Chapter 27 - Buyer Agency / Selling the Property

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) List at least two fiduciary duties owed by the seller’s broker to the customer.

2) Describe at least two types of buyer representation agreements.

27.1 Buyer Agency

Transcript

In the beginning, when you are trying to get clients, you may do a lot of work with prospective buyers. It is important to understand the standards that will apply to you as a Buyer's Broker. This includes specialized terminology, specialized duties owed the buyer, your client, and the owner, your customer, and an understanding of the contracts that impact your relationship with the buyer.

Duties Performed on Behalf of the Buyer

When you act as an agent for a buyer, your basic duties include:

- Finding the appropriate property for the buyer.

- Negotiating an offer with the listing agent.

- Resolve setbacks that come up in the process.

- Recommend other professionals when needed.

Let’s look at examples of each of these.

Locate the correct property. While you are interviewing clients, you want to know a range of requirements. Your list should include first picks as well as what they are willing to accept within the constraints of their budget. With this information, you will be able to visit homes that are more likely to suit your buyers, which can save a lot of wasted time and energy.

As an agent, your buyer will rely on your expertise in specific neighborhoods to help guide their decision. This should always be an honest assessment of the relative pros and cons of an area.

For example, Marcia Clarke wanted to find a home with a park nearby where she could take her young children. She had a limited budget and required 4 bedrooms and 2 bathrooms minimum for her growing family and work at home husband. You find a suitable home, two blocks from a neighborhood park. The downside is that the house is close to the street and the existing office is right next to noisy traffic. How do you present the home to Marcia? Because you are a creative and inventive agent, you suggest another room for the office and use the existing one as a guest and storage room. You also present several other properties with their various pros and cons.

Negotiate the offer. As the buyer’s agent you will advise your client on the reasonable price range of each property and make recommendations on offer prices. Ultimately, it is the buyer who determines the offer they are willing to make, and that is what you will present to the seller’s agent. The negotiation is the process of going back and forth until a mutually acceptable offer is presented and accepted, in writing.

The buyer’s agent draws up the offer and puts it before the seller. You will become very adept at negotiating deals and be able to honestly advise buyers of the advantages and pitfalls of various properties.

For example, your client falls in love with the price of a dilapidated property that has structural issues and leaky pipes. You advise them that they are unlikely to recoup the money spent on repairs in the event that they resell the home. Your client hears what you have to say then decides to buy the property anyway. Your responsibility is to put your own opinions aside and make an offer on the property.

Recommend other professionals to facilitate the sale. As the buyer's agent, you are expected to make connections that make the sale go faster. If the buyer needs to pre-qualify, walk them through the process with the banks to obtain a letter of eligibility to obtain the necessary funds for the purchase. If your clients have not obtained financing yet, recommend them to reputable mortgage brokers that you have worked with previously and who have proven to be reliable. Buyers should retain a real estate attorney to review the final deal. If your buyers plan to hire an attorney and ask for a recommendation, you must be able to provide competent recommendations.

The same theme holds true for other professionals commonly involved in the purchase of real property. Some of the service providers you will want to keep in your phone include home inspectors, movers and may more.

For example, your clients are elderly and not computer saavy. They want to do some major renovations on the home you helped them buy. You put them in touch with a project manager who can help them prepare a budget and manage the contractors. Your clients, after a successful remodel, recommend you to several buyers over the next several years. This is great for business, and you become known as a full-service agent who can always be counted one. All this from a recommendation that cost you nothing but a little time.

This practice helps you in several ways. You speed up the process of closing, gain a reputation for someone in the business with pull, and the holy grail of a successful sale – recommendations to family, friends and co-workers currently in the market.

Help resolve obstacles. It is possible that the inspector's report or appraisal points out additional issues with the house, such as electrical problems, a crack in the foundation or any of a myriad of issues that could turn into an expensive ordeal down the down. Part of your job is to calmly advise your client on how to proceed. Then, you can act as a buffer between your buyer and the seller or seller’s agent. This often keeps discussions on a professional level so that problems can be resolved instead of becoming tense and heated.

For example, the inspection is completed and the inspector has turned up several minor issues. Your buyers, Debby and Simone Wassler, are immediately up in arms about the length of the list and want to rescind the offer. You look over the list a few times, to ensure that your initial assessment was correct. Sure enough, all the items are minor and those there are 12 on the list, some will take a few dollars (such as replacing a washer in a leaky faucet) while others are slightly bigger ticket items (such as light fixtures that are not up to code and need to be replaced). You don’t see anything that would cost more than a few hundred dollars and some would not need to be undertaken in the near future.

You call up the Wasslers and give them your opinion on each item and what it would cost. Then, you call the seller’s agent to see if the sellers are willing to help with the essential repair. The sellers agree to take 30 percent of the repairs off the list price. Crisis averted.

Customer vs Client

There is a significant difference between a client and a customer in terms of the duties of Real Estate Agents and their Brokers. The following definitions apply from the perspective of the buyer, and assumes that you are representing the buyer in the transaction.

Client

A client has a legal and binding relationship with the Realtor or Broker. There is a signed agreement called a Buyer Representation Agreement that governs the relationship when a buyer’s agent works to obtain a property listed by another agent on behalf of the client. Conversely, the Listing Agreement for Sellers documents the relationship when an agent lists a property for sale.

