are opting to work from home, the office space may remain empty. This would mean the real estate was a riskier investment. Keep in mind, when the social makeup of a neighborhood begins changing, property values may also be impacted. Smaller families may replace large families, seniors may replace newlyweds, etc. Other factors include:

- Population trends — when a neighborhood is going through a period of stability, housing values tend to be stable. Should the neighborhood go through a period of growth with new properties being built, making a neighborhood attractive, the price of housing will typically increase. In times when people are fleeing the neighborhood due to various forces, such as crime rates, the homes in the area tend to decline.

- Family composition — the makeup of families has an impact on real estate. Today, more than ever, we have blended families where you may have parents living with children, children living with parents or you may have two parents who are now sharing a home. This means the demand for specific property configurations is different; let's face it, a two bedroom ranch will not be suitable for two parents who have four children between them.

- Aging population — there is no question that the overall population of the United States is getting older. Real estate that is specifically designed to meet the needs of an aging population, such as senior housing developments, will see values increasing while starter homes, those designed for young couples who may be considering starting a family, will decline. Seniors are typically interested in smaller homes, usually with a single floor and need easy access to medical care making neighborhoods that fit this mold more popular and therefore more valuable to seniors

Understanding Economic Forces

Various economic issues will impact neighborhoods. For example, if a specific area loses a large factory, or a large company moves from the city, the home values in the area will suffer as a result. This is largely due to the fact that employment will decrease meaning income levels are decreasing. Conversely, if an area goes through a period where new employers are moving into the area, the employment levels increase, incomes tend to increase, and therefore, property values increase. Remember, someone may want to purchase property but if their income is not stable, they cannot justify the expense.

Stop and think about a suburban neighborhood with 50 – 100 homes where more than half of the residents are employed by a large employer in a nearby city. Should that employer shutter their doors? Many of these locals could potentially need to sell their homes to find a more affordable home. This means a glut of real estate in the market resulting in lower prices.

It is also important to keep in mind that there is one other factor impacting every property on the market and that is the availability of capital. If mortgage lending is easily accessible, property values are likely to show a modest increase. This is particularly true if lenders are motivated to lend. Motivating factors may include: stable interest rates, low foreclosure rates or strong employment numbers. However, if the opposite happens, lenders may tighten lending resulting in fewer people being able to secure a mortgage to purchase a home. The net result is lower property values because the homes are sitting on the market for longer periods of time because there is less demand.

Real estate professionals must have an understanding of the various economic forces that could have an impact on real estate values. These numbers are tied not only to available opportunities in the area, they are also tied to the age of the population in a neighborhood. An example of this would be an area that is remote and has no large employers. These areas are likely to attract only older people without children since chance is there are fewer opportunities and likely fewer local services or schools.

The Impact of Construction Costs

The cost of financing new home construction can get complicated. There are hard and soft costs involved in all construction project. Hard costs include construction materials, the purchase of land, labor, etc. Soft costs include items like permits for construction, costs to rezone property for the use the builder intends, and utility connection fees, to name a few. These costs often determine the builder's willingness to develop new properties.

Other factors that must be considered include interest rates and the availability of money. When interest rates increase, fewer consumers are eligible for mortgage loans. Additionally, fewer investors will be interested in commercial and rental properties because their cost of funds is higher, meaning the property is less valuable to their portfolio.

In addition to the cost of financing, factors such as location also have an impact on new construction. Physical conditions such as land that will not pass perk tests, wetland restrictions and other environmental factors also impact the value of land. These factors have an impact on construction costs because they often consist of higher costs for permits, additional studies, etc.

Local transportation issues, which are largely dependent on the location of a property will also play a role in property values. Areas with a good public transportation system or easy access to interstate highways are often valued higher than more remote properties. This is because homeowners will always look at convenience when deciding where they prefer to purchase a home.

Finally, another factor that is likely to play a role in home value and construction costs is the area weather. While average temperatures may not impact value directly, climate issues like flooding, wind, and other natural phenomenon can impact the value of property. Builders who purchase homes in areas where tornadoes or hurricanes are common, tend to believe those properties will be lower in value than homes which do not have these types of weather hazards.

As a real estate professional, it is important to understand what factors may negatively impact a property to enable you to discuss sale prices with sellers. While not every factor will impact every property, understanding the unique characteristics that impact individual neighborhoods is an invaluable tool that will help you understand the appraised value of properties.

Governmental Issues and Property Values

Let's face it! Regulations are everywhere! This is true when you are building a home, buying a home or selling a home. However, there are governmental issues that have a direct impact on the value of property that you should be aware of, as you pursue your career in real estate. Some of the more common factors include: taxes, quality of schools and quality of services.

Let’s break them down one by one:

- Taxes — Property taxes are a concern for those who are purchasing a home. One of the questions most buyers will ask about is the property tax rate, and in many cases, when was the last time the rates increased. In addition, some municipalities have their own tax, separate from the taxes that are collected as property taxes. These taxes will have the effect of depressing property values; the higher the taxes, the fewer people who will be interested in the home.

