Please spend a few minutes reviewing the Infographic below

Chapter 9 - Leasehold Estates

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Describe at least one type of leasehold estate.

2) List at least two types of leases and what type of tenant is commonly associated with each lease.

3) Identify at least three elements found in a residential lease agreement.

9.1 Types of Estates

Transcript

In this lesson, we will explore another type of estate called a leasehold estate. As the name implies, a leasehold estate is created through a lease for real property (real estate.)

A leasehold estate refers to a tenant’s exclusive, but temporary, right to possess, occupy and use real estate (land or property) during the term of a lease. Rather than being considered an interest in real property itself, a leasehold estate is considered to be a personal property interest.

There are four primary types of leasehold estates – we will examine each of these in more detail later in this lesson. Before doing that, however, let’s explore some common terms that apply to all kinds of leasehold estates:

First, you will need to become familiar with the “lessor/lessee” terminology.

The “Lessor” is the landlord – the person who is actually allowing someone else to possess, occupy and use his or her real property.

The “Lessee” is the tenant, who contracts with the lessor for the right to possess, occupy and use the real estate.

George is new to town and is looking for somewhere to live. Carla is a homeowner who just accepted a ten-month position teaching English in Germany. If George decides to enter into a lease with Carla to live in her home while she is out of the country for that ten-month period, Carla is the “Lessor”, and George is the “Lessee.”

Now, let’s dive into the four types of leasehold estates.

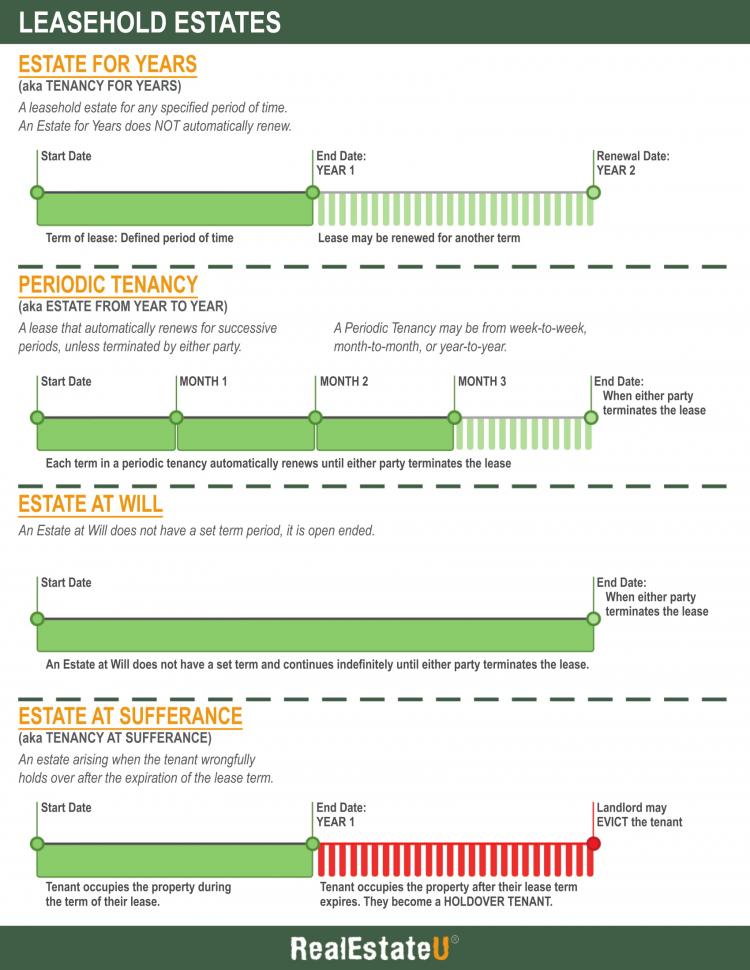

The most common type is known as an “Estate for Years.”

An Estate for Years is an interest in land that arises by contract for possession for a definite, but limited, period of time. Although the word “years” is in the name, an estate for years can actually be for any period of time, even if it is shorter than one year.

Typically, an estate for years lasts at least one year. At the end of the pre-determined time period, the lessee (the tenant) must vacate the property. In some cases, the tenant may be able to surrender their lease, which means voluntarily giving up their rights to occupy, possess and use the land, before the end of the lease.

Under an estate for years, rent may be paid monthly, quarterly, annually, or in any other kind of installments spelled out in the lease.

Sometimes, the terms “fixed term tenancy” or “tenancy for years” are used interchangeably with “estate for years.”

Let’s go back to George and Carla in our example. If the lease they sign says that George can possess, occupy and use the real estate for ten months, this is an estate for years. If, after six months, George no longer wants to continue with the lease, he can surrender it and move out. However, the lease may provide Carla with legal remedies in this case.

The next type of leasehold estate is known as a periodic estate.

Remember that under an estate for years, the lease spells out a specific time period at which point the lease will terminate. A periodic estate is different. With a periodic estate, there is a rental period defined by the lease, but there is not a pre-determined lease termination date. The rental period might be a week, month or a year. The amount of rent is fixed for that rental period. This type of leasehold estate is also known as an estate from period to period, or a periodic tenancy.

If you have heard of (or been a party to) a month-to-month lease, that is a great example of a periodic estate.

If the landlord and the tenant have not expressly included another type of arrangement in the lease, many states say that the lease is automatically a periodic estate.

Under a periodic estate, if the landlord wants to end the lease, they must give notice to vacate. Similarly, if a tenant wants to end the lease, he or she must also provide notice as specified in the lease.

It’s also important to note that, in most cases, an estate for years will automatically become a periodic estate when the first lease ends.

Let’s look at an example of a periodic estate that might help you understand it better.

Jack and Chrissy want to rent an apartment while their new house is being built. Ralph has an open unit in a building he owns, so he offers them a month-to-month lease with an initial rent amount of $1,200. Jack and Chrissy decide to sign the lease and they move in on July 1. They pay $1,200 in rent for July and on August 1, they pay $1,200 in rent for August. That same day, Ralph informs them that the rent is going up effective September 1. If they want to continue living there, the rent will be $1,250/month.

Ralph has the right to raise the rent in this manner because the lease term is month to month. Jack and Chrissy would have the right to terminate the lease with notice to Ralph.

If Ralph found someone else willing to rent the space for a longer period of time, he may decide to terminate the periodic estate, with notice to Jack and Chrissy.

The next type of leasehold estate we will look at is known as an “Estate at Will.”

Under an estate at will, the occupation of the land or apartment unit is for an undefined period of time, and can be terminated by either the landlord or the tenant, or both of them.

There are a few different ways a tenancy at will can come about.

- The landlord and the tenant agree that there does not need to be a formal lease

- The landlord and the tenant agree that no rent or other consideration needs to be paid for the tenant to occupy, possess and use the landlord’s real estate

- The tenant has an urgent need or desire to occupy the property but there hasn’t been time to formalize the terms in a lease yet. When the lease is finally inked, in this case the “estate at will” is going to terminate.

- A tenancy at will can even be created when a family member is allowed to stay at home without any kind of formal written agreement, although this may require them to pay some sort of nominal amount of rent or other consideration for the arrangement.

The language of an “at will” lease or oral agreement can be very important. If an estate at will specifies that the lease continues at the will or desire of the tenant, the landlord may not be able to terminate the lease, even for cause.