Customer

A customer in a real estate transaction normally has an agent that represents them. If you are the buyer’s agent, then your client (the buyer) is a customer of the seller’s broker. However, there is a difference between being a client versus being a customer. The law specifies some rights owed to a customer in a transaction, but since the relationship is not formal, they are very different than the agency owed to a client who has signed an agreement to hire you.

To recap, the client, or principal hires a broker to represent them as an agent. The prospective buyer is the customer of the seller’s broker.

What is the Difference between a Buyer’s Agent and a Listing Agent

As the buyer’s agent, you are legally bound to help the buyer. Obviously, if you are the listing agent, you represent the seller.

For example, your buyer, Namita Muppidi, goes to an open house and gushes to the seller’s agent about how much they love the house and need to buy soon. Namita is expecting the family’s second child and the lease on their tiny apartment is running out. The ebullient mother-to-be divulges all this to the seller’s agent who is the last person she should be telling this information. It is likely that the seller’s agent wishes her luck and will tell his seller not to budge on the price; they have a buyer on hand whose ‘clock is ticking’.

Two weeks later, when you aren’t able to get a concession on the asking price, Namita tearfully relays the conversation and wonders how the selling agent could be so cruel. You explain to her that the other agent was just looking out for his client’s best interest and that she needed to understand the difference between being a client and a customer.

Let's review some key words before discussing the fiduciary responsibility of a buyer's agent to his principal, or client.

Agency Law

Agency law occurs when one person hires another to represent them for a lawful transaction involving a third person, the customer. When an agent begins working with a buyer or seller, they are designated as the buyer's or seller's agent, respectively.

Agency implies a fiduciary relationship. A fiduciary can speak for the client in real estate transactions. A licensee is a fiduciary.

The principal is the person represented by an agent. They are also called the client. This is usually who pays the Realtor for their services.

Fiduciary Duties Owed to Customer

The seller’s agent owes certain duties to the buyer as a customer. These are limited to:

- full disclosure of material facts

- honesty

- reasonable skill and care

Honesty

An agent's duty of disclosure in an agent/principal relationship is not the same as a real estate broker's duty to disclose or tell customers about known material facts. Disclosing known defects is part of a broker's duty to treat all parties in a transaction honestly. In other words, the duty of honesty is independent of any agency relationship that may or may not exist between the realtor or broker and anyone impacted by the transaction.

What is a Material Defect?

Any fact that may have a significant and reasonable impact on the market value of the property is material.

Full Disclosure of Material Facts

A failure to disclose is one of the major reasons people go to court over real estate related transactions. Known defects have to be disclosed before the closing occurs on a property. It is the responsibility of the owner to make such disclosures to the buyer.

Examples of material defects include cracks in the foundation, termites or perhaps a leaky roof. Other types of defects are environmental hazards and zoning.

For example, while you are conducting a walk-through of a condo with your buyer, the owner, Jeff Fox, pulls you aside and mentions that there is a leak in the bathroom from the upstairs unit. The owner of the upstairs unit has refused to fix the issue and the condo association won't get involved. Jeff asks that you keep this to yourself, since he cannot remedy the situation, and that he will make it worth your while. You thank Jeff for his candor and finish the tour quickly. This is not a situation you want to put your buyer into, leaky pipes, bad neighbors and an ineffective HOA. Of course, since you are acting in a fiduciary role for the buyer, you tell him about Jeff's comments and apologize for wasting his time.

Duty of a Seller

A seller can be held responsible for damage if he does not make them known before a closing. No known material defects can be concealed from the buyer.

For example, during the inspection, it turns out that the refrigerator and stove are both not working. The sale specifies that all appliances in the home are included and in working order. The owners agree to replace the appliances, since they don't want to issue a credit that would reduce the sales price. When your buyers move in, the appliances have not been replaced. Luckily, the owners don't want to end up in court and provide funds for the buyers to replace the appliances. In this case, the owners had known about a material defect, had agreed to resolve it and then violated the terms of the contract.

Unfortunately, these cases come up more times than you would think. So, it is important to make sure that to follow through on every step of the way. In this case, you would have strongly advised your clients to pay for an inspection to catch any major issues with the property. Otherwise, they would have been out the money to replace the faulty appliances.

Duty of the Buyer

In order to hold a seller responsible for failure to disclose, the prospective buyer has to exercise due diligence by hiring a contractor to inspect the property. If defects are found after the preliminary inspection, the buyer cannot sue for material defects at a later date.

Duty of a Broker

A broker has obligations of disclosure too. They must disclose any material defects to the buyer, as well as any limitation that could impact the seller’s ability to complete the sale. However, the broker has no duty to inspect the property or financial standing of the seller since they do not have expertise in the fields needed to do so.

Reasonable Care and Diligence

An agent is committed to exercising reasonable care and diligence while representing the principle's interest. The standard of care required is that of a competent real estate professional. By holding a license, a broker is assumed to have expertise exceeding that of a normal person.

Your responsibility as an agent is to apply your skill and knowledge to further the interest of your client, the principal. You cannot be held responsible for an expertise outside your field, such as engineering, law or other professionals sometimes required to complete real estate transactions.

Finally, as an Exclusive Buyer's Agent, you must prepare yourself through study to gain the knowledge to represent the buyer with utmost competence and care in every aspect of the transaction.