- Quality of schools — this will be particularly important in areas where there are single family homes that attract couples with children. If the quality of the schools in the area is lacking, the property values will be depressed because parents will not want to be in the area. This is one factor that may not impact property values in places like retirement communities but in most neighborhoods it will certainly play a role in property values.

- Quality of services — when we think of town-supplied services we tend to think about fire and police. However, factors like town or city sewer, internet access and trash pickup can also play a role in property values. Let's take a look at simply internet access; today, more people are gravitating to working part or full-time from home which means they need reliable internet access. If a community lacks even basic internet this will decrease property values because fewer people, particularly young people, will be interested in the property in the community.

While a seller may have taken extraordinarily good care of their home, there are factors beyond their control that may still make the property less valuable than they believe.

Key Terms

19.4 Principles of Value

Transcript

Introduction to the principles of value

While property values may be based on the previous sales in the area, the condition of the property and other factors, there are certain principles of value that will also be evaluated during an appraisal. Understanding these principles will help you understand the value of nearly any property.

The Principle of Anticipation

While the basis of real estate valuation may appear to be based on today's dollars, the value is tied to the benefits the property may offer buyer in the future. For example, while an appraiser will look at demographics and growth of the neighborhood in the past, this is also used to apply a future value to the property.

There are some practical ways to look at this. For example, let's say a local neighborhood that is designed for families has no school or playground. If there is an indication that a playground and a school are in the works, the property in the neighborhood will likely increase because of the anticipation of what will happen in the future.

The Principle of Change

Over time, there are several factors that change the estimated value of property. Changing market conditions such as supply and demand, interest rates and property conditions will have an impact on the value assigned to a property.

The simple way to look at this is the aging of property. Homes which are built around the same time tend to age in similar manners. However, if someone purchases an empty lot in the neighborhood and builds a home that is similar in style, the newer home will have a lower value simply because the other properties in the area are older and not as modern. If you recall, when analyzing a property value, an appraiser will most probably use the Sales Comparison approach.

The Principle of Competition

Supply and demand is always a factor in property valuation. The more buyers there are, the higher the demand for a property thus driving the value up. The fewer the buyers, or the more properties that exist, the lower the value of the property.

One could reasonably apply this to a sub-division comprised of split-ranch homes which are primarily three bedroom homes. If there are 100 available three bedroom homes and there are 200 buyers looking for three bedroom homes, those properties become more valuable due to the number of buyers. The flip side of this would be if there are 200 available homes and there are only 100 buyers who are looking for this size home; the property would have a lesser value.

The Principle of Conformity

There are times when being unique is invaluable. When you are building a home, or looking at homes in a particularl neighborhood, conformity is actually a better option. This is because the value of a home that is unique in the area will typically be lower than if the home was similar to others in the area. An example of this would be if you have a neighborhood that is primarily split ranch homes and one of the homes in the area is an old Victorian style home. The Victorian home would be valued lower than it might be if it were located in a neighborhood that had similar properties, because it is considered non-conforming.

The Principle of Contribution

The features of a home will impact the value of the home; however, the value of features may be different from one person to another. For example, a gourmet kitchen may seem like an attractive selling point unless your buyer is a single person who eats out most nights. A selling feature like an "in-law" apartment may be ideal for a couple who has a parent or older child sharing their home, but may not seem as valuable for a couple with toddlers.

Another example of this would be an area that is primarily designed for senior citizens. The potential buyers of these properties would be looking for amenities which may not be sought after for younger buyers such as a community center, handicap bathrooms, etc. The better the amenities available for the target audience for the property, the more likely the property is to be valuable to those who are seeking to purchase and thus the property values are higher. One would not anticipate seeing a playground designed for young children in a senior living development.

Highest and Best Use

One would not expect to use a single-family home as a restaurant nor would one expect to house a family in a property that was previously a restaurant. The highest and best use for a property may also pertain to the legal use of that property. Again, a town or city would frown on using a restaurant as a home and vice versa. Commercial properties are most often subjected to this valuation method where it is important to understand what the best use of the property is, that will yield the highest net income. Specific types of income producing properties may not be easily adapted to other uses. For example, a gas station cannot be easily converted to a restaurant.

Income producing properties are also impacted by the residents of the surrounding area. For example, an arcade may thrive in a neighborhood which attracts families with children but may not do as well in a neighborhood that is primarily geared towards seniors. Therefore, the better use of that property may be a convenience store, a pharmacy or a coffee shop.

Increasing and Diminishing Returns

Property improvements typically increase the value of a property. For example, let's take a single-family home with only two bedrooms. If a property owner adds a single bedroom, the value of the property will typically increase; this is particularly true if most of the similar homes in the area have three bedrooms. However, if you add two bedrooms onto the home, you may see a decrease in the value because you are now facing the challenges that come with the property not conforming to the other homes in the area.

There is another way to look at this — let's assume for a moment properties in a neighborhood consist of primarily four-bedroom homes with gourmet kitchens. However, one or two homes in the neighborhood were built 15 years ago and have two bedrooms, and a standard kitchen. In this instance, the larger homes may suffer a small decrease in value while the smaller homes may see a small increase. However, if the two smaller homeowners decide to upgrade their homes to five-bedroom homes with a gourmet kitchen, the extra bedroom is excessive and therefore does nothing to further increase the value of the property. The addition of the first two bedrooms does bring the home value up as does the addition of the gourmet kitchen.