An estate at will can generally be terminated in the following ways:

- The landlord transfers the property to someone else

- The landlord dies

- The tenant dies

- The tenant tries to assign his or her tenancy (for example, by trying to sublet the space to someone else)

- The tenant causes some change or damage to the property, whether intentional, voluntary or not, without the permission or direction of the landlord. This is also sometimes referred to as “committing waste” against the property.

Because of its informal nature, an estate at will can be risky for both the landlord and the tenant.

Here’s an example of an estate at will:

Helen owns her home and a condo, which is vacant. Her adult son, Bill, has fallen on hard times, so Helen decides to let Bill move into the condo. Because she knows that money is tight for Bill right now, she says he does not need to pay her any rent while he gets back on his feet. Neither of them thinks about writing any kind of formal lease agreement for the arrangement.

Helen has created an estate at will with Bill.

Unfortunately, their relationship sours over the course of the next couple of months. Helen decides she does want to start receiving rent for the condo. Bill stubbornly refuses to pay rent and says he’s going to keep living there.

Helen, will likely need to go to court to start eviction proceedings in order to get Bill removed from the condo.

Finally, the last of the four types of leasehold estates is known as an “Estate at Sufferance.” Sometimes, this is also referred to as a “tenancy at sufferance” or a “holdover tenancy.”

An estate at sufferance arises when there was a lease in place, but the tenant did not renew the lease and did not move out when the lease expired. Instead, he or she continued occupying the space and continued paying the same rent as before.

Under an estate at sufferance, the landlord has a couple of choices. They could decide to treat the tenant as a trespasser and go to court to have the tenant evicted. However, another option is to simply accept the tenant for another similar term (i.e. another month or another year), under the same conditions as specified under the original lease. If the landlord had told the tenant that the rent was going up before the original lease expired, the landlord can charge the higher rent for the holdover tenant.

For an example of a holdover tenancy, let’s go back to the original example we used earlier in this lesson.

George is looking for somewhere to live and Carla needs a tenant while she is out of the country for the school year, teaching.

Let’s say that George and Carla signed a one-year lease. Carla has accepted an offer to stay on as a teacher in Europe for one more year, so at the ten-month point in the lease, she notifies George that he can renew the lease for another one-year period, but at a rent amount that is five percent higher than what he has been paying.

George never responds to Carla. The original lease ends at the one-year mark. If George continues living in Carla’s house, he is a holdover tenant and an estate at sufferance has been created. Carla can charge him the new, higher monthly rental amount, however she could also choose to take George to court to have him evicted since there is no lease in place giving him the right to continue possessing, occupying or using her property.

Key Terms

Estate at Sufferance

An estate arising when the tenant wrongfully holds over after the expiration of the term. The landlord has the choice of evicting the tenant as a trespasser or accepting such tenant for a similar term and under the condition of the tenant’s previous holding. Also called a tenancy at sufferance.

Estate at Will

The occupation of lands and tenements by a tenant for an indefinite period, terminable by one or both parties.

Estate For Years

An interest in lands by virtue of a contract of a contract for the possession of them for a definite and limited period of time. May be for a year or less. A lease may be said to be an estate for years.

Leasehold Estate

A tenant’s right to occupy real estate during the term of the lease. This is a personal property interest.

Lessee

One who contracts to rent, occupy, and use property under a lease agreement; a tenant.

Lessor

An owner who enters into a lease agreement with a tenant; a landlord.

Periodic Estate

An interest in land where there is no definite termination date but the rental period is fixed at a certain sum per week, month, or year. Also called an estate from period to period.

9.1a Leasehold Estates Infographic

Please spend a few minutes reviewing the Infographic below

9.2 Lease Contracts

Transcript

In this lesson, we will explore real estate lease contracts. If you are like most people, this probably is not the first time you have heard of lease contracts for real estate. In fact, odds are good that you have been a party to a lease contract yourself at some point, when you rented an apartment, house, or commercial space.

Let’s take a closer look at what leases are, what the requirements are to make a valid lease, what a lease allows each party to do, and more.

Before we dive into the content of this lesson, it’s important to understand that landlord/tenant law is state-driven so there are some state-specific nuances in certain cases. The information in this lesson is designed to cover those lease contract provisions and requirements that apply broadly to leases, wherever they are executed.

First, let’s start at the beginning, by defining what a lease is. Simply put, a lease is an agreement that a property owner enters into with someone else (called a tenant), giving the tenant permission to occupy and use the property, subject to certain terms and conditions.

In the language of leases, the property owner is called the “lessor”, and the tenant signing the lease is referred to as the “lessee.”

In exchange for rent payments from the lessee, the lessor agrees to provide a specific habitable unit to the lessee for a specific time period.

For example, John wants to rent an apartment in a building owned by Big Apartment Company, Inc. In order to be able to rent the apartment, he will need to sign a lease contract agreeing to pay a certain amount of rent every month in exchange for the keys and permission to live in and use the apartment.

Lease contracts are also used for commercial real estate leases, where a business owner wants to rent out office space or retail space to conduct their business.

Now, let’s spend a few minutes evaluating what it takes to make a valid lease.

First, a lease contract is a legal agreement, so it must be in writing, signed by both the lessor and the lessee (or their agents.) In the example above, John would sign the lease contract as the lessee and the apartment manager would sign on behalf of Big Apartment Company, Inc. as the company’s authorized agent.

The parties must have the legal capacity to contract. In the case of the rental agent signing a lease contract on behalf of the corporation, he or she must be legally authorized to act in that capacity.

In the case of individual lessors and lessees, legal capacity to contract means that the parties are at least 18 years old and have the mental capacity to understand what they are signing, and the implications of doing so.

Let’s look at a couple of hypothetical examples that might help illustrate this a little bit better:

Jennifer is a mature, college-bound 17-year old who just graduated from high school. She and her best friend, Amy, who is 18-years old, have decided to rent an apartment together for the summer near their new college campus, so they can get to know the neighborhood and get settled in before classes start. They look at several properties, and finally find the perfect 2-bedroom apartment at a rental price they can afford to pay. Jennifer and Amy sign a lease agreement with Big College Apartment Company, Inc.

Amy is 18-years old and has the legal capacity to sign a lease contract, however Jennifer does not, because she is only 17-years old. If the young women stopped paying rent or otherwise violated the lease, it’s unlikely that the lease contract would be enforceable.

Let’s change the facts a little bit, and assume that Jennifer and Amy are both 18-years old and mentally competent to sign a lease contract. On the day they plan to sign the lease for their new apartment, the normal property manager is out of the office unexpectedly. The administrative assistant decides to sign the lease agreement for her employer, Big College Apartment Company, Inc., thinking she’s doing everyone a favor so Jennifer and Amy won’t have to make another appointment to come back for the lease signing. Unfortunately, the administrative assistant has not been authorized to enter into contracts on behalf of the corporation. So, the lease agreement she signed is not valid.

In order to be valid, legal contracts and agreements, like lease contracts, must include some other key components, including offer and acceptance, and consideration.

The offer and acceptance simply means that the lessor (the landlord) is offering to rent the apartment, home or other space to the lessee (the tenant), on the terms spelled out in the agreement. The acceptance is the lessee’s (or tenant’s) signing the lease contract, agreeing to be bound by its terms.

Consideration for a legal agreement like a lease contract refers to the rent for the apartment or other space. There may also be a security deposit required as part of the agreement’s terms.