Negotiating Compensation for Locating a Property

Once a property is obtained and the offer is accepted by the seller, the buyer's broker receives compensation for acting as the client's agent. This compensation can be a flat fee or a percentage of the sales price. It is important to remember that commission is always negotiable, but you should have nailed down the percentage before beginning to look for properties for the client.

In return for this commission, you will schedule appointments to see homes and adjust the search criteria as the client solidifies the type of property that will work for them. Sometimes, it can take weeks or months to find the perfect fit. So, the more information you find out up front, the quicker the process will be completed.

Fiduciary Responsibilities Owed as Buyer's Broker

As the buyer's agent, you have the same fiduciary duties to your client as a seller's broker has to the seller. These include:

- Obedience

- Loyalty

- Disclosure

- Confidentiality

- Accounting

- Reasonable skill and care

Here is a closer look at the responsibilities an Exclusive Buyer's Agent owes to the principal. (Disclosure was discussed in detail in an earlier segment.)

Obedience

You must obey instructions from the Buyer regarding the real estate transaction.

For example, your client falls in love with a vacation home that is priced $20,000 over market price. Your client lives overseas and wants to close as soon as possible. They are paying cash so financing is not an issue. After advising them of the market value and the unlikelihood on getting back their original investment upon resale, your job is to follow your client's instructions and make an offer at the exorbitant asking price. Your client tells you privately that they spend thousands on hotels whenever they come to the area for business and so to them the investment pays off in the end.

Conversely, if your client wishes to make a ridiculously low offer on a home, after advising them against it, if they still wish to pursue it, you must present the low offer to the seller's agent.

Loyalty

You are obligated to do anything you can to lawfully win an advantage for your buyer.

For example, your client asks you to falsify a pre-approval letter from a bank so that their offer will be accepted while they are securing funding. You regretfully inform them that this is illegal and could result in you losing your license or going to jail. You caution them against that course of action, and they come back a week later with an authentic pre-approval letter for a reliable mortgage institution. You are still acting within the scope of agency for loyalty and obedience, which exclude carrying out illegal actions.

Confidentiality

As part of the agency relationship, you have to keep everything that the buyer discloses to you confidential. This includes any information that may impact the buyer's capability or motivation to pay more than the asking price.

For example, a buyer has been pre-qualified for $250,000, but part of the money they have on hand is a temporary loan from their parents that they are hoping will become a gift. If the parents don't come through on the gift, they will be unable to go through with the deal. Despite being upset at a falsehood that can impact your livelihood and reputation, you are prohibited from sharing this information because it would be harmful to your buyer's interest and result in a breach of your fiduciary duty of confidentiality to your client.

Reasonable care

You are required to prepare through education and ongoing study to achieve and maintain your expertise in the industry in order to be able to competently represent the Buyer.

Accounting

The buyer's broker is obligated to account any money or documents given to them.

For example, you are a broker representing buyers of real property. Prior to the sale, you collect $300 for an inspection of the property. You are legally required to keep this money in a separate account set aside for the transaction. You cannot commingle this money with any personal or business accounts unrelated to the sale. To do so would be a breach of the fiduciary duty of accounting that you owe to the buyer, your client. It is highly advisable to accept and hold monies of any kind for as short a time as possible.

Types of Buyer Agreements

A buyer agency agreement defines the type of agency implied by a signed contract.

The Basics

- The most common type of agency is Exclusive right to sell agency in which the buyer's broker receives commission if a property is found for the buyer. It doesn't matter if the buyer or another realtor found the property. The broker is still compensated per the agreement.

- In Exclusive buyer agency you only receive commission if you find a property the buyer purchases.

- In Nonexclusive buyer agency, any broker can look for properties for the buyer. Whichever agent finds a property receives a commission. Most realtors avoid this type of contract since there is no protection that your time and energy won't be wasted.

Buyer Representation Agreement

To prevent misunderstandings, you and the buyer sign a contract defining your agency relationship. Within the contract both parties will have specified duties. There are three main types of buyer agency contracts: Nonexclusive Not-for-Compensation Contracts, Nonexclusive Right-to-Represent Contracts and Exclusive Right-to-Represent Contracts

Let’s start with the Nonexclusive Not-for-Compensation Contracts

This contract specifies commission is not due to the broker. The buyer can retain multiple brokers and revoke the contract at any time. If the broker does find a suitable home, commission is paid at that time.

For example, you find a buyer for a single-family 3-bedroom, 2-bath home in the Harrisburg area. When you present a contract to the owner, they call your clients up and make a side deal. You try to get them to pay your commission, knowing that your clients had never met the owners before. Since you are the only one with anything to gain, no one backs you. With no contract, you have no recourse to fight for the commission you have earned. This is the least desirable type of contract and most realtors avoid it altogether.

Nonexclusive Right-to-Represent Contracts

This contract provides the terms of compensation due if the broker finds a suitable home for the buyer. The buyer may obtain a home on their own or through another broker. This agreement can only be prematurely canceled under specified conditions.

Exclusive Right-to-Represent Contracts

This is the most common buyer's broker contract. This agreement defines broker-agent relationship, which includes the obligations of the buyer and the broker. The buyer cannot retain another broker for the duration of the contract. The broker is due a commission even if the buyer or another broker finds the house the buyer purchases.

Nonexclusive contracts usually are good for one to two months. Exclusive agreements are generally several months to one year and cannot be terminated except under specified conditions.