Principle of Substitution

Real estate values are impacted by the ability to acquire another property that is both desirable and similar in a short period of time. Here is how to think about how this applies to the value of a home. If a seller lists a home for sale for $300,000 and other similar homes in the area are selling for $265,000 then chances are, the home for sale is considered "above market value". If the cost of new construction on a similar home is $255,000, then the property for sale is still too high; substitution would be less expensive than the listing price.

There is an important distinction that must be noted in the statement "ability to acquire another property that is both desirable and similar in a short period of time". The period of time is also a consideration. For example, let's say you need to replace a three-bedroom home for a displaced family. Also, let’s say that every three-bedroom home in the area is occupied and has not turned over in several years. Suddenly, one of these homes is up for sale. Because of the scarcity of that type of property, the value assigned would be higher — this naturally relates back to supply and demand.

Principle of Regression

Real estate values are tied to the value of properties in the area. Think about the structure of most sub-divisions; each property conforms to a similar size, style and therefore each has a similar value. Let's assume for a moment the sub-division is comprised of two-bedroom homes and abuts two roads that have no property built on them. The property on those two roads is subsequently sold to someone who manages owner-occupied mobile homes. As a result, the sub-division is now surrounded by two mobile home parks that are individually valued. Since mobile homes are generally valued lower than stand-alone residential homes. Therefore, the higher valued properties in the sub-division will be considered worth less because of the surrounding property values.

Principle of Progression

The opposite of regression is progression. Let's use the sub-division we referenced above and take a look at what happens if a developer were to purchase the property on the two abutting roads. This developer specializes in high-end luxury homes and the properties which are built are three-bedroom, two-bath luxury homes with high end features. These properties are going to be worth more on the marketplace, and therefore the properties in the sub-division, while lesser in size and luxury, are going to increase modestly in price. This is because the higher-end homes are going to give a perceived higher value to the other homes in the neighborhood.

As a real estate professional, you must be aware of these principles for assisting sellers in listing properties at a price that will be likely to facilitate a sale. Understanding how these principals impact the overall value of a single property, as well as the surrounding properties, is important. Fortunately, you have the benefit of using a professional appraisal, so these factors are generally already considered in the property value.

Key Terms

Highest and Best Use

An appraisal phrase meaning that use which at the time of an appraisal is most likely to produce the greatest net return to the land and/or buildings over a given period of time; that use which will produce the greatest amount of profit. This is the starting point for an appraisal.

Principle of Anticipation

Affirms that value is created by anticipated benefits to be derived in the future.

Principle of Change

Holds that it is the future, not the past, which is of prime importance in estimating value. Change is largely the result of cause and effect.

Principle of Conformity

Holds that the maximum of value is realized when a reasonable degree of homogeneity of improvements is present. Use conformity is desirable, creating and maintaining higher values.

Principle of Contribution

A component part of a property is valued in proportion to its contribution to the value of the whole. Holds that maximum values are achieved when the improvements on a site produce the highest (net) return, commensurate with the investment.

Principle of Progression

The worth of a lesser valued residence tends to be enhanced by association with higher valued residences in the same area.

Principle of Substitution

Affirms that the maximum value of a property tends to be set by the cost of acquiring an equally desirable and valuable substitute property, assuming no costly delay is encountered in making the substitution.

19.5 Direct Sales Comparison Approach

Transcript

There are three typical approaches to appraising a piece of real estate. They are the sales comparison approach, the cost approach and the income approach. Let's take a look at the cost and income approaches and then we'll discuss the sales comparison approach separately.

Cost Approach – when an appraiser is determining the value of the home, the cost approach method assumes some things. One of the assumptions is used for the cost approach is basically that the cost of the home should be nearly equal to the price to build a property that matches it. So, if you're valuing a 4-bedroom ranch, you're going to want to know what it would cost to build the same property in that neighborhood.

Income Capitalization Approach – this is used particularly if a neighborhood has numerous properties that are investment properties. First, the capitalization rate is obtained which means taking the market value of the property and dividing by the net operating income. Then, the value is calculated based on the potential net operating income from rents the owner could collect, and dividing it by the capitalization rate. This might sound confusing however remember that for the income capitalization approach there are three numbers that play an important role: the net operating income, the capitalization rate (also known as Cap Rate) and the property value. Once you know two of these numbers you will be able to determine the third.

What is the Sales Comparison Approach?

Nearly all residential properties are valued using the sales comparison approach. Sales comparison approach means we are going to compare one property against the most recent sales of properties in a neighborhood. One of the best ways to do this is to find properties that were sold recently. Direct sales comparison approach works better if the neighborhood experiences a period of numerous sales. Generally, a real estate appraiser will look at homes in the immediate area which were sold within the previous six months. The properties should be comparable; for example, if you are valuing a ranch you would want to compare it to another ranch and not a single family property. The properties must be similar in scope and size as well. We will touch on this more later on in this lesson.