So, if Jennifer and Amy in our above example enter into a lease contract with Big College Apartment Company, Inc. to rent apartment number 101, the lease would begin with something similar to the following language:

“This lease agreement is entered into between Jennifer Sample and Amy Example (“tenants”) and Big College Apartment Company, Inc. (“landlord.”) Landlord owns real property situated in College City, CA with a street address of 1234 College Lane, College City, CA 12345. Landlord intends to lease unit #101 to tenants on the terms and conditions of this agreement. For valuable consideration, the receipt of which landlord acknowledges, the parties agree to the following…”

Next, let’s explore what information should be included in a lease contract or agreement.

- The lease should clearly define who the lessor and the lessee are (the parties to the contract), and it should include contact information for each party. Every adult who will be occupying the property should be identified as a party on the lease agreement.

- The lease agreement or contract should also clearly spell out the legal objective of the contract (that is to say, it should say something to the effect of “lessor and lessee intend to enter into a valid rental agreement…”)

- Next, the lease will clearly define exactly what space is being leased. In the case of an apartment, the lease will provide the address and the unit number. If garage or storage space is included or is being contracted for, the lease should also clearly define those types of extras.

- As mentioned earlier, the lease contract must include consideration in order to be valid. The agreement should clearly spell out the amount of rent, the frequency of rent payments, how they should be made, the date rent is due, and the consequences of not paying rent on time as agreed.

- Lease agreements usually spell out what is included with the monthly rent, and what is not included (what is the responsibility of the tenant.) For example, an apartment lease might include some utilities like electricity and water, but the tenant may be on their own for things like telephone, internet and cable TV.

- The lease should spell out how the lease might end, and what happens when the lease ends. For example, a lease can include provisions saying what happens if the tenant breaks the lease early, or what happens at the end of the original lease term.

As mentioned earlier, the primary purpose of a lease contract is to give the tenant (the lessee) the right to occupy, possess and use the property being leased.

However, that right to occupy, possess and use does not give the tenant carte blanche to do anything they want in the space being leased. Most leases include restrictions specifying that if the tenant engages in any illegal activity, such as drug-related crimes, he or she will be evicted.

Landlords should make sure that lease agreements include other limitations and restrictions, if there are things they don’t want their tenants to do in the rented space. If there are no restrictions specified, tenants are well within their legal rights to use the leased property for any lawful purpose.

Some examples of restrictions landlords often include in residential lease agreements are:

- Not using the rented property (or unit) for commercial activities (so, the tenant could not run a business out of an apartment unit.)

- No pets allowed, or if pets are allowed, the lease should provide clear language identifying what kind of pets are – and are not- allowed, how many pets are allowed, etc. Landlords who do allow their tenants to have pets on the premises often include an additional security deposit designed to cover any damage to the carpet, floors or walls caused by such pets.

- Occupancy controls. Landlords are responsible for making sure the property they are leasing is in compliance with local ordinances about occupancy, so leases may include language specifying the maximum number of adults who can lawfully reside in the unit.

- Sublease provisions. If a tenant has to break their lease before it would otherwise end, some landlords are OK with the tenant subleasing the property. This means that the tenant would find someone else to take over the remainder of the lease, and would enter into their own agreement with the sub-lessee. However, many landlords may not be comfortable with sublease arrangements. Their lease contracts can spell out whether or not the tenant is allowed to sublease the unit or space.

One of the most important components of a real estate lease contract is the term of the lease. Simply put, the term of the lease is the period when the lessee (the tenant) has the right to occupy, possess and use the apartment, home or other space being rented.

The term of the lease may start on the day the lease is signed, but it could also be another day. If the lease is for a one-year period, the term of the lease will expire at the end of that one year. Typically, leases include provisions addressing whether and under what circumstances a lease term can be extended for another period.

Let’s go back to our college students, Jennifer and Amy, and let’s assume that everyone has legal capacity to enter into the lease agreement. They meet at the rental office on June 15 to sign their lease agreement. The lease term is for a one-year period, beginning at noon on July 1. This means that they can get the apartment keys and move in at noon on July 1, and they will have the right to live in and use the apartment space until June 30 of the following year, assuming they pay rent and otherwise meet the terms of the lease during that time period.

As mentioned earlier, the lease should also specify whether there will be a security deposit required, and what the amount of the security deposit will be. The security deposit is an amount of money the tenant pays to the landlord up front. If the tenant meets their requirements under the lease during the lease period and returns the unit to the landlord in substantially the same condition it was leased to them, they should receive their security deposit back. In some states, landlords must also include interest when they repay the deposit.

However, if the tenant damages the property during the term of the lease, or leaves it in such a condition that the landlord must clean it before renting it out again, the landlord can keep some or all of the security deposit.

Finally, lease contracts, particularly those for commercial real estate, may also include provisions referred to as “confession of judgment clauses.” This clause says that if the tenant defaults on their obligations under the lease, the landlord can “confess judgment” without requiring notice or a hearing. The confession of judgment clause specifies whether that judgment means evicting tenants, collecting monetary damages, or both. These clauses can make things significantly faster, cheaper and easier for a landlord when a tenant isn’t holding up their end of the bargain, because the tenant has essentially waived the right to notice and court hearings.

Key Terms

Lease

A contract between an owner and tenant, setting forth conditions upon which the tenant may occupy and use the property and the term of the occupancy.

9.3 Legal Principles of Leasing

Transcript

In this lesson, we will explore the legal principles of leasing real estate, as they affect both the lessor (the landlord) and the lessee (the tenant.) Unless indicated otherwise, information presented in this lesson refers to residential real estate leases rather than commercial property leases.

Real estate leases are legal contracts. As such, their provisions are governed by contract law in the state where the property being leased is located. In this lesson, we will introduce some of the common provisions and terms that apply across different states and jurisdictions.

The first principle that comes with leasing real estate is possession. When someone contracts with a property owner to lease the real estate from them, one of the benefits they are getting is the right to possess the unit or parcel being leased.

Possession also entitles the tenant to what is known as the “covenant of quiet enjoyment.” This covenant essentially says that the tenant has the lawful right to possess the land, and that the landlord cannot substantially interfere with the tenant’s right during the term of the lease. If this right is violated, the tenant may have legal standing to claim damages.

Of course, there are always situations where the landlord will need to be able to enter the premises. For example, making needed repairs, performing maintenance, conducting inspections required or permitted by law, or showing the property or unit to other prospective tenants. The lease should clearly spell out how, and under what kind of circumstances, the landlord is authorized to enter the premises being leased by the tenant.

Let’s look at an example of the principle of possession, and the covenant of quiet enjoyment.

Debra got a new job and is moving to a new town. She wants to find an apartment to rent near her new job. Fortunately, she is in luck, and finds what she thinks is the perfect space in her price range, offered for rent by Barbara. Both Debra and Barbara sign a residential rental lease agreement, effective at noon on June 1st.

The implied covenant of possession under real estate law means that, beginning at noon on June 1st, Debra has the right to possess and use the apartment she has rented, assuming she has paid the required amount of rent specified in her lease.

Similarly, the implied covenant of quiet enjoyment means that once Debra takes possession of the apartment and uses it as agreed in the lease, she should not have to worry about Barbara entering the premises except for repairs, maintenance or other legal reasons spelled out in the lease.

If Barbara starts coming into the apartment several times a week without a valid reason to do so, she is violating the covenant of quiet enjoyment. Debra may have legal or equitable remedies.