For example, you sign an Exclusive Right-to-Represent contract with Pearl and Forrest Kennedy. A week later, you have an offer to present to them, but Forrest says that they already found a buyer and no longer need your services. You remind them about the contract they signed and that they have to pay your commission either way. It turns out they accepted a much lower offer from buyers that did not even have a pre-approval for financing. Your prospect is a cash buyer, highly motivated to close quickly. Thankfully, you are a masterful negotiator, and the Kennedys go with your offer, thus avoiding a court case with the incumbent expenses.

You should now have a good understanding of the legal duties and common practices that surround your fiduciary duty to a buyer who you are representing in a transaction involving the transfer of real property. You are now one step closer to your career as a successful realtor well versed in the duties and responsibilities owed to a client versus a customer.

Key Terms

Buyer Agent

An agent who represents the buyer in a real estate transaction.

27.2 Risk Reduction

Transcript

Every time you engage in a real estate transaction there is an opportunity to fall into a legal issue. Buyers and sellers can file lawsuits against real estate professionals for a number of reasons in both common and statutory courts. According to RealtorMag, misrepresentation of property conditions is the number one reason that brokers and agents are sued by clients and customers. Fortunately, many lawsuits are the product of a society where frivolous lawsuits are the norm and 75 percent of cases end in favor of licensees per the NAR Legal Affairs board.

There are ways to protect yourself from legal problems and unjust lawsuits for misdemeanors. The best way is to arm yourself with an understanding of the law so that you can avoid falling into any legal pitfalls. Following are examples of the types of misrepresentation and fraudulent activities to avoid when representing clients. Understanding the gray areas between unethical and illegal behavior will help you steer clear of any behavior that could be perceived as fraudulent and jeopardize your license and reputation.

Avoiding Lawsuits Based on Misrepresentation

The most common misrepresentations are based on the condition of structural features or the foundation of a home. Other kinds of misrepresentations include statements made in writing regarding the condition of the roof, termite infestations and property boundaries.

One of the easiest ways to avoid misrepresentation is to ensure that you provide all the necessary disclosures during the sale of a property. Some of the most commonly forgotten disclosures involve renovations completed with the appropriate permits, the existence of easements that complicate property improvements, environmental issues and title issues.

There are three kinds of misrepresentations in real estate: fraudulent, negligent, and innocent. Innocent misrepresentation simply means that you are accused of misrepresentation for a problem you didn't know about. On the other hand, negligent misrepresentations involve knowledge of material property defects that you fail to disclose out of ignorance. Finally, fraudulent misrepresentation is the result of intentionally hiding a property flaw just to make a sale.

Let's look at examples of ways to avoid misrepresentation.

The seller of a house you have listed tells you the roof was replaced four years prior to the sale. When referring to the condition of the roof (in writing or verbally) make sure to attribute this information to the source. In other words, you might say that according to the owner who is selling the property, the roof is four years old. This protects you legally because, in order to be considered misrepresentation, an incorrect fact has to be based on your opinion or physical observation.

Another way to limit misrepresentation lawsuits for brokers is to ensure that all salespeople in the brokerage use seller disclosure forms. In order to be useful, these forms have to be completely filled out by the seller. Wherever possible, document the seller's source, or even better, encourage the use of other professionals in obtaining concrete evidence of the statements made on the disclosure. Other professionals can include architects, engineers, inspectors, plumbers and attorneys or anyone who can authoritatively speak to the material condition of real property.

You should avoid compromising statements of any kind. For example, during a booming market you tell a client, "The house will only appreciate in value." Since you cannot predict the whims of the market, it is best not to make unqualified conjectures of this kind in any situation.

Consequences of Misrepresentation

Ann Barry is a licensed sales agent responsible for helping her clients buy and sell real estate. She is involved in marketing properties and showing them to prospective purchasers. Ann also explains the documents involved in real estate transactions. As such, clients rely on what she tells them and trust that she is being honest with them.

By law, Ann is obligated to deal honestly with everyone. If she makes incorrect statements that can be considered fraudulent, Ann could face severe consequences for her actions. These consequences range from the loss of her license, regulatory sanctions, civil court penalties and, in severe cases, criminal conviction. Unfortunately, as a real estate professional, Ann is bound to the duty of honesty, even if she is not at fault. If her client has committed fraud, she must attempt to correct it. Otherwise, she can be seen as participating in the fraudulent behavior and could face the same consequences already discussed.

Puffing

Puffing refers to incredulous claims made by sellers or seller’s agents to attract potential buyers. Exaggerating the positive points of a home may seem harmless, but there is a fine line between creative marketing and fraudulent statements that simply aren't based on facts.

Puffing can be found in statements made by a salesperson, or included in advertising regarding the quality of a listing. This practice gives unsubstantiated opinions rather than verifiable facts, and it's generally not determined to be a legally binding promise. Nevertheless, deliberate puffing in real estate is dishonest and should be avoided. The best way to attract buyers is through an honest assessment of the challenges and opportunities presented by a particular property.

Examples of Deliberate Puffing

Truth: A home has an upgraded kitchen with granite countertops and new cabinetry. However, the plumbing under the sink is leaking through to the basement.

Puffing: Stating that the above home has “A brand new kitchen with new appliances, cabinets and luxurious granite countertops.” Even if everything else has been replaced, if the plumbing is leaking then there isn't much truth in saying the kitchen is "brand new."

Truth: A condo is close to the ocean, but the view is blocked by trees and other buildings.