Identifying the Sold Properties

Appraisers will search numerous public records for data including records from the clerk in the county, MLS services, etc. The most important part is the appraiser will need to make sure the properties were sold in an arms-length transaction and they are as similar as possible to the subject property. An arms-length transaction means the parties were not related in a manner that could have resulted in their getting a favorable price, or financing, to purchase the home. In many cases, this step will be the most challenging and one of the most time consuming.

Appraisers Approach to Sales Comparison

The primary way an appraiser will start the sales comparison approach is to look at the other sales of properties in the area. This will give them a baseline to start the process. Again, we'll go back to our statement earlier; you don’t want to compare a ranch home with a single family home. The best way to get a good sales comparison is to use properties which have as many similarities as possible. The closer the homes are in style, size, location and age, the easier it is to take this approach. It is also important to keep in mind, the appraiser is going to bring the home that is the subject of the appraisal more in line with the properties they are comparing. In other words, if all other homes in the comparison are three bedrooms and the home you are looking to evaluate has two bedrooms only, then the appraiser will assign a lower value for the two bedrooms home.

Let's look at the method an appraiser is going to use to fine-tune this appraisal.

Sales Comparison: Understanding the Steps

Step one: Property Identification

One of the first things that you'll need is to find properties that are similar to the property being valued. This means looking at the number of bedrooms, bathrooms, square footage, the size of the lot and the property location. Whenever possible, homes that are in the same neighborhood should be used for comparison, and the most recent sales considered should not be older than six months. The closer the proximity, the closer the sale date and the more like each other the properties are, the easier the appraisal will be to complete.

Other factors that will impact the property valuation is similar sales. For example, if someone was facing foreclosure and they sold their home to avoid foreclosure, this is considered a "fire sale" and the property may actually be worth more than what it was sold for.

Step two: Compare the Properties

Generally, the appraiser will look at three similar properties. The first step is to determine the average square footage value. This is done by looking at three similar properties that were previously sold. Then the appraiser will sum up the sales prices and divide them by the sum of all the square footage of the three properties in order to obtain the average square footage price.

Here is an example that will illustrate this. Let’s assume we have thee similar properties:

- Property 1 has a Size of 1,500 square feet and a sales price of $125,000

- Property 2 has a size of 1,600 square feet and a sales price of $135,000…and

- Property 3 has a size of 1,550 square feet and a sales price of $127,600

First we would have to sum up all the sales prices which come up to $387,600. Then we will sum up all the square footage of the three properties which comes up to 4650 square feet. To determine the average price per square foot we would need to divide the total sales prices by the total square footage.

$387,600 / 4,650 = $83.35 which is the average price per square foot

Therefore, if the subject home we are looking to evaluate is 1,650 square feet, the value of the property is $137,527.50. We determined that by multiplying 1,650 by $83.35.

Home capacity:

If the subject home has more bathrooms or additional bedrooms compared to the homes sold, the appraiser would then take the cost of construction of new bathrooms or bedrooms and add that to the value.

Let's assume the three homes we used earlier all have three bedrooms and one and a half baths while the home that is being valued has three bedrooms and only one bath. The appraiser would then adjust the price by the construction costs of one-half bath.

Other factors which may result in the value of the home being increased or decreased include finished versus unfinished basements, attached garages versus unattached garages, etc. These are all going to play a role in the final value of the subject property.

Home condition/age:

Appraisers will also apply debits and credits to the value of a subject property based on other factors, including the size of the lot the property is built on, age of the roof on the property, age of appliances/fixtures in the home and how well the property is maintained. For example, if the roof is brand new, the subject home would get a boost in value. If the bathrooms are from the 1970s, then the value would take a hit since an investment would be required to bring them up to the same standard as the comparable sales.

Rights/location/financing:

Appraisers will review what property rights are involved in a transaction. For example, some properties may have specific rights of way given up to a neighbor. They will also factor in neighborhood location, particularly if the comparable sales are outside a specific subdivision or neighborhood in order to ensure the value of the subject property is as close to the actual value as possible. Financing terms may also play a role; for example, if no lenders are offering new 30-year mortgages and the comparable sales all had more favorable terms, the subject property may be valued slightly lower. In some cases, the appraiser may use a percentage rather than a fixed number to account for these differences.

Step three: The Final Valuation

Once all the comparisons are done the appraiser will then take all deductions/additions into consideration and reach a final property value. The final report issued by the appraiser will be used by the buyer, seller, lender and will also be used by the insurance company. If you're the real estate broker, this appraisal may also change your approach to how you're marketing the property if it is for sale.

Why Appraisals Matter to You?

As a real estate professional, part of your role will involve making sure a seller has a realistic idea of what their property is worth. In many instances, without the help of an appraiser, you'll be asked to provide an estimate of the value of the property. The sales approach comparison may provide you with sufficient data for you to make an estimate on your own. However, only an appraisal that is performed by a trained professional will give you an accurate property value that will be accepted by lenders, buyers and sellers.