Now, let’s turn to another principle: improvements.

A tenant has an implied right to make improvements to the property, with the landlord’s permission. When specific improvement provisions are included in the lease, they are sometimes referred to as “leasehold improvements” or “tenant improvements.” This is common in commercial leases, under which business tenants may also install trade fixtures or otherwise customize the space to suit their needs, with their landlord's permission.

The terms of the lease agreement may be used to allow the tenant some sort of concession, such as a reduction in rent, for making improvements.

Tenants with disabilities are also allowed to make reasonable accommodations to the property at their own expense, in order to make the property handicapped-accessible. Note that in the case of commercial property, the landlord may be required by law to make certain improvements to bring the property into compliance with the Americans with Disabilities Act (ADA.)

Let’s take another look at our example from earlier. Remember that Debra signed a lease agreement to rent an apartment from Barbara, the owner of the property. While the apartment is clean and there are no obvious defects, Debra doesn’t like the color of the paint on the walls. She also wants to replace the carpeting with laminate flooring.

The principle of improvements says that Debra can make these modifications at her own expense, and with Barbara’s permission to do so. Remember that Barbara is the property owner, so she holds veto power over making such cosmetic modifications or improvements.

Assuming that Barbara agrees to allow Debra to make the improvements and recognizes that doing so may improve the market value of the unit, she may decide to give Debra a discount on her rent or some other type of concession.

If Debra becomes disabled and is confined to a wheelchair, she can also make modifications such as installing a wheelchair ramp, modifying the bathroom, or widening doorway entries to accommodate the wheelchair, at her own expense.

The next principle or covenant of residential leases we will examine in this lesson is known as “habitability.”

The implied covenant of habitability means that the landlord leasing space to a tenant is expected to take whatever action is necessary, at the landlord’s own expense, to provide their tenants with a habitable dwelling unit.

This means that the landlord is required to keep the premises in reasonable repair, and must comply with all health and safety codes. One exception to this obligation is if the tenant is somehow responsible for damage through malicious, willful or simply irresponsible actions.

It doesn’t matter what the landlord (or the tenant) includes in the lease; the parties cannot agree to do away with the covenant of habitability. The landlord is also not absolved of their responsibility to provide a habitable dwelling unit simply because they allow the tenant to inspect the premises before taking possession.

An example illustrating habitability might help this concept make more sense.

Adam owns a dozen single-family rental homes on the city’s South side, which he rents to families. Adam opted not to hire a property management company, thinking he can save money by handling any repairs or maintenance needs when they arise.

Bob and Cindy are renters in one of Adam’s homes and they faithfully pay their rent on time every month. The water heater in the home they are renting is 15 years old and it finally gives out. Although Bob and Cindy called and reported the broken water heater to Adam as soon as they became aware of it, he didn’t take any action on it. When they finally got a hold of him, he said he was on vacation and would look into it in a couple of weeks.

In this scenario, Adam is violating the implied covenant of habitability by not keeping the dwelling in a habitable condition.

Let’s change the scenario a little bit now though, and assume that Adam is an attentive landlord and addresses any repairs or maintenance needed that his tenants report.

Bob and Cindy have a leaky toilet in the upstairs bathroom of the home they are renting. They noticed the slow leak almost right away after it started, but they didn’t call their landlord, Adam. Over the next several weeks, the leaking water caused significant damage to the floor of the bathroom and the ceiling below, which has started to crumble. Mold is also forming in the walls.

Bob and Cindy’s friend tells them about the covenant of habitability, and says they don’t need to pay their rent because their landlord, Adam, isn’t keeping the rental home in reasonable repair or in a habitable state. Do you think their friend is right?

It would be one thing if they had reported the leaky toilet to Adam right away (or at any point) and he refused to fix it or simply ignored their request. However, Bob’s and Cindy’s own negligence caused the problem to render the home uninhabitable. Therefore, they do not have a legal claim and they are not within their right to withhold their rent payments.

Options are another common principle of leasing real estate.

Leases generally give the tenant certain options. The most common of these is the right to renew the lease for another, similar term, or to extend the original lease term with a periodic tenancy (such as a month-to-month rental arrangement.)

Leases for real estate may also give the tenant an option to purchase the property. If they choose to exercise that option within the time period specified in the lease, they can do so at a pre-determined purchase price.

Another common option in a residential real estate contract for single-family homes is a right of first refusal. This means that if the landlord decides to put the house up for sale on the market, the tenant will have the first right to purchase the property before the general public has that chance.

Jane and Todd are a young couple just starting their family. They are not ready to buy a house of their own yet, but they found a home to rent in a desirable neighborhood with good schools, parks, and in close proximity to their jobs. They decided to ask their landlady, Sandy, about whether she planned to sell the home at some point in the future and if she would be willing to sell it to her tenants sometime in the future.

Sandy does not have any immediate plans to sell the home she is renting to Jane and Todd, but she agrees to insert options into the lease giving Jane and Todd the right of first refusal for any future sale. This says that if Sandy decides to put her home up for sale in the future, she has to first offer it to Jane and Todd before selling it on the open market.

If, when they asked her, Sandy had already been thinking about selling the home, she might have considered including a rent-to-own option in the lease instead of the right of first refusal. Under the rent-to-own option, Jane and Todd would pay rent to Sandy for a period of years, at the end of which they would have the option to purchase the house for a previously agreed-upon price. This is advantageous for Jane and Todd, who don’t need to find somewhere else to live if they are enjoying living in the home they’ve been renting. It’s also advantageous for Sandy as their landlady, because she doesn’t need to go through the cost or hassle of listing and selling the home (assuming her tenants decide they want to exercise the option to purchase the house at the end of the pre-determined term.)

Real estate leases can be discharged, or terminated, in several different ways.

First, the lease term can simply come to an end, with both parties having fulfilled their obligations and having exercised their rights under the agreement.

Leases can also be discharged if the premise is destroyed, as the landlord can no longer provide habitable dwelling in that scenario.

For example, if a tornado destroys the home Jane and Todd were renting from Sandy, the lease will be effectively discharged.

A tenant’s rights and responsibilities for the property can also be terminated or modified through the process of assignment or by subleasing the rental home or unit. Let’s spend a moment exploring these concepts, as they are similar, but have some key differences.

When a tenant assigns their obligations and rights under a real estate lease to someone else, they are effectively terminating their own involvement in the lease. The assignee, or the new tenant, becomes responsible for upholding the tenant’s end of the lease. If the new tenant defaults, the landlord will pursue action against the new tenant.

In contrast, subleasing real estate, works a little bit different. With a sublease, the original lease between the landlord and original tenant remains in effect. A sublease allows the tenant to enter into their own lease agreement for the space with another tenant (called the sublessee), often for a short period of time. The sublessee pays the original tenant. The original tenant is the one who is still responsible for making rent payments to the landlord, and for ensuring the use of the space complies with the requirements of the lease. If the rent isn’t paid, or if the sublessee damages the space, the original tenant (the sublessor) will be responsible under the terms of the original lease.

Let’s look at examples to help illustrate the difference.

Daniel is renting a duplex from Simon, and there are still eight months left out of the twelve-month lease. Daniel has decided he wants to live on the other side of town, closer to his job.