Puffing: Stating that the above home is "an oceanside condo with clear views of the Atlantic Ocean from every room."

Is Puffing Prohibited by Law?

Puffing is not illegal per se. However, false advertising is illegal and there is a fine line between exaggeration and fraud. Statements of puffing generally do not hold up as a creation of express guarantee or warranty. Part of the reason puffing is not illegal is that most courts consider these statements to be so obviously unreliable that they cannot form a foundation for liability. The exception is a statement that contains a material misrepresentation or a boldly false statement. In such cases, the consumer may be able to hold the realtor liable for false advertising or fraudulent misrepresentation.

It is difficult to prove false advertising because the consumer has to show that the statement was deceptive. In other words, in order to be considered false advertising, a representation must be motivated by a deliberate desire to deceive the consumer or general public. On the other hand, puffing can be perceived as a matter of opinion aimed at attracting buyers rather than a purposeful deception.

For example, Realtor Lance Perry tells a prospective renter that an apartment is "cozy and rustic." In reality, the apartment is cramped, damp and has faulty plumbing that creates questionable odors in the bathroom and kitchen. Lance's description is an exaggeration that overlooks some pretty major faults, but it isn't patently untrue. Although Lance is arguably acting unethically with his puffing, he isn't breaking the law. However, let's say he takes it a step further and states that the studio apartment has brand new plumbing and has been completely re-modeled. None of these statements are true and they go beyond exaggeration and fall in the realm of false advertising and misrepresentation, both of which are legally actionable by the deceived renter should she choose to file suit.

Negligent Misrepresentation

Negligence is the failure of a real estate licensee to use reasonable care to uncover and reveal property defects. This duty goes further than the requirement to disclose known material defects. It requires the licensee to be proactive in discovering potential defects and issues. However, liability for negligence does not include the detection of defects outside a real estate professional's expertise.

Negligent misrepresentation is making a statement that is not intentionally wrong, but is not correct because the agent or broker fails to confirm the accuracy prior to making the false statement.

For example, Adam Barrister is a real estate agent showing a home he has listed through his broker. Melinda Thomas is the prospective buyer interested in a home with finished office space for her home-based business. Adam, who hasn't seen the property or discussed potential office space with the seller, goes ahead and assures Melinda that the home comes with fully finished office space. When Melinda sees that the "fully finished office space" is in actuality a damp room in the basement with exposed fiberglass insulation and no electrical outlets, she snaps several photos and sends them along with Adam's email describing the space to a lawyer. Adam is accused of negligent misrepresentation.

Types of Fraud

Fraud is behavior that is intentionally deceptive. “Active fraud” happens when a real estate licensee makes a claim that they know is false. “Passive fraud” happens when a real estate licensee purposely fails to disclose material information impacting a real estate transaction.

Passive Fraud (Intentional Non-disclosure)

Passive fraud is the intentional failure to reveal a material fact that impacts a real estate transaction. This is also known as a negative fraud.

For example, Lionel Malcolm is a real estate agent representing seller Morty Rosenbaum. Morty tells Lionel that he knows that the basement contains asbestos and that Morty and his wife are unable to pay for the costly removal process. The Rosenbaums are willing to accept a lower offer on the home, which has been paid off for many years, in exchange for an "as-is" offer in which the buyer is willing to handle the asbestos remediation.

Instead, Lionel frantically tells Morty to keep this information under the lid. Lionel does not wish to compromise the sales prices and, consequently, his commission by revealing this material defect. The Rosenbaums are uncomfortable with this plan of action but reluctantly agree when Adam informs them that this is standard operating procedure and assures them they are not doing anything illegal.

Since state law requires that the seller disclose the presence of asbestos, Lionel and his hapless clients are committing passive fraud by failing to disclose a material defect in an attempt to trick someone into buying the defective home at full market price.

Active Fraud (Intentional Misrepresentation)

Active fraud occurs when you intentionally deceive a person by misrepresenting a material fact that induces the person to rely upon the fact. This is also known as actual fraud. Let's look at an example.

Let's return to Lionel Malcolm, our intrepid Realtor with questionable decision-making skills. In this episode, Lionel has a buyer who is seeking a home with at least 2,500 finished square feet. Lionel decides that this buyer is a perfect sucker (clears throat) rather than a perfect prospect for the Rosenbaums home. Now, the Rosenbaums property does indeed consist of 2,700 square feet. However, 900 square feet of that is the unfinished basement that requires remediation to remove the asbestos before it is habitable, let alone "finished."

Lionel goes ahead and adds to his growing list of fraudulent actions by assuring the potential buyer that the home contains 2,700 square feet of "move-in ready, finished space." Recalling that Morty mentioned that he replaced the hardware but nothing else on the kitchen cabinetry 10 years earlier, Lionel throws in a blurb that the home also had "a fully renovated kitchen with new cabinets and appliances." Whether or not 10 years ago constitutes "new" is questionable in itself, but the rest of Lionel's assertions are blatant examples of intentional misrepresentation and constitute examples of active fraud.

Self-Dealing

Self-Dealing involves a Realtor or broker who acts in his own best interest in a real estate transaction rather than in the best interest of his client, to whom he owes a fiduciary responsibility. Let's see what trouble we can get Lionel Malcolm in this time. It is likely our self-serving Lionel will be quite comfortable abandoning his client’s best interest in return for making a quick profit.