Key Terms

Sales Comparison Approach

A valuation method which compares a subject property’s characteristics with those of comparable properties which have recently sold in similar transactions.

19.5a Direct Sales Comparison Approach Infographic

Please spend a few minutes reviewing the Infographic below.

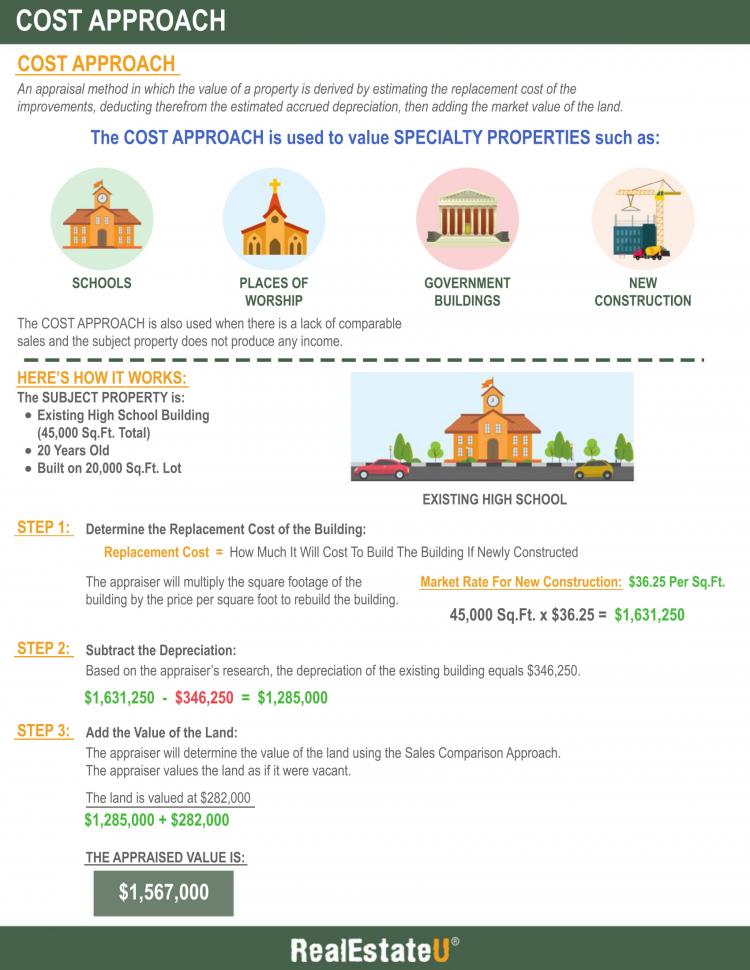

19.6 Cost Approach

Transcript

Appraisers face numerous challenges when establishing the value of a property. One of the complications they could encounter is a property that is being built, a property that must be rebuilt, or appraising a property with special uses. When this occurs, most appraisers will depend on the cost approach for the appraisal.

What is a cost approach appraisal?

The cost approach is simply defined as an analysis in which a value estimate of a property is derived by estimating the replacement cost of the improvements, deducting there from the estimated accrued depreciation, and then adding the market value of the land.

In other words, the appraiser will calculate the cost of replacing the property as if it were completely new. Then the appraiser will deduct the depreciation cost based on the number of years the property was depreciating. And finally will add the current value of the land in order to determine the value of the asset.

When would the cost approach be used?

Typically, the cost approach to an appraisal will be used for buildings having a specific use. Think about how challenging it would be to find comparable sales on a church or school. These properties are unlikely to go through multiple sales, making the sales comparison impossible to determine.

In cases of manufactured housing, Fannie Mae also requires an appraisal using the cost approach. They require this as part of their consumer protection rules. In effect, it is to ensure the homeowner is not paying more for a manufactured home than they would for a similar home that is not classified as manufactured. In these instances, appraisers would use both the comparable sales approach and the cost approach, which would be reported on Manufactured Home Appraisal Report Addendum (Form 1004C).

The cost approach may also be used if a home is newly constructed. As an example, think about a sub-development with homes that were built in 1985. Should a new home be built on a new lot, finding a comparable sale in the same development would be impossible. In this case, the cost approach would likely result in a value that is more in line with the actual value of the home.

Determining value using the cost approach

There is a formula for determining value when using the cost approach which is:

Value = Replacement cost – depreciation + value of land

[Value equals Replacement cost minus Depreciation plus Value of Land]

In effect, the appraiser will need to estimate the value of the land where the property is located. This value is based on the land being vacant. In some cases, the appraiser will find similar lots of land in the area and do a cost appraisal or use other estimates of land value.

Once this process has been complete, the appraiser will need to estimate the cost of building out each room. Think about this step in the process as adding a room onto an existing home such as a bedroom.

Then comes the more complicated part of the process which is depreciation.

Nearly everything loses value over time. Therefore, the appraiser would need to make an estimation of how much would be lost in total depreciation if the property was already standing. By using all this information, the appraiser would then determine the final property value using the formula as indicated previously.

How does the cost approach work? We will go through the step by step process.