If he simply breaks the lease, Daniel will be responsible for paying any lease termination fees or other remedies specified in the lease he signed. He consulted his lease and saw that it allows for assignment. So, Daniel found a new renter, James, to take over the remaining eight months of the lease. When he assigned the lease to James, James is now on the hook for complying with the requirements of the lease. If James doesn’t pay his rent, it doesn’t have any impact on Daniel, who had assigned the lease obligations to James.

If instead of assigning the lease to James, Daniel entered into a sublease with him, Daniel is still on the hook until the original lease ends. So, if James stops paying rent, Daniel is responsible. James would be responsible to Daniel, under the terms of the sublease, however Daniel is the one that the landlord will pursue in court.

A breach of the lease can occur by either the landlord or the tenant’s actions. The most common cause for breaching a lease is the tenant not paying the rent as agreed.

If this occurs, lease principles give the landlord the right to sue for possession and actual eviction of the tenant. Actual eviction means that the tenant is removed by the landlord, because the tenant did not meet the obligations under their lease or other rental contract.

Actual eviction is different from what is known as “constructive eviction.” Constructive eviction means that the landlord hasn’t upheld their end of the agreement, ultimately disturbing the tenant’s possession of the leased premises because the premises are uninhabitable, unfit, or are unsuitable for the purpose for which the space was leased in the first place.

Finally, let’s spend a few minutes discussing how landlord-tenant legislation is impacting real estate lease agreements, their principles, and their enforceability.

Some states have adopted the Uniform Residential Landlord and Tenant Act (URLTA), or some variation of it. The URLTA addresses issues including the landlord’s right to enter leased property, as well as their right to use and maintain the property. The provisions of the act, where enacted, also give tenants some statutory protection against retaliatory actions by the landlord, and provide for legal remedies for each party in the event either the landlord or tenant defaults on their contractual obligations.

It is important for you to understand the basics about landlord/tenant law in any jurisdiction where you will be working as a real estate professional.

Key Terms

Actual Eviction

The removal of a tenant by the landlord because the tenant breached a condition of a lease or another rental contract.

Constructive Eviction

Any disturbance of the tenant’s possession of the lease premises by the landlord whereby the premises are rendered unfit or unsuitable for the purpose for which they were leased.

Sublease

A lease given by a lessee.

9.4 Types of Leases

Transcript

In this lesson, we will dive into and explore several different kinds of leases you might encounter when you are working as a real estate professional. Certain types of leases tend to be more common in residential leases as opposed to commercial leases, and vice versa. We will look at key components and differences, using examples to help you understand them.

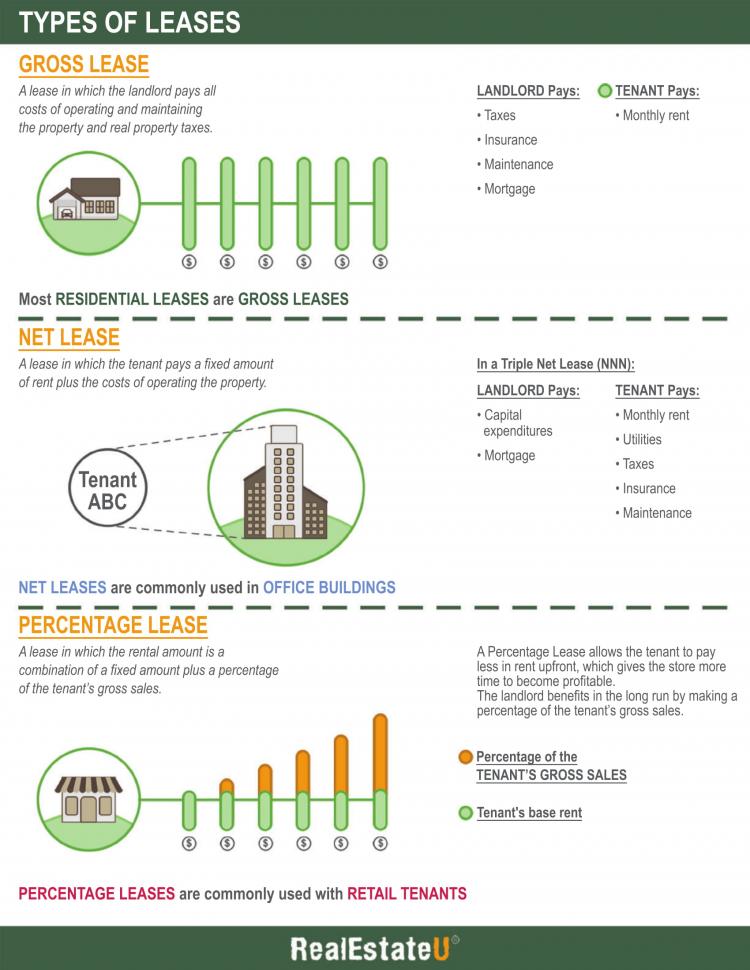

The first type of lease we will look at is called a “Gross Lease.” A gross lease is a lease where the landlord (also called the “lessor”) is responsible for paying all of the costs that come up related to operating and maintaining the property. Under a gross lease, the landlord also pays all of the real estate taxes.

While a standard gross lease says the landlord pays for everything, a gross lease could also be modified to say that the tenant would pay utility bills.

Most often, residential leases are gross leases and some commercial leases are gross leases.

Now, let’s look at an example of a gross lease in action. Terry is an insurance agent and wants to rent out some office space in his neighborhood to set up his insurance agency.

He works with a commercial real estate agent to find and tour several possible spaces that might meet his needs. His agent tells him that all of the office space in the area he is looking at renting is offered on a “gross lease” basis.

When Terry finds the perfect space at the perfect monthly price, he is ready to sign the lease. Sure enough, the lease says that the landlord will pay for property taxes, property insurance, and ongoing maintenance/upkeep. The landlord will pay for the costs of heating and cooling the building, as well as the water bills, cleaning the building’s common areas and parking lot, and paying for keeping the buildings facilities in good working order.

Terry’s insurance agency will be responsible for paying its own internet and telephone expenses, and for purchasing business insurance to cover the business property inside the leased space.

Terry’s lease is an example of a gross lease.

The next type of lease we are going to look at, net lease is essentially the opposite of a gross lease. Under a net lease, the tenant (also called the “lessee”) is responsible for paying their agreed-upon rent PLUS additional expenses like taxes, insurance, and maintenance costs.

Net leases are very common for some office tenants and other companies leasing commercial space to run their businesses.

Underneath the “net lease” umbrella, there are actually three different types of net leases. Let’s explore those now:

A single net lease is an agreement where the tenant pays the rent plus the property taxes. The landlord is still responsible for paying the costs of insurance and maintenance for the space rented to the tenant.

Using our example from earlier, Terry’s lease would have been a single net lease if his rent included a fixed monthly rental amount plus a prorated amount for property taxes based on the square footage of the office space Terry rented.

If a tenant signs a double net lease, they are agreeing to pay the rent, the property taxes and insurance premiums for insuring the building or space rented. For a tenant in a multi-unit building or mall, these costs are usually prorated based on the percentage of the building a tenant is occupying or leasing. Under a double net lease, the landlord still pays the costs associated with maintaining the property.

A tenant might find that what they thought was a really cheap rent amount is actually not such a good deal when they learn that they are responsible for also paying the property insurance and property taxes – as any homeowner knows, these costs can add up quickly, and they can change from year to year based on any number of factors outside the tenant’s control.