Lionel hasn't moved the Rosenbaums' home as quickly as he hoped. He recalls that the Rosenbaums had been willing to sell their home at a discount to an informed buyer made aware of the asbestos issue in the basement. He decides to make a heavily discounted offer on the home himself, minus his commission, of course, and present the offer to the Rosenbaums under Lionel's mother's name. This is an example of self-dealing fraud.

We hope that you have learned from Lionel how NOT to conduct yourself when representing clients. In any case, it is just as important to understand these laws to avoid unintentional misrepresentation and fraud. This last example, in particular, was intentionally over the top. Things, of course, aren't so cut and dried in practice. A good rule of thumb is to ask yourself whether the decisions you are making are in your client's best interest and to take your own considerations out of the equation. The best way to avoid a case of self-dealing is not to ever put yourself in a position where there is a conflict of interest that would make you choose between your own financial well-being and that of your client, whom you are legally obligated to put first.

Key Terms

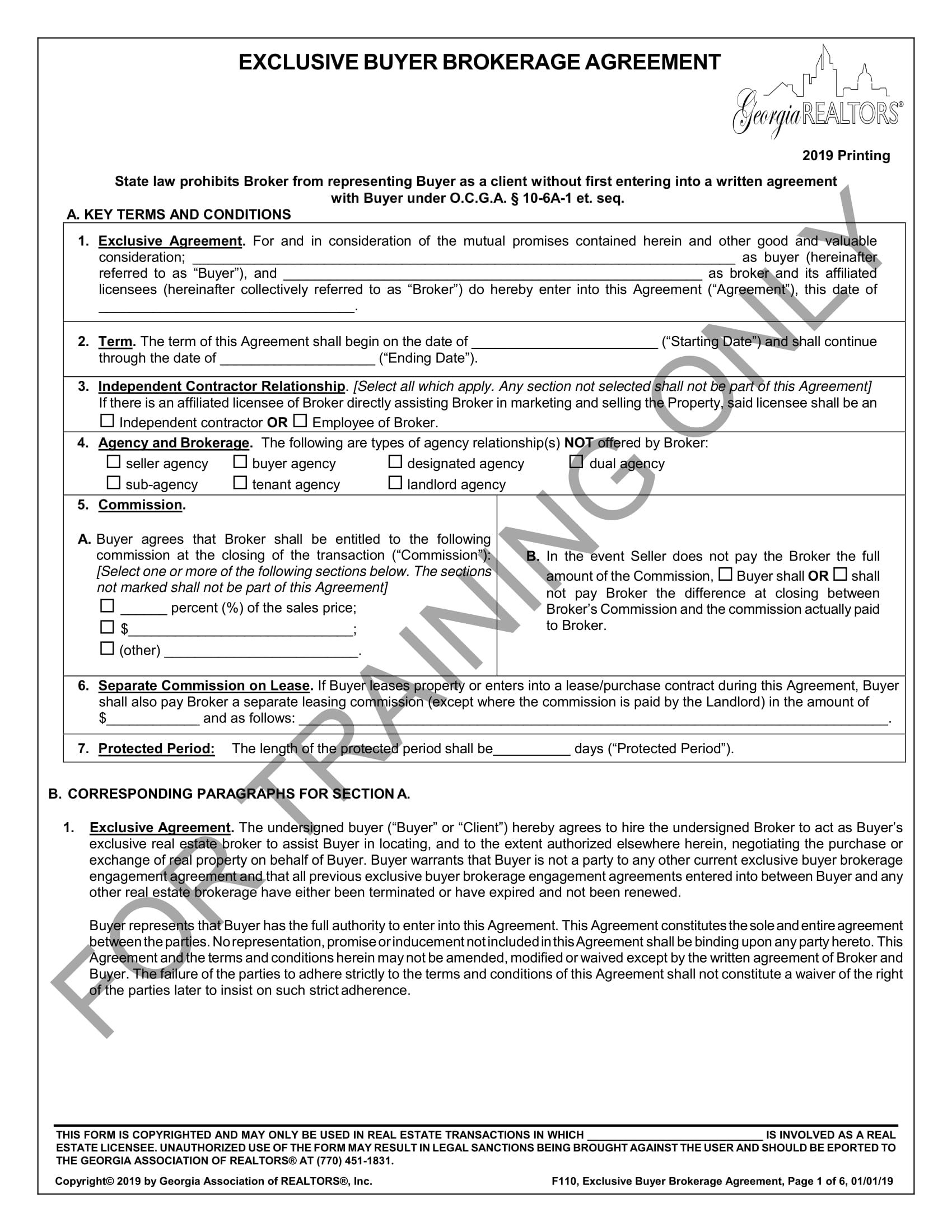

27.3 Exclusive Buyer Brokerage Agreement Example

Please spend a few minutes reviewing the document below.

27.4 Exclusive Buyer Brokerage Agreement Review

Transcript

When someone decides to buy real estate and hire a Georgia real estate broker to help them with the process, they need to sign an agreement with the broker. That document is called the “Exclusive Buyer Brokerage Agreement.” In this lesson, we will walk through this document carefully so you will understand what each section asks for and will know how to complete the agreement when you represent buyers.

We will start with Part A, “Key Terms and Conditions.”

Section 1 is where you will document the buyer’s name and the broker’s name, and the date the agreement will be signed. The agreement also extends to the broker’s affiliated licensees. The buyer is hiring the broker to represent their interests, and to help them locate and purchase real estate that meets their criteria and specific needs.