Step One: Valuation of Land – the first step is to value the parcel of land where a property will sit. This involves looking at various factors including location, size of the lot, whether the land is level or requires leveling, and any other factors including frontage and even the shape of the lot. The appraiser will more than likely try to find comparable sales for similarly sized lots in the area if they are available, or they will use whatever methods are most common in the neighborhood for valuing the underlying lot.

Step Two: Cost of Development – to determine the value of the project, the appraiser will need to establish the cost of the improvements. It is important to remember there are two possibilities; first is reproduction and second is replacement. Replacement costs are typically used when appraising property. Reproduction costs may be used in very limited circumstances (such as reproducing a burned-out area of a church) but in nearly all cases, the cost of building a replacement is what is used during a cost approach appraisal.

There are three methods for determining cost of development:

- quantity survey method,

- unit-in-place method and

- square foot method

Each method is slightly confusing and in some cases, the appraiser may be instructed by the lender which option to use.

Quantity survey requires a lot of work and is typically avoided by most appraisers thanks to the amount of work that's involved. This would involve taking everything from the most minor of fees to each piece of material the builder would need to construct the property.

Unit-in-place offers accuracy by combining direct and indirect costs for a specific piece of construction. For example, to price an office building, for each unit the cost would be estimated the same and for features such as bathrooms, elevators, etc. the estimate would be calculated the same way.

Square foot method is based only on the floor area of the structure. Depending on the type of building, the value would be assigned per square foot or per cubic foot. This method is the least accurate and therefore typically the least commonly used.

Step Three: Depreciation – this is where the calculations can become very tricky because one should keep in mind they are forecasting how quickly a property will deteriorate and lose value. The depreciation calculation must take into consideration three factors; physical deterioration, functional obsolescence and location obsolescence. What this means is that the age of the property, loss of utility and factors such as what is nearby will cause the property to depreciate.

Step Four: The Math Matters – finally, the appraiser will use the formula we referenced earlier which was Value = Replacement cost – depreciation + value of land to get the final total.

Fortunately, in most cases, the cost approach of the property will not be necessary, apart from manufactured housing, using FNMA for financing. This process is confusing and the final value established at the end of a cost approach may not be suitable for insurance purposes.

As a real estate professional, you'll need to know if a lender is expecting an appraisal using this approach. The good news is unless you are primarily focusing on properties like churches or schools, you'll probably encounter this type of appraisal rarely in your career. The method of appraising you will most often encounter, and use in your career as a real estate agent, is the sales comparison approach.

Key Terms

Cost Approach

An analysis in which a value estimate of a property is derived by estimating the replacement cost of the improvements, deducting therefrom the estimated accrued depreciation, then adding the market value of the land.

19.6a Cost Approach Infographic

Please spend a few minutes reviewing the Infographic below.

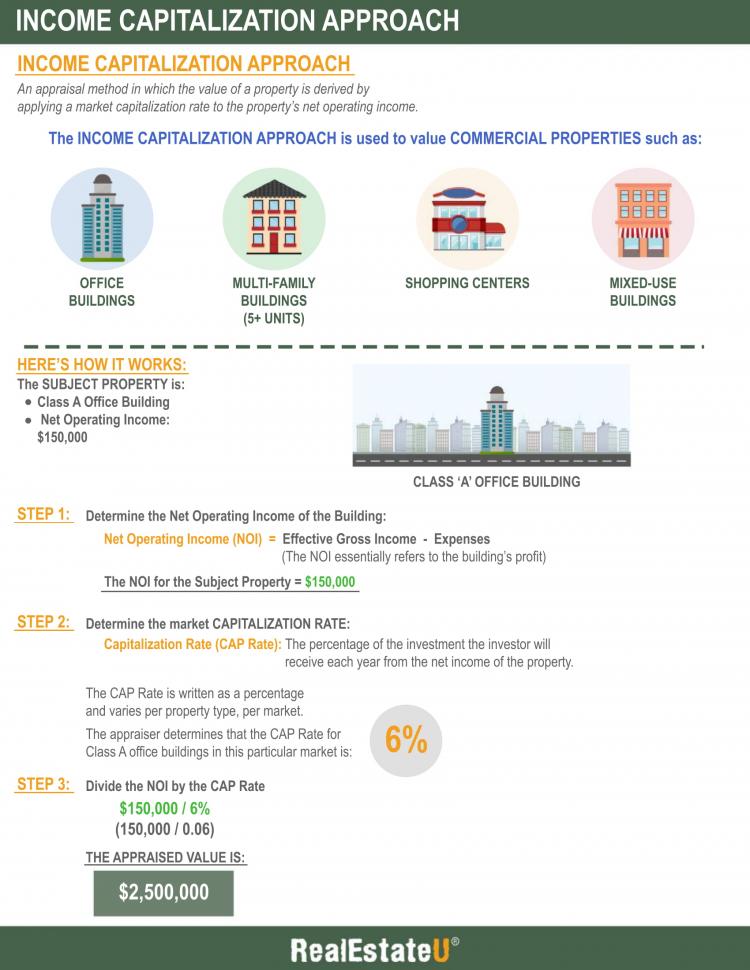

19.7 Income Capitalization Approach

Transcript

For those real estate professionals who are involved in selling commercial properties, it's important to gain an understanding of the income capitalization approach to appraisals. Since this is one of the more complicated types of property appraisal, this process will generally take longer.