Finally, a triple net lease is a lease contract where the tenant is agreeing to pay the rent plus the property taxes, insurance, and maintenance including repairs. In recognition of the fact that the tenant is responsible for paying those expenses, the monthly rent is typically lower than what a tenant would pay for a single net lease or a double net lease.

John and Jane want to open a corner convenience store in their neighborhood. Working with their real estate agent, they found a perfect spot. Their realtor quotes them a very attractive rental price, which will help them get their store going faster. However, when they review the lease, they learn that they are also going to be responsible for arranging for, and paying for any maintenance or upkeep to the building while they are leasing it. They also need to pay the property taxes to the county twice a year, and they will be responsible for obtaining and maintaining a sufficient amount of commercial property coverage for the building. If they sign the lease, John and Jane will be entering into a triple net lease.

Next, let’s explore a type of lease called a “percentage lease.”

A percentage lease is a lease on the property where the amount of rent is based on how much business the tenant brings in at that location on a monthly or annual basis. This is typically expressed as a percentage of gross receipts, although smart landlords will include a minimum, base rent amount.

Percentage leases are commonly used by retail stores that lease space in shopping malls, strip malls, or other multi-tenant spaces. The owner can negotiate a percentage of the store’s sales by attracting and leasing other tenants for nearby storefronts, with the idea being that customers of one store will be likely to visit another store/business while they’re there shopping anyway.

Let’s look at a percentage lease in action, as that might help illustrate this concept a little better.

Frannie wants to open a smoothie shop, and is looking at leasing some prime space in a strip mall near a busy intersection in her town. She thinks the location is perfect, as it is in the same strip mall as a fitness center, a bookstore and a coffee shop.

When she reviews the terms of the lease, she notices that the lease provides for the following payments:

- Minimum/base rental amount: $4,000/month ($48,000/year)

- Natural breakpoint amount of 7% ($57,142.86.)This means that when Frannie’s sales go over $57,142.86, she will have to pay her landlord an additional 7% of her business sales, in addition to the $4,000/month she is already paying. This is what is known as a percentage lease.

Frannie may be able to negotiate a higher breakpoint amount in an attempt to fix her monthly expenses.

Another type of commercial lease is what is called a “graduated lease.” Sometimes, graduated leases are also called “graded,” “index,” or “step-up” leases.

With a graduated lease, rent payments are not fixed. Instead, they can vary periodically. Graduated leases are common for long-term lease arrangements, protecting a landlord lessor by adjusting the amount of rent due every one, five, or even ten years.

For shorter-term leases, graduated leases can help entice business owners to lease space by requiring a smaller outlay of funds in the early years, while the business establishes itself and gets up and running.

There are different types of graduated leases. In some, the rent payment due “graduates” upward each month, every quarter, every year, or on some other pre-defined basis.

In other graduated leases, the monthly rent may go up or down, based on the consumer price index, based on periodic appraisals of the property rented, or by some other factor the landlord and tenant agree to ahead of time.

An example might help you understand graduated leases in action.

Let’s say your city ended up closing one of its elementary schools last year due to low enrollment. As luck would have it, a local arts cooperative has outgrown its current space and is interested in leasing the now-vacant elementary school building to use for arts classes and performances.

Having just received a major grant from a donor and being confident that they can continue to grow the arts community in the city, the cooperative decides to enter into a 20-year lease with the city for the space. Their lease provides that every five years, the rent will be increased by any corresponding increase in the Consumer Price Index.

This is what is known as a graduated lease.

Next, let’s look at ground leases. A ground lease is an agreement to use land (not a structure or unit of a building,) although sometimes that lease is secured by improvements the tenant makes to the land.

Typically, ground leases cover a long time period – often between 50 and 99 years. With a ground lease, ownership of the land itself is separated from ownership of the buildings, or improvements the tenant builds on that land.

Ground leases are commonly used by well-known corporate tenants – many fast-food and retail stores corporations will enter into ground leases instead of trying to purchase the land where they build their stores and restaurants. The tenant doesn’t have to come up with funds to buy the land; they just need to come up with funds to lease it, significantly lowering the initial out-of-pocket expense so they can put that money toward constructing and running their new stores.

Landowners may like ground leases because they can provide a predictable, steady income stream. These types of leases often include features similar to those we discussed earlier when we explored graduated leases, so the tenant in a ground lease can expect their rent to rise over time.

Now, let’s look at an example of a ground lease:

Mega Department Stores is expanding into your city and wants to find a spot to open their newest Mega Store.

They explored available existing retail space, but did not find anything that would suit their needs. So, they began looking for land where they could build a new store. When they found a suitable plot of land on the edge of town, they negotiated with the landowner and ultimately ended up signing a lease rather than buying the property from her.

The lease gives them the right to use the land they are leasing for the next 99 years, and to build on and improve the land with their new retail establishment.

Mega Department Stores, as the lessee, is entirely responsible for the cost of construction, maintenance, upkeep, hazard insurance, and property taxes. In exchange, they pay a fixed rental amount to the lessor landowner. The lease provides that, every five years, the amount of rent will be adjusted for inflation. This provides protection to the landowner.

Mega Department Stores has signed a ground lease to lease what will be the site of their newest store.

Finally, let’s look at another type of lease: an oil and gas lease.

Under an oil and gas lease, the lessor (landowner) and the lessee (the oil and gas company) agree that the lessee will have access to the oil and gas on the lessor’s property.

These types of leases are usually for a set time period. Leases should clearly spell out the description of the property, what the lease allows the lessee to do, how much the lessee will pay the lessor, and how long the lease will remain in force.

When it comes to payments and compensation, oil and gas leases typically provide for three types of payment. First, the lessee might pay the landowner a “bonus payment” up-front. Second, oil and gas leases generally provide for an annual, fixed rent payment. Finally, oil and gas leases often include “royalty clauses”, which say that the landowner will get a percentage of the profits from the lessee’s drilling on their land.

Usually, if drilling is underway when the lease period is set to expire and oil or gas is being produced, the lease will remain in effect.

Here’s an example of an oil and gas lease:

Patty owns land in North Dakota that has been in her family for generations. When she is approached by Oil & Gas R Us, Inc., she isn’t sure what kind of lease she should enter into with them to allow them to drill on her land.

After researching her options and talking to her real estate and legal professionals, she decides to enter into an oil and gas lease with the company. The lease has a primary duration of five years, specifying that Oil & Gas R Us, Inc. must drill a well within that primary lease period.

If they do follow through by drilling the well, then the lease will continue for a secondary period of ten years, or as long as the well continues to produce oil or gas, whichever is longer.

In exchange for letting Oil & Gas R Us, Inc. drill and use a well on her property, Patty will receive an initial bonus payment up front and an annual, fixed payment during the lease term. She will also receive periodic royalty checks from what the well is actually producing from her land. She might also be able to negotiate for free gas for household use, during the term of the lease.

In conclusion…

There are several different types of leases, but don’t let these differences overwhelm you. Remember that a lease where the landlord pays all expenses is considered a “gross lease” and a lease where the tenant is responsible for some or all of the property taxes, insurance, or maintenance is considered a “net lease.” Beyond that, the various types of leases will depend largely on the type of business leasing the property or land, and what their intended use is.

Key Terms

Graduated Lease

A lease which provides for a varying rental rate, often based upon a future determination; sometimes rent is based upon the result of periodic appraisals; used largely in long-term leases.

Gross Lease

A lease in which the lessor pays all costs of operating and maintaining the property and real estate taxes.