When a buyer signs an exclusive brokerage agreement, they are confirming that they have the right to do so, and that they are not currently subject to an exclusive agreement with any other real estate broker or agent.

In section 2, list the starting date and ending date for the agreement. If there is not a sales contract or option to purchase contract in force on the ending date, this Georgia Exclusive Buyer Brokerage Agreement will end. If, however, there is a contract in force, this agreement will be automatically extended through the date of the real estate closing. Similarly, if the buyer entered into a purchase agreement with a seller during the term of this exclusive brokerage agreement but that purchase agreement fell through, this exclusive brokerage agreement will be automatically extended for the number of days the buyer’s purchase agreement was in force.

Section 3 refers to affiliated licensees of the broker who may be included as parties to the agreement, and asks the broker to indicate whether such licensees are independent contractors or employees of the broker. With respect to the broker and the buyer, the broker is never an employee of the buyer. Although the real estate broker is working for the buyer’s interests, their relationship is an independent contractor relationship.

Section 4 asks the broker to disclose which types of agency and brokerage relationships the broker is offering. These may include “seller agency,” “buyer agency,” “designated agency,” “dual agency,” “sub agency,” “tenant agency,” or “landlord agency.”

If the same broker represents both the buyer and the seller in a real estate transaction, the broker is acting as a “dual agent.” That means the broker is representing both the buyer, who is trying to get the best possible deal on their real estate purchase, and the seller, who wants to get top dollar for their sale. This can create an inherent conflict of interest. So, if the broker practices dual agency, the buyer’s signature on this agreement serves to document the buyer’s understanding of the potential conflict and risks. Brokers acting as dual agents must still protect client privacy

Similarly, if the broker’s agency practices “designated agency,” it may assign one agent to represent the buyer and another agent to represent the seller. A buyer who signs an exclusive brokerage agreement with a designated agency broker acknowledges and agrees to this practice.

Section 5 addresses the commissions the buyer agrees to pay the broker. There are two parts to this section:

Part “A” includes the agreed-upon commission that the broker is entitled to at closing, as a percentage of the sales price, a fixed dollar amount, or some other method. Typically, the real estate commissions for Georgia real estate transactions are paid by the seller. However, that is not always the case.

Part “B” in section 5 contemplates the possibility that the seller will not pay all of the commissions. For example, when property is sold by the owner directly and without a broker’s help (an “FSBO” listing), sellers are sometimes unwilling to pay real estate commissions. In such cases, the buyer agrees in the exclusive brokerage agreement to pay the commission by checking the appropriate checkbox in section 5, part b.

The buyer is also responsible for immediately paying the real estate commissions to the broker if the buyer defaults on a purchase contract for which the broker would have otherwise earned a commission. Buyers also owe brokerage commissions when they try to work directly with sellers to circumvent paying the brokerage commissions.

If the buyer is leasing property from the seller, the buyer also agrees to pay the broker a separate leasing commission – in addition to and not as a replacement for the real estate commissions on the sale transaction. This is documented in Section 6. This section includes a spot to document both the dollar amount of the leasing commission, how frequently, and when the leasing commission will be paid.

Section 7 specifies how long the “Protected Period” will be, in days. The “protected period” is a period of time after this exclusive buyer brokerage agreement ends during which the buyer will still be responsible for paying the full amount of commission the broker would have otherwise earned, if certain conditions were met.

It is important to understand that the protected period applies whether the agreement reached the ending date without a signed purchase agreement, or whether it was terminated by the parties before reaching that date. Generally speaking, a buyer may owe the broker commissions during the protected period if the buyer purchases, enters into purchase agreement, or enters into an option to purchase a contract for real estate that the buyer found out about, from the broker, during the term of this exclusive brokerage agreement. The same holds true even if the buyer didn’t find out about the property from the broker but did get information from the broker about the property during the term of the exclusive buyer brokerage agreement. This provision protects brokers from buyers who might decide to wait until after the expiration of their exclusive brokerage agreements before moving on with the property purchase, in an attempt to avoid paying commissions.

Part B of this agreement includes more detailed information about each of the sections in Part A. It is recommended that you read through Part B to get a better understanding of each section.

Now, let’s turn to Part C, “Other Terms and Conditions,” which starts on page 3.

This part of the agreement documents and clarifies some key provisions. By signing the agreement, both the broker and buyer are acknowledging their understanding of, and agreement with, these items.

Section 1 in part C documents the broker’s responsibilities and duties toward the buyer. These duties include making required legal disclosures, working to help the buyer find real estate to purchase that meets the buyer’s needs and requirements, complying with all applicable laws, and helping the buyer negotiate sales and complete a purchase and sale agreement when the buyer is ready to make an offer to a seller.

Section 2 addresses the buyers’ responsibilities to the broker. The broker can only help the seller if the seller is actively cooperating in the process, so buyers who sign this agreement acknowledge that they will make themselves reasonably available to view available properties to determine whether one or more of those properties meets their needs. Buyers also acknowledge their obligation to respond to communications from their broker, provide their broker with complete and relevant information, work only with the broker (who is the other party to this agreement) to understand the terms of purchase agreements and other documents related to the purchase of real estate, and to inspect and become familiar with the condition of properties they want to purchase.