When would income capitalization be used?

Property that is expected to generate income for the owner is usually appraised using the income capitalization approach. This would apply to facilities like office buildings, shopping malls and large apartment complexes. If you recall multi-family apartments with more than four units are considered commercial properties.

What is the income capitalization approach?

The income capitalization approach to appraising property means the appraiser will value the property by using net operating income and dividing it by the capitalization rate (also called Cap rate).

The specific formula looks like this:

Net Operating Income/Capitalization Rate = Market Value

[Net Operating Income divided by the Capitalization Rate equals the Market Value]

There is one important thing to note about capitalization rates, based on this formula.

The lower the capitalization rate, the higher the property value.

And vice versa, the higher the capitalization rate, the lower the property value.

Capitalization rates are an indication of risk.

A real estate investor would apply higher capitalization rate to a property if they feel the property is more of a risk from an investment stand point.

On the other hand, a real estate investor would be willing to use a lower capitalization rate if the property is less of an investment risk. Capitalization rates vary from property type to property type, and neighborhood to neighborhood.

A new luxury apartment building may be sold using a capitalization rate of only 5% (since it may be deemed less of an investment risk), while a 30-year old apartment building in a bad neighborhood may be purchased using at a 10% capitalization rate.

Knowing your terms

Before gaining an understanding of how this method of appraisal works, it is helpful to understand the terms that are associated with obtaining the market value.

- Net Operating Income – this figure is calculated using the rental amounts the property is generating and subtracting the normal expenses of the property. The mortgage payments are not considered part of the expenses!

- Capitalization Rate – this rate is determined by the return the investor is anticipated to get on the property. For example, if a building was generating $30,000 in net operating income and the property sold for $300,000 the capitalization rate is 10 percent (30,000/300,000 = 0.10)

Determining value using the income approach

As we previously indicated, the formula for determining value using the income approach is Net Operating Income/Capitalization Rate = Market Value. To further understand how this formula is used to get to the current market value, it's important to know how each number is determined.

To calculate the Net Operating Income you first have to know the gross income.

The gross income is based on all income the building is expected to generate. This would include rental fees, parking fees if applicable, in the case of an apartment building it would also include fees such as those applied to pets or income received from laundry facilities. One can use the average market rents for similar properties in the area and base the gross income on 100 percent occupancy. For example, if the going market rent for a two-bedroom apartment, three blocks away, is $1,000 per month, and the building has 20 units that are two-bedrooms, then the gross income is $1,000 multiplied by 20 units multiplied by 12 months, which is equal to $240,000 gross income.

Gross income is good for an investor’s bottom line and it would be great if one could count on 100 percent payment and occupancy year-round. Reality is much different however so the gross income isn't what gets used to reach a market value. The property will seldom be 100 percent occupied and from time to time the property owner will be unable to collect one or more months' rent. This estimate, usually a percentage of the overall rents, is calculated to arrive at the effective gross income.

For example you may know that due to tenant turnover, vacancies and uncollected rent you would consistently lose 10% of the gross rents in a year. That means that the Effective Gross Rent will be 90% of the total gross rents.

Finally, there are the overall expenses of the property. Remember, the mortgage payments will not be used as expenses! Fixed expenses, which are expenses that do not vary, such as taxes and insurance, are added to variable expenses such as reserve requirements for replacing appliances, ground maintenance expenses (such as snow removal, landscaping), and utility payments. These expenses are then deducted from the effective gross income to determine the net operating income of a building.

Finally, the capitalization rate should be determined.

Remember, this is the anticipated rate of return an investor would expect on the property. This is calculated based on net operating income and the sales price of the property. The formula looks like this:

Net operating income/Sales price = Capitalization Rate

[Net operating income divided by the Sales Price is equal to the Capitalization Rate]

The appraisal steps for the income capitalization approach

Since both lenders and buyers will have an interest in the overall market value of the subject property, the appraiser's job is a bit complicated. Whenever possible, the appraiser will want to obtain income and loss statements from the actual property because they will provide them with the most accurate information, barring in mind that there are still other ways to get to the value.

Step One: Determine market rent – the appraiser must determine what the average market rental rates are in the area for properties that are similar in structure. For example, one would not take rent from an office building and apply it to an apartment building. Comparing apples to apples is important for this step. The appraiser will typically use the full occupancy rate allowing them to calculate potential gross income.

Step Two: Vacancy and missed payments – appraisers need to decide on average vacancy rates. Should the appraiser have access to the most recent income statements for the property, this calculation is straightforward. Lacking that, the appraiser can use "typical" vacancy and default rates for comparable properties which can often be obtained from the last sales data for those properties. These losses are deducted from potential gross income to arrive at the effective gross income.