Ground Lease

An agreement for the use of land only, sometimes secured by improvements placed on the land by the user.

Net Lease

A lease requiring a lessee to pay charges against the property such as taxes, insurance and maintenance costs in addition to rental payments.

Percentage Lease

Lease on the property, the rental for which is determined by the amount of business done by the lessee; usually a percentage of gross receipts from the business with provisions for a minimum rent.

9.4a Types of Leases Infographic

Please spend a few minutes reviewing the Infographic below

9.5 Lease For Residential Property Example

9.6 Lease For Residential Property Review

Transcript

In this lesson, we will review the standard Georgia Lease for Residential Property.

Residential real estate leases protect both the property owner and the tenant, documenting the terms the parties agreed on and each party’s obligations to the other. As a real estate professional, you should understand the sections and components of the Georgia Lease for Residential Property agreement. In this lesson, we will walk through this document, highlighting necessary information so you will be able to complete the agreement if you need to do so.

We’ll start with Part A, which establishes the primary terms for the lease agreement. Each of the items in Part A are clarified in greater detail in Part B, so know that you can refer to Part B if you have questions about a particular section.

In section 1, record the physical address of the property to be leased, including the unit number, if applicable. In some cases, you will need to add a separate “Exhibit A” to describe the leased property. The tenant’s rights in the leased property is not transferable to anyone else, however the landlord’s rights may be assigned to the new owner, if the landlord sells the property during the term of the lease.

Section 2 includes the start date for the lease as well as the end date. There is also a spot in this section to document a time period, in days, where the renter can terminate the lease after the start date if the property owner still has not granted possession of the property. For example, let’s say a lease started on June 1, and included a 10-day delay provision in the lease. If the property owner hasn’t let the renters into the property yet by June 11, the renter may cancel the lease agreement without penalty.

If the landlord does not deliver the property on the agreed-upon start date, the tenant is not responsible for rent for the days they do not have access.

The parties should use section 3 to document the amount of the rent, who it should be paid to and where payments should be delivered, and the due date each month. This section also includes important information about when rent is officially considered late, and the amount of the penalty for late rent payments. If a tenant pays late, the landlord is not obligated to accept the late rent; the landlord could instead consider the renter to be in default of the lease.

If the lease starts or ends any time other than the first day of the month, rent will be prorated for that month.

If the property owner/landlord accepts credit card payments, any convenience fee should be included in section 3(d). And, section 3(e) documents the returned check or returned ACH payment fee due to the landlord if the renter’s payment is returned for insufficient funds.

Section 4 covers the amount and form of payment for the security deposit, and documents where the landlord will keep the deposit. Depending on the type of landlord, they may be required to deposit the renter’s security deposit into a separate escrow account, as opposed to putting it into a general deposit account.

The landlord must provide the tenant with a list of any damage existing on the lease start date, and the tenant has the right to inspect the property prior to taking possession to confirm all known damage has been documented. Both the landlord and tenant sign the inspection report.

When the renter ultimately moves out of the property, the landlord must provide them with a statement showing why the landlord retained part or all of the security deposit. Just as both the tenant and landlord sign the move-in statement, they should also both sign the move-out statement. The landlord is obligated to follow then-current Georgia landlord/tenant laws when delivering the move-out statement and returning the tenant’s security deposit.

In section 5, document the number of days’ notice a renter needs to give the landlord before the end of the lease, if the renter decides not to renew the lease. Either the landlord or the tenant can give notice of non-renewal under this provision, when the end of the lease period approaches.

Such notices must be in-writing and must be delivered according to the provisions outlined in Part B, section 5(c). Generally, notices provided to a broker are not considered to be delivered, except if the broker is acting as the manager for the landlord.

The landlord can require the renter to pay a fee to change the locks after the end of the lease. This “re-key” fee should be documented in section 6. When setting this fee, landlords should also consider the costs of changing mailbox locks or changing/replacing access key cards after a tenant vacates the property.

Section 7 is a spot to include an extra dollar amount the tenant will pay to the landlord as a one-time, non-refundable administrative fee.

The landlord should use section 8 to indicate whether or not pets will be allowed on the premises. If the landlord does allow pets, they must complete and attach a separate pet exhibit which provides additional information and obligations.

Section 9 documents whether smoking is allowed on the premises or not. Generally, unless smoking is specifically authorized, renters and their guests may not smoke. “Smoking” is defined to include using electronic cigarettes and vaping.

Section 10 puts the tenant on notice that they may not sublet the rented premises. That includes one-time or nightly rentals through services like AirBnB or VRBO. If a tenant violates this provision by actually renting the apartment or simply by advertising or listing it for short-term rental, they are in breach of the agreement.

If the landlord intends to pay for some of the utility costs for the leased property, they should document which utilities are included in section 11. For any utilities that are the tenant’s responsibility, the tenant must arrange to connect and pay within three banking days of the lease start date. The tenant is responsible for ensuring those utilities remain connected through the lease termination date.

Section 12 is designed to document the tenant’s right to terminate the lease before the expiration date listed above in section 2, if the landlord wants to give the tenant this right. If early termination is allowed, this section specifies how much notice the tenant must give, what percentage of the remaining rent due the tenant must pay, and the amount of any early termination fee.

If the tenant is called to active military duty, then special provisions apply under the Servicemembers' Civil Relief Act of 2003. Part B, sections 12(b) and 12(c) provide more information about this exception.

There may also be circumstances under which the landlord needs to terminate the lease early. Section 13 is a spot to document how many days’ notice the landlord must provide the tenant of their intention to cancel the lease, and the compensation the landlord will provide the tenant if they need to exercise their rights under this provision.

If a tenant does not vacate the property at the end of the specified lease term, they are said to be “holding over.” Section 14 of the lease agreement documents the daily fee the tenant will owe the landlord under such circumstances.

Section 15 includes a fee for preparing an amendment to the lease agreement, if there is a need to create an amendment, later on.

Landlords have the right to limit who can occupy the leased property. Those approved occupants should be named in section 16. Generally, a “Guest” is someone who visits for 14 consecutive days or fewer, or for 28 non-consecutive days or fewer, in a 12- month period. Anyone who does not meet the definition of a Guest must be listed on the lease agreement as an authorized occupant.

In section 17, check the applicable boxes for the appliances that come with the leased property, provided for and maintained by the landlord. By signing this lease agreement, the tenant is confirming that he or she had a chance to inspect the landlord-provided appliances and found them to be in good working order.

Section 18 documents who is responsible for providing exterior maintenance and lawn care – the landlord or the tenant. Part B section 18 provides more specific requirements and expectations for lawn maintenance and maintenance of driveways, walkways, and grounds.

Similarly, in section 19, check the applicable box to indicate whether the landlord or the tenant is responsible for providing pest control services. Generally, the landlord is responsible for providing termite control and rodent control. This section indicates who is responsible for other pest control, such as ants, spiders, and cockroaches. If bedbug treatment is necessary, it is the tenant’s responsibility to use a licensed Georgia pest control remover and to permanently remove affected items.

If the property has flooded at least three times in the past five years, the first box in section 20 should be checked. This puts the tenant on notice of possible flooding or water intrusion.

If the home or any structure on the premises was built before 1978, the landlord must note in section 21 that the tenant was provided with a copy of the Lead-Based Paint Pamphlet, number CB04, and must attach form F316, the Lead-Based Paint Exhibit.

Section 22 provides certain financial protections for the landlord.