Buyers who sign this Georgia Exclusive Buyer Brokerage Agreement also acknowledge that they will not try to view properties being sold as FSBO, or “for sale by owner”, without alerting the broker so the broker can try to enter into an agreement with the seller for a commission.

In section 3, the buyer acknowledges the broker’s commitment to fair and equal housing opportunities.

This Exclusive Buyer Brokerage Agreement is exclusive as to the buyer, who may not work with another broker during the term of the agreement. However, it is not exclusive to brokers. Section 4 in Part C spells this out. When a buyer signs this agreement, he or she is acknowledging that the broker might show the same property to multiple clients, that the broker does not owe any duties to the buyer, and that the broker is not responsible for making sure the buyer meets deadlines and obligations under purchase agreements or other real estate contracts.

The buyer also acknowledges that the broker is not responsible for inspecting the property or for providing the buyer with information the buyer could have learned themselves from other sources. That responsibility rests with the buyer.

Section 4, also explains that the broker’s potential liability under this agreement is limited to the amount of commissions he or she earned from the buyer’s purchase, or if the broker did not earn any commission, his or her liability is limited to one hundred dollars. The buyer also agrees to indemnify the broker and hold the broker harmless from certain legal claims arising under this agreement.

Section 5 provides important promises the broker is making to the buyer. These include a statement that the broker will not knowingly provide false information, and a promise to keep information confidential if the broker knows the buyer wants that information kept quiet, unless disclosure is required by law.

The broker is also promising that he or she does not have any other agency relationships that could conflict with his or her representation of the buyer, except for its role in representing other buyers, sellers, landlords, and tenants.

In section 6, the buyer explicitly authorizes the broker to report suspicious activity, including potential mortgage fraud, to mortgage lenders and/or government authorities, as appropriate. The buyer acknowledges that while he or she gives the broker the authority to report such activities, the broker is nonetheless not an expert in real estate fraud matters. This means that potential fraud could go undetected and unreported, while everyday, routine activities could be flagged as being fraudulent.

When legal disputes occur, they can be costly and time consuming. One popular method of resolving disputes without going to court is “arbitration.” Section 7 contains the same arbitration provision you have likely seen in other Georgia real estate forms and agreements.

The purpose of this arbitration statement is ultimately to reduce the cost, time, and expense associated with litigating disputes in court. The parties agree that, if there is a disagreement about either party’s performance under the agreement, that their dispute will be heard by a mutually-acceptable arbitration company in Georgia, rather than being decided by a judge and/or a jury. The arbitrator’s decision will be final and will be binding on both the broker and the buyer. In a perfect world, there is never a need to enforce legal disputes. If a disagreement arises, however, this arbitration provision can be a valuable alternative dispute resolution tool.

Sometimes, buyers want to buy property in a geographic area that the broker simply is not familiar with. Section 8 authorizes the broker to make referrals for the buyer so the buyer can work with someone who knows the area better. By signing this agreement, the buyer acknowledges that the broker might receive compensation for making this type of referral.

Section 9 documents the buyer’s acknowledgement that the broker’s licensees may not have the same knowledge about properties that the broker has.

In section 10, the parties agree that Georgia law will govern the interpretation of the agreement’s terms. This section also documents that there may be multiple counterparts, meaning that the parties’ original signatures may be on different copies of the agreement.

Section 11 says that the broker’s rights to earn commissions under this agreement, and the buyer’s obligations to pay such commissions, will continue past the expiration date or termination of the agreement.

Sometimes with legal contracts, there is confusion about whether verbal statements or other promises should be considered part of the contract. Section 12 in Part C documents that this written, signed agreement is the entire agreement between the parties, and that the terms of the contract can only be changed by a written amendment or modification signed by the parties.

Section 13 references the Georgia Association of Realtors Forms, or GAR Forms, which are templates intended to help realtors. The parties acknowledge that these forms may not fit every situation, and that it might be necessary to customize a GAR form before using it.

In Section 14, the parties acknowledge that communications in real estate matters are time-sensitive, and agree to try to be available during the term of this agreement so they can receive and respond to communications in a timely manner.

Section 15 reiterates that time is of the essence with real estate contracts.

Unfortunately, cyber fraud in real estate transactions is an ongoing concern. Fraudsters impersonate mortgage lenders, real estate brokers, or attorneys in an attempt to get unwitting buyers to wire money to them. By the time the fraud is discovered, it is often too late to recover the funds. Section 16 provides a valuable reminder and warning to be on the lookout for cyber fraud, as well as tips to help buyers avoid becoming victims of would-be fraudsters.

Finally, section 17 in part C is a spot to indicate which other brochures or exhibits are being included with this agreement. These other exhibits and brochures are designed to give buyers who may not be real estate experts themselves information about the process, helping to make real estate transactions smoother for buyers. If you are filling out the Exclusive Buyer Brokerage Agreement, check all applicable boxes under section 17.

That’s the Georgia Exclusive Buyer Brokerage Agreement! You should review the entire agreement before using it, so you understand and are comfortable with it before you use it with new clients.

Key Terms

COPYRIGHTED CONTENT:

This content is owned by Real Estate U Online LLC. Commercial reproduction, distribution or transmission of any part or parts of this content or any information contained therein by any means whatsoever without the prior written permission of the Real Estate U Online LLC is not permitted.

RealEstateU® is a registered trademark owned exclusively by Real Estate U Online LLC in the United States and other jurisdictions.