Step Three: Total operating expenses – some fixed expenses such as taxes and insurance are easy to obtain. Tax rates can be obtained from the municipality and insurance rates can be obtained from a reputable insurance provider who has similar properties in their portfolio. Variable expenses, such as reserves, will be calculated based on numerous factors including what amenities the owner offers to tenants, what furnishings and fixtures are part of the building, etc. The appraiser should review the purchase and sales agreement as well as speak with the property owner to obtain these figures. Once the appraiser has the estimated total operating expenses, they will be deducted from the estimated gross income to arrive at the net operating income.

Step Four: Capitalization rate – when the appraiser reviews similar properties that have sold in the area they can arrive at a reasonable capitalization rate. For example, if a $500,000 property averaged $50,000 a month in net operating income, they would use a capitalization rate of 10% (Net operating income/sales price = capitalization rate). Remember, the most effective way to get the true cap rate is to get the actual net operating income from the property owner.

Step Five: Determining value – the last step the appraiser will take is to establish the market value of the property. This is done by dividing the net operating income by the capitalization rate of the property. Keep in mind, these results are an estimate and nearly anything can have an impact on the result including tax increases, supply and demand and sales of similar properties.

The income capitalization approach to appraisals is typically only used on commercial properties. Commercial properties include large apartment complexes, strip malls, shopping centers and office buildings. This appraisal approach is not always a perfect gauge of real value however because there are numerous factors that can have an impact on the income of commercial properties.

Lenders are often concerned about funding properties such as malls unless there is a long-term lease with a tenant who would be considered an "anchor". Let's face it; a mall with a long-term lease with Wal-Mart is more valuable than a mall where the best-known tenant is Bill & Tom's BBQ Stand. As a real estate professional, if you focus on commercial properties, in many cases, you may also find that the buyers of these properties would like to have this type of appraisal completed before they agree to sign a purchase and sale agreement. This process can be complicated and take additional time versus other methods of appraisals.

Key Terms

Capitalization Rate

The rate of interest which is considered a reasonable return on the investment, and used in the process of determining value based upon net income.Capitalization Rate = Net Operating Income (NOI) / Purchase Price

Income (Capitalization) Approach

An appraisal method applied to income producing properties, which involves a three-step process. First, the appraiser must find the net annual income. Second, an appropriate capitalization rate or “present worth” factor must be set. Finally, the appraiser must capitalize the income by dividing the net income by the capitalization rate.

19.7a Income Capitalization Approach Infographic

Please spend a few minutes reviewing the Infographic below.

19.8 Reconciliation

Transcript

One of the challenges a real estate appraiser is going to face is getting multiple values through the sales comparison method, the cost method and the income approach to an appraisal. When the appraisals are concluded, this means there has to be a method for determining which of the three values are the most accurate. This is done using a process called reconciliation.

What is reconciliation?

Reconciliation is considered the final step in reaching a market value after the appraisal process. The appraiser will take the three values reached and reconcile the numbers by applying their best judgment and experience. The appraiser will make a determination of the market value based on the approach that is most appropriate for the property that is being appraised.

Here is how the reconciliation process works.

The appraiser is going to review all information obtained in the appraisal process and take specific action to ensure the information is valid. The appraiser will review the information accuracy and apply logic and judgment.

When review accuracy of information the appraiser ensures the data collected is relevant and accurate is the first step in reconciliation. An example of this is when the appraiser collects data based on comparable sales. The appraiser will verify the various sales prices, and verify the adjustments they have made to the values.

Although the data tells a good portion of the story, there does have to be some logic and judgment applied to the reconciliation process. For example, if there is a significant difference in the values of two of the approaches and there are no clear discrepancies found in the data, the appraiser will have to apply their judgment to determining the market value of the property.

How is the Final Value determined?

While an appraiser may take different approaches when seeking to get a fair market value of a specific property, when it is all said and done, in nearly all cases, the final value is determined by the type of property being valued.

For example, it does not make sense to use an income approach for valuation when appraising a residential property with one unit. Therefore, in nearly all cases, the sales comparison value will be used for most residential properties.

The same logic holds true for other properties; when appraising a commercial property that will be producing income such as a shopping center, an office building, or large apartment complex, the income approach value will nearly always be applied.

When an appraiser is working on a special use property like a school, a government building or even a church, they will nearly always base the final market value on the cost approach value.

As a real estate professional, you depend on appraisers to provide an accurate value of a property being purchased or sold. The reconciliation process allows the appraiser to take stock of the data they have collected, make sure the data is accurate, and finally, reach a fair market value. Without this important step, any errors that occurred during the initial process could be missed, which can have a negative impact on buyers and sellers. While it may seem as if this step is not necessary, consider the reconciliation to be a check and balance process.

Key Terms

Reconciliation

The final stage in the appraisal process where the appraiser reviews the data and estimates the subject property’s value.

COPYRIGHTED CONTENT:

This content is owned by Real Estate U Online LLC. Commercial reproduction, distribution or transmission of any part or parts of this content or any information contained therein by any means whatsoever without the prior written permission of the Real Estate U Online LLC is not permitted.

RealEstateU® is a registered trademark owned exclusively by Real Estate U Online LLC in the United States and other jurisdictions.