Section 22(a) documents the amount of any fees the tenant will need to pay to the landlord to stop the eviction process. For example, a landlord who initiated eviction because a tenant’s rent was late may decide to accept a late rent payment and stop the eviction proceeding before the court date. In that case, the landlord may charge the fee noted in this section.

Section 22(b) is a fee the tenant must pay the landlord if the tenant does not allow the landlord to access the property as otherwise required under this lease agreement. Generally, landlords have the right to access their property with 24 hours’ notice for valid business purposes, as explained more fully in Part B.

If a tenant has an unauthorized pet on the premises, they must pay the landlord the fee stated in section 22(c).

If a tenant or another party smokes on the premises when smoking is prohibited, the tenant must pay the landlord the fee provided in section 22(d).

Finally, section 22(e) is a fee for unauthorized disconnection of utilities.

Section 23 addresses lease renewal. In section 23(a), the landlord can check one of two boxes, indicating that the lease automatically renews for another set period (such as six months or twelve months), or that it becomes a month-to-month lease at the end of the original lease term.

Section 23(b) gives the landlord the right to document how much the rent will increase under the automatic renewal provisions, as long as they give the tenant at least 90 days’ notice of the increase, after which the tenant has a 30-day period to either accept the increase or notify the landlord of their intention to terminate the lease.

In section 24, identify the leasing broker and listing broker, and indicate how they are working with their respective customers.

Section 25 is a spot to document and disclose any material relationship between the parties or others that could impact the lease in some way.

Finally, it’s important to be clear who owns the property, and who manages it, if that is someone other than the owner. The owner’s and manager’s names and contact information should be documented clearly in section 26.

That’s it for Part A. Again, Part B provides additional information about each of the sections in Part A.

Now, let’s turn to Part C.

Section 1 explains the circumstances under which the tenant may be in default of their lease agreement. For example, a tenant who doesn’t pay rent on time as agreed, who moves out of the premises before the end of the lease, or who shuts off utilities without authorization to do so is in default. A tenant is also considered in default if he or she files for bankruptcy. In that case, the lease automatically ends.

Section 1(b) puts the tenant on notice that if the tenant defaults on any obligation under the lease, the landlord can terminate the lease and pursue legal remedies in court.

Section 2 in Part C explains that the tenant is responsible for making sure the leased premises remains in good condition. While the tenant is not responsible for making repairs to the property, they are responsible for notifying the landlord when repairs are needed. Tenants are responsible for minor things like changing light bulbs and HVAC filters, as well as dealing with clogged plumbing during the lease period. Landlords are responsible for other plumbing issues and needed repairs, including septic tank problems.

Tenant is responsible for other routine maintenance, including checking to make sure smoke detectors are working, taking proactive measures to avoid frozen pipes, and inspecting the property regularly to identify potential mold or mildew hazards from water intrusion. The tenant bears the responsibility of notifying the landlord if they become aware of potential problems that need the landlord’s attention.

Section 2 also establishes the landlord’s obligation to give the tenant any and all access codes for security systems or gates.

Section 2(f) states that, if the property is part of an association-maintained community like a condo community, that the tenant agrees to comply with all of the association’s rules and occupancy restrictions.

Section 3 includes rules that the tenant agrees to abide by during the term of their lease. In addition, the tenant agrees that their guests and visitors will also abide by the rules.

Section 3’s rules address the property’s door locks, where vehicles can be parked and prohibited vehicles, waterbed use, shower curtain/door use, space heaters, roller-skating or skateboarding on the property, window treatments, wall-hangings, tenants’ and guests’ behavior, environmental hazards, and more. You should read the entire list to familiarize yourself with these standard Georgia lease rules.

In section 4, the parties agree that the tenant is responsible for their own personal property and that they store it at the leased property at their own risk. This provision suggests that tenants purchase their own renter’s insurance policies to cover any potential loss or damage to their property. This provision also notifies tenants that if someone occupying the premises is injured and wants to file a personal injury claim against the landlord, such claims need to be filed within one year of the injury.

Section 5 provides several important disclaimers.

First, section 5(a) protects brokers, documenting that the landlord and tenant will not bring claims against them for brokers’ advice, representation, or statements. Brokers are also protected from claims related to the property’s condition, uses, zoning, etc.

In section 5(b), the tenant acknowledges that the property, or parts of it, may have been constructed when building codes were different than they are currently.

And, section 5(c) explains that the tenant is responsible for becoming acquainted with the surrounding neighborhood; it is not the landlord’s job to describe all possible objectionable conditions.

Section 6 in Part C includes legal provisions that you will find in almost any legal contract in Georgia. These include definitions of terms used in the agreement, a statement that the parties intend to make this written lease agreement the entire agreement, a statement that if there is a legal dispute, the party who loses the dispute is responsible for paying the prevailing party’s fees and expenses, a choice of law provision, disclosure rights, fair housing disclosure, and more.

Section 6 also specifies that only the named occupants in this lease agreement may occupy the property, and that the landlord may release keys or otherwise open the premises to any of the named occupants. The only exception to the named occupants provision is for minor children. If the landlord later discovers that there is someone staying at the property who is not named in the lease agreement, the tenant will be considered in default.

This section also includes the tenant agreement not to sue the landlord for damages related to the tenant’s failure to comply with the lease, injuries sustained due to the tenant’s own actions. This is covered under the “Indemnification” paragraph, 6(g).

Section 7 in Part C addresses the possibility that the premises could be destroyed by, or otherwise made uninhabitable by, a flood, fire, storm, mold, or another hazard. In the event of such an occurrence, rent will be adjusted because of the hazard and either the landlord or tenant may terminate the lease. If the damage does not make the property uninhabitable, the landlord is obligated to adjust the rent and to make needed repairs to the property. However, if the tenant or a guest is responsible for causing the damage, they do not have the right to terminate the lease, nor will rent be adjusted in such cases.

Section 8 makes it clear that, if there is a mortgage on the property, any rights the tenant has are junior or subordinate to the mortgage company’s rights.

Section 9 is a standard paragraph you will see and become familiar with in these forms, provided by the Georgia Association of Realtors. This paragraph reminds the parties that the forms are standard and may need to be amended or modified to reflect the parties’ unique needs and terms.

Section 10 in Part C gives the landlord an additional opportunity to document any additional rules that may apply to the leased property. For example, if the property includes a swimming pool, the landlord may want to include additional rules in the lease to help limit the landlord’s risk of loss.

Section 11 is an important reminder for both parties to be aware that cyber fraud exists with residential real estate lease transactions. This provision gives the parties some examples of how cyber criminals may try to defraud landlords and renters, and suggests ways the parties can protect themselves and avoid becoming victims.

This summary was intended to highlight these provisions of the standard Georgia “Lease for Residential Property.” As always, you are encouraged to read the entire lease agreement, including those provisions we did not cover in this lesson, so you have a solid working knowledge of the agreement. That way, when you need to complete a lease agreement for a client, you will understand the questions being asked and can be more confident in your ability to answer those questions.

Key Terms

COPYRIGHTED CONTENT:

This content is owned by Real Estate U Online LLC. Commercial reproduction, distribution or transmission of any part or parts of this content or any information contained therein by any means whatsoever without the prior written permission of the Real Estate U Online LLC is not permitted.

RealEstateU® is a registered trademark owned exclusively by Real Estate U Online LLC in the United States and other jurisdictions.